2,99 €

Mehr erfahren.

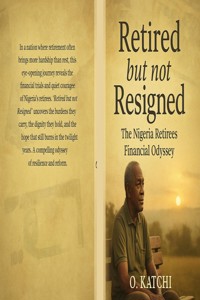

- Herausgeber: Victor Onyebuchi Katchi

- Kategorie: Ratgeber

- Sprache: Englisch

This powerful narrative blends personal testimony with policy critique to illuminate Nigeria’s fragile retirement landscape. Drawing from lived experience, Retired But Not Resigned reveals the silent struggles of retirees, exposes systemic failures in pension and financial systems, and issues a call for urgent reform.

Yet beyond lamentation, it offers practical guidance, comparative global insights, and concrete policy blueprints for building a society where aging is marked by dignity rather than despair.

A vital read for workers, retirees, policymakers, and all who are invested in shaping Nigeria’s future.

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Veröffentlichungsjahr: 2025

Ähnliche

Retired But Not Resigned:

The Nigerian Retiree’s Financial Odyssey

By Victor O. Katchi

Preface

This book was born not from theory, but from the lived experience of navigating Nigeria’s fragile retirement landscape. I am both a subject and an observer, compelled to document not only my story but also the stories of millions who silently struggle. This work combines personal narrative, policy critique, and a call for reform. It seeks to empower retirees, inform policymakers, and awaken society to its moral responsibility. May this book serve as both witness and guide for building a Nigeria where aging is not a sentence, but a dignified phase of life. —Victor O. Katchi

Table of Contents

Chapter 1: Introduction: The Silent Struggle of Nigerian Retirees

Chapter 2: Nigeria at a Glance: Demographic and Economic Backdrop

Chapter 3: Inside the Pension Landscape

Chapter 4: My Journey: A Retiree’s Financial Odyssey

Chapter 5: Global Retiree Realities: A Comparative Lens

Chapter 6: Nigeria’s Retiree Crisis: Root Causes and Realities

Chapter 7: Ponzi Schemes and Financial Despair

Chapter 8: The Microfinance Illusion

Chapter 9: SMEs Under Siege

Chapter 10: Entitlements of Political Office Holders vs. Civil Servants

Chapter 11: Financial Freedom: Myths and Models

Chapter 12: Policy Blueprint for a Dignified Retirement

Chapter 13: Conclusion: Towards Equity and Dignity for All

Chapter 14: The Retirees Speak - A Data-Driven Glimpse into Financial Hardship

References

Appendix A - Glossary of Pension Terms

Appendix B - Sample Retirement Planning Checklist

Appendix C - Financial Literacy Self-Assessment Tool

Appendix D - Survey Questionnaire Instrument

Appendix E - Policy Proposal Template for Lawmakers

Appendix F - Cooperative Business Models for Retirees

Appendix G - Key Resources and Organizations

Author Bio

Chapter 1

Introduction – The Silent Struggle of Nigerian Retirees

“The true test of civilization is not the census, nor the size of cities, nor the crop — no, but the kind of man the country turns out.” – Ralph Waldo Emerson

In the sprawling expanse of Nigeria—a country famed for its diversity, abundant natural resources, and youthful population—an invisible crisis simmers. It plays out not in the headlines but in the homes of those who once served the nation with diligence: its retirees. These men and women, having spent three to four decades in public or private service, now face a stark and often humiliating decline in the quality of life. They are forgotten by the system, abandoned by policy, and sometimes even neglected by society.

Retirement, by its ideal definition, should be a time for rest, reflection, and reward. It should symbolize a graceful transition into a phase where one's years of labor yield peace and provision. But in Nigeria, retirement more often signals a descent into uncertainty. Pensions are delayed or denied outright. Gratuities are caught in bureaucratic tangles or misappropriated. For many, there is no health coverage, no financial cushion, no social security—only a bitter dependence on already struggling children or the false hope of investment schemes.

This struggle remains largely unspoken. National discourse is consumed by security, youth unemployment, elections, and inflation. The plight of the elderly—the people who helped build this nation—rarely enters the conversation. The silence around their suffering is deafening.

Why This Book?

This work is not just a chronicle of hardship; it is also a call to conscience. I write as both participant and observer—as someone who meticulously planned for retirement but still found himself buffeted by waves of economic misfortune, financial betrayal, and policy failure. This book represents a convergence of my lived experience with the stories of thousands of others I have encountered or researched.

My goal is to offer more than lamentation. This book is designed to:

- Educate readers on the realities of Nigeria’s pension systems, their structural gaps, and the ripple effects on the broader economy.

- Compare global retirement systems to expose Nigeria’s shortcomings and highlight workable solutions.

- Inspire through personal resilience and the resourcefulness of retirees who refuse to surrender to despair.

- Propose actionable reforms for institutions, policymakers, and civil society.

We will journey through the national pension framework, delve into failed investments and entrepreneurial attempts, examine the psychological impact of financial insecurity, and compare international models of retirement. Each chapter will offer a mirror to Nigerian society—and a potential roadmap for change.

A Larger Question

What does it mean to age with dignity in Nigeria? Can a society that neglects its elderly claim to be just, functional, or humane? These questions will echo throughout the book. I hope they provoke dialogue—and ultimately, reform.

To begin, let’s examine the context in which this crisis unfolds: Nigeria’s demographic makeup, economic structure, and systemic pressures that shape the retirement experience.

Chapter 2

Nigeria at a Glance – Demographic and Economic Backdrop

“Nothing ever becomes real till it is experienced – even a proverb is no proverb to you till your life has illustrated it.” – John Keats

Understanding Nigeria’s retirement crisis requires more than anecdotes or policy reviews—it requires context. This chapter explores the macro landscape that shapes individual experiences: the demographics, economic structures, and systemic vulnerabilities that collectively set the stage for the retiree’s silent struggle.

Demographic Realities: A Nation of the Young