10,49 €

Mehr erfahren.

- Herausgeber: Elliott & Thompson

- Kategorie: Fachliteratur

- Sprache: Englisch

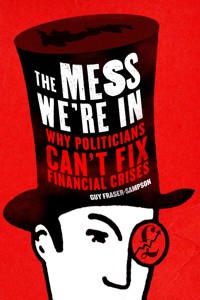

Various politicians present themselves as having the answers to our financial woes yet, as bestselling author Guy Fraser-Sampson shows, they are not part of the solution. They are the problem. His trenchant views have been heard frequently on radio and television programmes discussing the current situation. Here he sets out the facts supporting his belief that at every opportunity politicians choose the course of action which pursues their own short-term political ends, rather than doing what is right for the national long-term interest. In an entertaining mix of historical narrative and conceptual analysis, he argues that the present crisis has in fact been several decades in the making, and is the inevitable outcome of years of neglect and betrayal by those we have trusted to serve and govern us. As national debt reaches record levels around the world, and politicians continue to pile up fresh borrowings year after year, many are starting to ask just what, if anything, can be done to rescue us from the stark consequences of government folly. 'The Mess We're In' will open your eyes to the true causes of the crisis, and suggest some radical common-sense measures to drag the world back from the edge of the abyss.

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Seitenzahl: 510

Veröffentlichungsjahr: 2012

Ähnliche

First published 2012 by Elliott and Thompson Limited

27 John Street, London WC1N 2BX

www.eandtbooks.com

ISBN: 978-1-908739-06-3

EPUB ISBN: 978-1-908739-07-0

MOBI ISBN: 978-1-908739-08-7

PDF ISBN: 978-1-908739-09-4

Text © Guy Fraser-Sampson 2012

The Author has asserted his right under the Copyright, Designs and Patents Act, 1988, to be identified as Author of this Work.

All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form, or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of the publisher. Any person who does any unauthorized act in relation to this publication may be liable to criminal prosecution and civil claims for damages.

9 8 7 6 5 4 3 2 1

A CIP catalogue record for this book is available from the British Library.

Printed and bound in the UK by CPI Group (UK) Ltd, Croydon, CR0 4YY

Typeset by Marie Doherty

CONTENTS

ONE

‘Just why are we in this mess?’

TWO

The Tangled Knot

THREE

Money and Inflation

FOUR

Markets and Crashes

FIVE

Keynes and the Great Depression

SIX

Keynes’s General Theory

SEVEN

Marx and the Marshall Plan

EIGHT

Building a New Jerusalem

NINE

‘A little local difficulty’

TEN

The Chickens Come Home to Roost

ELEVEN

The Thatcher Revolution

TWELVE

A Last Chance Squandered

THIRTEEN

‘Certificates of Dubious Odour’

FOURTEEN

Planning to Fight the Last War

FIFTEEN

Drinking Poison Can Be Dangerous

SIXTEEN

Democracy and Totalitarianism

SEVENTEEN

The Great Pensions Disaster

EIGHTEEN

‘New Ideas From Dead Economists’

NINETEEN

Getting Ourselves Out of the Mess

Index

ONE

Stability is necessary for our future economic success. The British economy of the future must be built not on the shifting sands of boom and bust, but on the bedrock of prudent and wise economic management for the long term. It is only on these firm foundations that we can raise Britain’s underlying economic performance.

GORDON BROWN, 1997

.

‘Just why are we in this mess?’

It was really all Peter’s fault. I was sitting in a beach hut restaurant in Goa, enjoying that feeling of deep contentment with the world that only chicken achari, garlic naan and several cold beers can induce, when he piped up with his question.

Peter is not his real name, by the way. If anybody is going to get the blame for this book then it clearly should be me, not him. After all, I wrote it.

Peter is a hugely intelligent and highly educated man, a professor no less, and a Fellow and gold medal winner of the Royal Society. When he addresses a subject you would be well advised to listen carefully, for what comes forth tends to be pure, condensed wisdom. Which also makes it rather unsettling when it is your opinion on a matter that he is requesting, since you know that your answer will be weighed in the white heat of his intellect, and quite possibly found wanting.

‘So just why are we in this mess?’ he enquired.

‘What mess?’ I queried. Surely we had enough cash on us to pay for the meal?

‘Oh, you know, the financial crisis,’ he said, with a grandiloquent gesture that the waiter happily interpreted as an order for two more beers. ‘The banks, Greece, pensions, all that sort of stuff.’

‘Ah, that,’ I said, giving myself time to think. I suppose I had brought this on myself, since I had recently been featured on various television programmes on the subject, claiming to know what I was talking about. Fortunately, most of these sort of appearances are so short that there is rarely time for the limits to one’s knowledge to be exposed. This occasion would be different. The baking hot afternoon stretched ahead of me and just across the table a razor-sharp mind lay in wait.

‘The main difficulty,’ I began, ‘is that it isn’t really just one problem at all. It’s actually at least five different problems, all of which have become tangled together like a big knot, and if you really want to understand what’s going on then you need to unpick the knot and examine each of the strands separately.’

‘Go on,’ he said, lighting a cigarette. An avowed non-smoker, he was trying unsuccessfully to limit himself to twenty a day.

‘In no particular order,’ I went on, ‘there are five of them.’

I started ticking them off on my fingers.

‘First, there is the aftermath of the banking crisis of 2007 and 2008. Governments need to work out how they are going to manage the banking sector so as to minimise the chance of having to use public money again in the future to rescue banks which get into trouble.’

‘Second, there is the question of governments around the world running budget deficits and as a result having higher and higher levels of national debt. That’s what has happened in Greece, but it’s a problem everywhere, not least in the USA, as well as most European countries.’

‘Third, there is the threat of recession, and what governments might do to try to avoid this by boosting the economy.’

‘Fourth, as yet largely confined to the UK, there is the problem of pension funding. As you know, many schemes are in deficit, that is to say they simply don’t have enough money to meet their obligations.’

‘Fifth, and this may come as a surprise since it doesn’t seem an obvious point to make from an economic point of view, there is the whole question of how our political system works, and in particular how it works in making economic decisions.’

I checked my hand. Five digits, five issues. So far, so good. Thank goodness I couldn’t think of a sixth.

In fact, writers being the slippery customers they are, I have taken certain liberties with my account so far. Not only names have been changed, but also the chronology, though only slightly. This conversation did indeed take place one long afternoon in a beach hut in Goa, but by then I had already embarked on the odyssey that would lead to this book.

It would prove to be a journey of more than two years’ duration as I wrestled to analyse what was going on in the world of finance. In the meantime, many books were published claiming to have all the answers about how the financial crisis had happened, but I wasn’t really interested in ‘how’ things had happened so much as ‘why’. The distinction is subtle, but highly significant. I was not so much interested in the crisis as in understanding the economic framework within which events had unfolded. This brought a very different perspective to the situation.

For instance, most writers seemed to be treating the crisis as having begun in mid-2007 (though admittedly the various causes which they ascribed to it had happened earlier – most said from about 2003 onwards) and ended some time in 2009. The more I read, the more I realised these views were defective in two respects. First, it seemed to me that the crisis had not ended, but was still with us, though having developed in nature. Second, it seemed to me that its causes had been constant and ongoing for many years, indeed decades.

To some extent, this was because many people appear to have treated the events of recent years as a banking crisis, with bankers, in their various forms, being responsible for it, and an avalanche of future banking regulation as the solution. I beg to differ, believing this to be part, not all, of the problem; only one contributory factor, though a significant one.

Similarly, everyone seemed to agree that what had occurred was a dramatic failure of the financial system, evidenced by banks tumbling like dominos during the dark days of 2008, though they differed as to what precisely had brought it about and when (or indeed whether) it had come to an end.

The conclusion to which my reading and thinking brought me was startlingly different. That what had occurred was in fact a massive and sustained failure of the political system, which had begun many decades ago and been eagerly abetted by just about every prime minister since the Second World War, with Margaret Thatcher perhaps being the only exception and even then only partially.

If this is so, then how is it that so many people have been led to such a profoundly mistaken conclusion?

First, it seems to me that people show a disinclination to examine the past in analysing the present and, in particular, critically to explore the past actions of politicians. It is as if politicians enjoy some sort of privileged status in this regard. If the head of an industrial firm manages it into insolvency then he is blamed and dismissed, though not always in that order. In the public sector, things work differently. The governor of the Bank of England can repeatedly miss his inflation target and yet be praised and rewarded. Politicians move seamlessly on to retirement, board seats and lucrative consultancy contracts, yet never have to face the consequences of whatever damage they may have inflicted. It is as though the day of reckoning can be indefinitely postponed.

This appears to be coupled with an instinctive trust in politicians to do the right thing, a trust which, remarkably, seems to have survived despite the clear evidence to the contrary of the last several decades. In fact, as I will demonstrate, politicians are part of the problem – indeed, they are the problem – rather than the bringers of solutions.

This unwillingness logically to analyse a situation based on clear data runs right through every aspect of our present situation. For example, though most people seem to believe that our problems had been caused by a banking crisis, nobody outside the world of academia has actually bothered to enquire into the nature of banking crises. What causes them? Can they be prevented? If so, how? These are all questions that even a commission specifically set up to enquire into banking regulation totally failed to address.

Then there is the related problem that, in order to understand what has happened, using knowledge drawn from only one discipline is no longer sufficient. For example, most people instinctively describe our present circumstances as ‘the financial crisis’ whereas in fact it is an economic and political crisis; only its symptoms are financial, and even then not all of them.

Again, the writer in me is taking a few liberties. This was not a journey upon which I suddenly embarked two years earlier. As both a reader and writer of history, I was already familiar with the works of Correlli Barnett, to whom I must acknowledge a huge debt. It was his Pride and Fall series, upon which I have drawn heavily in this book, which first made me aware that the official version of events should at least be seriously questioned, and that our problems really began several decades ago, not a few years. Going back to reread these was where I began my quest.

In fact, partly thanks to Barnett, the historical side of things was the easy part. I already had several bookshelves (and a few wardrobes) groaning under the weight of a myriad of books on modern history. What I was lacking was a specialist knowledge of economics and I immediately embarked upon a sustained reading spree. I had in fact strongly considered signing up for a degree in economics at one time, but as things turned out I think the fact that I had not previously studied the subject was a strength rather than a weakness, as I was able to come to things with no preconceptions and ramble about at tangents as one book suggested another, rather than having to stick to a preset curriculum.

I started off reading about economics from textbooks but soon progressed to reading economics itself, acquiring various rather battered second-hand volumes in the process. It was here that I struck gold.

I had long been aware that post-war economics had featured two rival schools of economic thought: that of socialism, inspired initially by Karl Marx, and that of Keynesianism, named of course after the great economist John Maynard Keynes. I was also aware that British economic policy had featured an uncomfortable mix of these, with different administrations drifting between the right- and left-hand sides of the road.

What I had not previously known was that there was in fact an additional school of thought, to which we might refer loosely as the Austrian School, which was viewed as so deeply subversive that many economics textbooks entirely failed to mention it, preferring to pretend that it had never existed. Yet, on investigation, its subversive tendencies seemed to be based on little more than a passion for personal freedom and a belief that money should actually possess some absolute value, hardly things that struck me as likely to bring about the collapse of civilisation as we know it.

Going back to reread history from the perspective of the Austrian School was a revelation. Suddenly the real causes of our current difficulties, the fundamental causes with their roots deep in the past and their consequences glaringly obvious in the present, became clear. What also became clear was that if I was to report them honestly and fully then this was going to be a deeply controversial and provocative book, and certainly in many quarters a deeply unpopular one.

So it is only right that I should acknowledge from the outset that many readers may find what I have to say disturbing. Those with any sort of involvement with the public sector will almost certainly brand it alarmist, cranky, foolish, impractical or even just dangerously insane. In my defence, all I can say is that the historical facts that I state can be checked and that the views that I express seem to me to be logical conclusions drawn from a combination of theory and circumstances, though I freely acknowledge that others may disagree with them. My intention throughout is to attempt to awaken an awareness of past actions and to prompt an informed debate about the present and the future.

One thing seems to me clear, and I take it as my starting point. Whatever approach has been taken in the past has failed. In fact, it has created the present mess. The two points of which I will seek to convince you are firstly that some totally new approach seems to be called for, and secondly that politicians are not the ones to whom we can look to implement it. My central argument will be that it is politicians themselves who have caused our current problems, and that the time has come for them to be called to account. The day of reckoning can be postponed no longer.

TWO

The Tangled Knot

Peter is an eminent scientist of international renown, one of the most impressive and intelligent people I have ever met, who has progressed effortlessly over the course of a glittering career from an Oxbridge starred first to the Royal Society’s gold medal. Yet he, like so many other people, has no idea exactly why we are being bombarded with daily messages of gloom about the economy, pensions, national debt, budget deficits and threats not just to global growth but apparently even to the world’s banking and other financial systems.

Being an essentially modest fellow, Peter puts this down to lack of understanding on his part, coupled with the fact that he has never studied economics. In fact, though, it is debatable just how much such a course of study would assist in the current situation. Of course it would be some help; it would be facile to suggest that after three years at university studying the subject one would not have a better knowledge of economic theory. The problem is that, at least in the present case, it only takes us so far.

First, the problems that we face are only partly economic in nature, representing a melange of issues from economics, finance, politics, psychology and philosophy, to name but five. Economists have long recognised that the world of economic activity is a hybrid one, demanding knowledge from many different fields properly to analyse it, but the levels of pluralism, diversity and complexity appear to have risen sharply in recent years.

Second, economics is not a precise science. Again, this is recognised by most economists, and distinguishes the subject from the study of finance, for example. Finance tends to assume as its starting point when examining any situation that there is one right answer and that it can be calculated. Economists recognise that a more useful and valid approach is to seek to identify trends and interconnections, and to suggest ranges within which possible outcomes may occur. As the late Edgar Fiedler, himself a distinguished economist, said: ‘Ask [the same question of ] five different economists and you’ll get five different answers – six if one of them went to Harvard.’

As so often, a joke relies on a serious point for its humour. Because economists know that economics is not a precise science, and certainly not a predictive one, they will rarely be drawn into giving a definitive answer, preferring instead to suggest a number of alternatives. President Truman famously asked for the White House staff to include a one-armed economist, so frustrated did he become with economists who said ‘on the one hand ... but on the other hand...’.

So even if we did spend three years at university learning about economics there is no guarantee at all that we would even be able to come to a firm conclusion ourselves, let alone one that could withstand discussion with other economists.

Third, if we want truly to understand any state of affairs, it is imperative that we know how it came about. The circumstances of today are the result of the circumstances of lots of yesterdays. Unless we study their history, then we can never understand them in their overall context; we can at best observe them within a temporal vacuum.

As we will see, an added benefit of history for our present purposes is that by looking at what has happened in the past we may be able better to consider what may happen in the future. Of course it is absurd to suggest that the future will exactly mirror the past, so that a record of past events may be taken as a close approximation of future outcomes (though not so absurd that finance theory adopts this assumption as one of its fundamental beliefs). Yet where specific remedies have been applied to particular problems in the past it is surely valuable to know how effective or otherwise they proved, and to note and understand how the present situation may differ from the previous one.

So, in seeking to explain the problems of today, and in tentatively suggesting some possible solutions, this book will look not just at current economic indicators, but also at how present circumstances were created by the unfolding story of history and how real world events influenced, or were in turn influenced by, the development of economic theory.

In looking at the causative factors, the objective will be to bring things together into an amalgam of strands that, when placed together in a certain combination, illuminate the truth. It will be as if a number of different lenses are being tried out by an optician, one on top of another; our vision is hopelessly fogged until the one optimum combination arises, at which point we can see through all the lenses together with perfect clarity.

Yet in analysing the present issues themselves, we first need to do exactly the opposite. They have become hopelessly tangled together and if we are to get anywhere at all we first need to unknot them and set them out singly, so that we may consider each strand individually. Let us do this straight away, since it will help to define our enquiry.

As I explained on the beach to Peter, the present situation represents a combination of issues, of which the following may be identified as the most prominent and/or more serious.

First, there is the ongoing impact on the banking and financial system generally of the crisis which began in 2007. This issue is of international dimensions.

Second, there are the closely related issues of budget deficits and national debt. Again, these are international in scope, though some countries are worse, and more immediately, affected by them than others.

Third, there is the question of the collapse, as yet partial, of the chosen method of occupational pension provision. Thus far, this is an issue that affects largely the United Kingdom, though it may yet become a significant issue in various other countries as well.

Fourth, there are concerns over the strength and robustness of economic growth generally and, indeed, fear of recession. This is a global issue, though certain countries are more susceptible to such vagaries than others.

Fifth, and this may come as a surprise entry into the list to many who have not previously considered it a problem or issue, there is the question of whether the political system within which government has to work in making decisions relevant to the running of the economy is one in which such decisions may be taken and implemented in an optimal manner. In the case of countries such as the UK and others, this question obviously arises at two different levels: domestic and European.

The aftermath of 2007 and 2008

Some people persist in referring to the period from about September 2007 until the early part of 2009 as ‘the crisis’, as if it ended as soon as stock markets began to rise again. As we will see when we examine these events in detail, it is strongly arguable that ‘the crisis’ did indeed begin in 2007 but is still with us, albeit that it may have changed its nature in the interim.

For these introductory purposes, however, let us confine ourselves to what might be called the banking liquidity crisis, which peaked with the collapse of Lehman Brothers in September 2008 (ironically on Battle of Britain Day: 15 September).

The immediate aftermath of these events saw many well-known names disappear, either failing altogether, ceasing to exist as independent entities, and/or being bailed out and recapitalised by their nations’ taxpayers. Lehman Brothers, Northern Rock, Nat West, Lloyds TSB, Merrill Lynch, Citibank, Bradford & Bingley, Alliance & Leicester, and the American institutions Fannie Mae and Freddie Mac were all casualties. Others, such as the insurance giant AIG, were struck savage blows from which they are still struggling to recover.

In the process, it became clear that government policy was being made up on an ad hoc basis as they went along, and frequently with little attempt at international cooperation or consistency, a factor that was blamed for the failure of Lehman Brothers. More worrying still, it became clear that governments were often prepared to ride roughshod over laws and regulations, thus raising significant concerns about the accountability of the executive in supposedly democratic societies. For example, many of the banking mergers that were pushed through almost overnight would have been outlawed by the competition authorities had they been attempted by the banks themselves. In addition, it was subsequently argued that the bans on short selling imposed by France and Germany were illegal under EU regulations, individual governments not having the power to do this unilaterally without consultation. Incidentally, it is strongly arguable that such a ban must create a false market, something that if done by an individual would constitute a serious criminal offence.

As far as the banking sector is concerned, two different but related trends have so far emerged. One is a general psychological aversion to banks and those who run them, a feeling that they were responsible for what occurred but have escaped taking responsibility for their actions. The other is a debate, which has undoubtedly been clouded by the emotions we have just mentioned, into how future financial crises may be averted, with increased regulation of banking activities the prime candidate. In the UK, for example, the government established the Independent Commission on Banking, known as is customary by the name of its chairman, Sir John Vickers, to report on how this might best be achieved. Outside the UK, discussion has focused on the Basel Accords, which we will consider in more detail later, but, briefly, which provide levels of so-called ‘capital adequacy’ for financial institutions.

In the area of non-banking financial services, such as institutional investment management, similar siren voices have been heard luring the industry onto the rocks of ever-increasing regulation. Chief among these in Europe have been the AIFM1 regulations emanating from the European Union. In the United States, similar sentiments have driven such measures as the Dodd–Frank Act and the Volcker Rule, which aims to ban various types of speculative activity.

As we will see, this understandable concern on the part of legislators and regulators alike to prevent another crisis from occurring has become little short of an obsession, which is unfortunate. People driven by an obsession rarely make good decisions. A need to make at the same time fine-sounding public statements pandering to prevailing mass emotions can only make things worse. As a result, regulatory discussions have been initiated from the wrong starting point and thus, inevitably, have missed the correct target. Rather than asking ‘how can we control what the banks do?’ it would have been infinitely preferable to ask ‘what are financial crises and how might they be averted?’

It should be noted that this is a hugely complex area. It would be possible to write an entire book about ‘the banking crisis’ and still not be able properly to discuss all the relevant issues. Nor is it likely that the authors of even two such books, let alone several, would agree in their description of the current situation or in their analysis of its causes and possible effects.

For the moment let us simply note that, apart from sparking a debate on the regulatory framework within which banks should operate in future, the events of 2007 and 2008 saw one key development, which was a series of events by which many banks were effectively recapitalised at public expense.

Budget deficits and national debt

If a government spends more than its income, the difference between the two is called a budget deficit. If it spends less than its income, the difference is called a budget surplus. In the case of a budget deficit the shortfall has to be made up somehow or the government would simply run out of money. Just as with individuals, this can only come from debt, from borrowing money from other people.

A government that consistently runs a budget deficit year after year is like a household living on its credit cards. At the end of each year the amount that they have borrowed is added to the running balance and they are then in an even worse position than they were at the end of the previous year because, not only are they going to have to borrow again for the coming year, but the amount of interest that they have to pay to service their debt is rising all the time. First, because they owe more money, so even if the interest rate stays the same the total interest for the year will also be greater than it was before. Second, because, just as with a business, the more money a government owes, the more nervous creditors become about lending them even more money, and so the higher an interest rate they will look to charge. This is exactly what we saw happening during 2011, for example, when the rates that investors required to persuade them to buy the bonds (debt) of various governments rose sharply.

If things get really bad, the household might get to a stage when they cannot even pay the interest on the accumulated debt, and so this too is added to the running balance. In effect, they are now borrowing to pay the interest on their existing debts. Imagine what would happen if they were to go to their local bank manager and ask for a new bank loan to pay the interest on their existing loans. Once he had stopped laughing, he would reach for the phone and speak to his debt recovery department. With credit cards, though, things have worked differently and much more like the way things have worked for governments. Just as the household becomes really desperate because they are running out of room on their credit cards, a letter arrives noting that their credit limit no longer appears adequate for their purposes, and increasing it.

Those who buy government bonds have acted in a similar manner, being prepared always to extend more credit to a government regardless of the state of their existing budget deficits and national debt levels. Incidentally, this tendency goes back a long way. During the fourteenth century, Edward III’s Italian bankers, the Bardi family, extended him huge amounts by way of loans to prosecute the early stage of the Hundred Years’ War. It may come as a surprise to those who know of the glorious victories of Crécy and Poitiers (Agincourt came much later, under Henry V) to learn that the early part of the war was in fact an abject failure and that, had Edward died young, then he would almost certainly have gone down as one of England’s worst kings.

His strategy at that time was to pay other people to do his fighting for him. Predictably, most of them took his money but then found all sorts of reasons for staying at home. His military campaign collapsed, as did the public finances. Unable to service the loans, England went bust. Its immediate aftermath was Europe’s first banking failure and financial crisis. The Bardi went bankrupt, because they had borrowed most of the money they had then lent to Edward from other banking houses across present-day northern Italy. Some of these banking houses went bust in turn because they were unable to satisfy their creditors. For a while the crisis threatened to engulf even governments and the richest institution in Europe, the Church. Sound familiar?

Then, as now, investors and bankers were forced to learn a salutary lesson. Debts sooner or later have to be repaid and the idea that just because you are lending to a government you are somehow exempt from normal financial consideration is nonsense. It is a lesson that has to be painfully relearned every so often, but this new reality never seems to last for long. Argentina defaulted on its debts in 2001, though according to the IMF creditors eventually got back more than ninety cents in the dollar. Perhaps finding encouragement and comfort in this first foray into national bankruptcy, four years later Argentina had to be rescued again and this time creditors got back less than thirty cents in the dollar.

Since the early part of 2011, recognition has been dawning that some governments are getting into a position from which they may never be able to pay their debts in full, at least without dramatic restructurings and slashed budgets, neither of which do many governments seem able to offer or deliver. This belated realisation of course came at a time when many governments were already stretching their finances to the limit simply to pay interest on existing debt. In the UK, for example, the government is at the time of writing being forced to pay more in interest on its debts than it receives by way of corporation tax.

As an added complication, people began to question whether the conventional way of measuring government debt might not give a dangerously misleading picture. In the UK, for instance, net debt in 2011 was about 60% of GDP, already well above a previous guideline of 40% as the absolute maximum for safe borrowing. However, this did not include the government’s contingent liabilities under public sector occupational pension schemes, nor did it include the government’s liabilities under PFI contracts.2 Nor, and this is where the link to our first identified issue emerges, did it include the cost of the government’s rescue operations on behalf of the banks, officially known as financial intervention. So it is arguable that, partly because the government continued to run a budget deficit during the meantime, all their intervention really achieved was to transform a bank liquidity crisis into a potential government solvency crisis.

Occupational pension provision

The extent of change in the circumstances of occupational pension schemes, at least in the UK, has been genuinely revolutionary, but is as yet little understood by the general public.

Traditionally, occupational pension schemes, that is, pension plans provided for their workers either by individual employers or by groups of employers within a single industry, were what in America are called defined benefit (DB) schemes and in the UK final salary schemes. As the British name suggests, these promised to pay a worker during their retirement a sum equivalent to a certain percentage of their salary level on their retirement date. Typically these benefits were index-linked to protect against the effects of inflation and could be extended to the pensioner’s partner, though usually at the expense of accepting a slightly lower annual amount.3

For reasons that we will later examine, in the UK most DB schemes have now closed, either to new members or altogether, and been replaced by what in America are called defined contribution (DC) schemes and in the UK money purchase schemes. These operate on the same principle as the personal pension plans with which many will already be familiar. Money is paid in during an individual’s working lifetime, usually with the benefit of tax relief, and invested, again usually with the benefit of tax relief. On retirement the resulting balance, or much of it, must for most people be used to buy an annuity. An annuity is an annual sum paid by an annuity provider, usually a life insurance company. Again, benefits can be index-linked and extended to one’s partner, at the cost of a lower annual amount.

This change has radically altered various aspects of pension provision, yet here too realisation is dawning but slowly.

First, the investment risk has passed from the scheme to the individual. In the case of a DB scheme, the trustees are obliged to pay a certain level of benefits regardless of the scheme’s investment performance and other financial circumstances. In the case of a DC scheme, the individual will get whatever the final ‘pot’ might be, and there is absolutely no guarantee that this will have accumulated to an amount sufficient to fund an acceptable level of benefits.

Since the only way in which the payments made into a scheme can grow is by investment performance, this means that the risk of poor performance is now borne by the individual rather than by the scheme itself. Yet in the case of an occupational scheme the individual will often have little or no control over the choice of investments,4 while even in the case of a personal plan they may be limited to a small number of mutual fund-type vehicles owned by or associated with the scheme manager.

So the individual is now put in the position of having responsibility for a situation yet without having the means to control it. Since nobody would accept such a position within an organisation, it seems strange that nobody has objected to this particular instance of it. This argues strongly that what might be called the ‘unethical’ aspect of money purchase pensions has not yet been properly appreciated.

Second, the responsibility for payment of the benefits has shifted from the scheme to the insurance industry. Thus pensioners are now effectively in the same position as creditors of a commercial business. Were some future financial crisis to engulf the insurance sector in the same way that the events of 2007 and 2008 engulfed the banking sector, it is entirely possible that many people might be deprived of their pension altogether, despite having purchased an annuity. Again, this aspect of the situation appears to have been largely overlooked.

Finally, and most crucially, the level of benefits that a money purchase scheme is likely to provide is very much less than that which people might have been expecting from a final salary scheme. Calculations performed by the writer elsewhere5 suggest that the annual amount generated by a money purchase scheme may actually only be about one-third of what would otherwise have been payable under a final salary scheme.

We will examine how and why this has come about, but the conclusion seems inescapable: retirees will in future have to put up with a relatively impoverished lifestyle. Some have even questioned whether history will look back on retirement as a novel late twentieth-century experiment.6

Even in countries other than the UK, where pension provision may be structured differently, there is yet another issue that does not appear to have been properly appreciated. Pension funds typically hold very high levels of the bonds (debt) issued by their own government. Indeed, in some cases they may be forced to. With the growing recognition of the very real possibility of governments defaulting on their debt, this raises the prospect of a disaster (sovereign debt default) being turned into a tragedy (loss of pension provision).

Global economic prospects

Economic cycles come and go. We in the UK should be more aware of that than most, since we have witnessed a seemingly endless cycle of boom and bust. This is linked to various of our other issues, most notably that of budget deficits and national debt.

First, as we will see, economic theory strongly suggests (indeed, this should be obvious) that during good times you put something away for a rainy day and then, when that rainy day finally arrives, as arrive it must, you have something to fall back on. In other words, in the ‘boom’ part of the cycle you run a budget surplus and build up a buffer of cash reserves and/or pay down debt. Then in the ‘bust’ part of the cycle you will have flexibility to borrow money and/or to use up your accumulated cash reserves.

Sadly, this has not happened, and so governments around the world now find themselves trying to navigate a particularly nasty downward part of the cycle with no safety net.

Second, if you are the government of a heavily indebted nation, then economic growth is the fairy godmother you look for to wave a magic wand and get you out of trouble. With economic growth come both higher taxes (since there is more income and activity to tax) and lower spending (since unemployment will fall, thus reducing the welfare budget). This double whammy will transform both the annual budget and total debt as a proportion of GDP since a budget surplus will allow debt to be paid off, so the level of total debt will be falling at the same time as GDP is rising.

At the end of the Napoleonic wars, for example, Britain, whose strategy once again had been largely to pay huge subsidies to other people to induce them to do the bulk of the fighting (on land, that is), had national debt exceeding 200% of GDP. Luckily Britain then experienced explosive economic growth over the next fifty years or so by virtue of being in the forefront of the industrial revolution. By 1850 debt had halved as a proportion of GDP, and by 1900 it had more than halved again.7

Some believe that if all the various elements of UK government debt, which we considered briefly above, were added together they would once again approximate to 200% of GDP. Given that we clearly cannot expect the same explosive economic growth of the nineteenth century, then this may signal a bleak future. The only other time that national debt was at that level was at the end of the Second World War, and by then Britain had already effectively gone bust (that happened in 1941, with Britain able to continue the war only as a credit client of the United States).

At the time of writing it is unclear whether we really are heading into a global recession and, if so, whether it would be anything like as severe or prolonged as the Great Depression of the 1930s, but it does seem that even the most optimistic medium-term forecast is for no more than sluggish growth.

The political system

It is impossible to separate economics from other fields of study. For example, economic circumstances and outcomes are directly influenced, in some cases even directly caused, by policy decisions. Policy decisions are made by politicians and those advising them, and they do this within the framework of the relevant political system. The question of whether that system helps or hinders optimal decision-making is therefore clearly relevant.

Systems currently in use range from what might be called the western democratic model, slightly different versions of which are employed by countries such as America, Britain, Japan and Germany, to outright dictatorships such as North Korea. Along the way we meet oligarchies such as Russia, benevolent despotisms such as the UAE and totalitarian single-party states such as China.

Politicians from democratic states have regularly bemoaned the phenomenon of boom and bust. Indeed, Gordon Brown even claimed to have halted it but, like Canute holding back the waves, his confidence proved unfounded. This is ironic since arguably political decisions, rather than damping down boom and bust, have in many cases exacerbated it. In 1958, for example, British Prime Minister Harold Macmillan, with an eye to a forthcoming election, wanted increased public spending. His Chancellor of the Exchequer (finance minister), with an eye to inflation and economic cycles, wanted decreased public spending. Macmillan got his way and, most unusually, his entire treasury team (Thorneycroft, Powell and Birch) stuck up for their principles and resigned en masse. Of course this was effectively the end of their careers; nobody likes a politician with principles.

To be effective, economic planning must be long term in nature. It must also embrace other areas, such as technology, innovation, global trading conditions, currency movements, social issues and government policy. One of Macmillan’s successors, Harold Wilson, at least recognised this, though he proved unable to put it into practice.

Strategic long-term planning across any discipline, whether it be military, industrial, investment or any other type of strategy, reveals a common and all-pervading principle. Like many common and all-pervading principles it is ignored, or even denied, by those most affected by it, but it is valid nonetheless. It is this: most strategic decisions come down to a trade-off between one choice which has a short-term benefit but a long-term cost, and another choice which has a long-term benefit but a short-term cost.

Within a western democratic system we place our politicians in an impossible situation. We ask them to make decisions with long-term effects, but because they must seek election every few years we more or less force them to consider only the short-term consequences. Thus, like Macmillan in 1958, they will always tend to choose a short-term benefit rather than a short-term cost, almost regardless of the possible consequences in the long term. Is it a coincidence that China, a totalitarian state, has just witnessed a twenty-year economic miracle, while those countries currently struggling with high debt and stagnant growth are all western-style democracies? Or does it speak to the ability of a single-party system to conduct strong, long-term central planning and efficiently oversee its consistent implementation?

To be clear, it is no part of this book’s mission to advocate totalitarianism, but it is valid to ask whether the system within which we force our politicians to operate fosters good decision-making, and, if not, what we might do to change it while still remaining true to the ideals of democracy.

A good example of this problem may be seen in the UK government’s decision to use their Project Merlin initiative (which consisted essentially of taking money from the banks by force) to provide investment capital to private companies. Clear evidence from the United States shows that the most logical place to deploy this would be by way of early-stage venture capital to start-up companies with dynamic growth potential, often based around some proprietary technology application. Studies show that about 20% of American GDP is currently contributed by companies that are, or were, venture-backed.8 Yet instead, government has chosen to deploy the money to medium-sized companies with limited growth potential, though being careful of course to have their spin doctors apply the word ‘growth’ to both the fund and its target companies.

Why have they done this? It is obvious where the money should be targeted and that the government has got it wrong. Is government stupid? No, or at least not in this instance. They are simply looking determinedly at the short term. If UK venture performance were to be even a fraction as effective as American, then the benefit to the economy of seeding early-stage companies would be dramatic. Yet it would take at least ten years to show through, whereas it is just possible that they may be able to persuade people that the ‘growth’ fund is showing some results (perhaps by stating the number of investments made) within the lifetime of a single Parliament.

Politicians are interested in votes, not the long-term national interest, and we should not feel entitled to complain because we force them to act that way. We get the politicians we deserve because we are not prepared to take the trouble to think seriously about political or constitutional reform.

A further problem within countries such as the UK and Germany is of course that national sovereignty has been ceded to the European Union. It is because of this that regulatory regimes are able to be imposed upon countries across a whole range of things from financial services to vitamin pills to light bulbs without the consent of the electorate. Since in cases such as the UK the electorate never got to approve the handover of sovereignty in the first place, this does raise the question of just how ‘democratic’ such a democracy might be. At the very least, it requires that any review of the political system should be all-embracing; it is no longer sufficient for EU member countries to consider only what takes place domestically.

The rest of the book

I have now rehearsed briefly what seem to me to be the five main strands of the knot, which we must try to unpick and consider in more detail. Thus far we have focused largely on the current situation and have been content to consider the broad outline of what we can observe. I now need to introduce the economic ideas that I believe will help us understand the issues which we are facing, and the unfolding events that created them.

Once I have done this I will come full circle and, armed with this new-found knowledge, analyse the full extent of our current problems and consider some possible ways in which we might seek to address them.

I could begin this quest just about anywhere. I have already mentioned the Napoleonic wars, and even Edward III, but there is probably no need to go back to the nineteenth century, let alone the fourteenth. Let us start instead with the Treaty of Versailles, which was finally concluded in 1919 after what Edward House called ‘eight fateful months’. The Treaty, which of course reshaped the map of Europe after the First World War, sought to deliver ‘justice’ (in Clemenceau’s words) but had many critics. Among them was a man who is destined to play a major part in our story: John Maynard Keynes.

.

1 Alternative Investment Fund Managers Directive.

2 Private Finance Initiative: a way of encouraging private sector capital into key infrastructure projects such as the building of roads, hospitals and railways. More cynically, a way of keeping such projects off the government’s balance sheet.

3 This is a deliberately simplified summary. For example, the phrase ‘final salary’ was often not applied literally.

4 This is much less true in the US with 401(k) type schemes, and some limited flexibility is now also being offered by similar schemes in other countries, including the UK and Australia.

5 See Guy Fraser-Sampson, No Fear Finance, London, Kogan Page, 2011.

6 See for example various publications by Professor David Blake of Cass Business School.

7www.ukpublicspending.co.uk

8 Source: National Venture Capital Association (NVCA).

THREE

Money and Inflation

John Maynard Keynes was a true Victorian, being born in 1883, by coincidence the same year which marked the passing of Karl Marx. Keynes was to prove at least as influential a thinker, though believing in a very different socioeconomic model.

A childhood prodigy who is said to have puzzled over interest calculations at the age of four, he won a scholarship to Eton, followed in due course by a scholarship to Cambridge, where incidentally his father was a lecturer in ‘moral sciences’, an academic area which no longer exists but which included – yes, you’ve guessed it – economics. Incidentally, Keynes was more or less exclusively gay for the first part of his life and his first known love affair occurred at Eton with the older brother of the same Harold Macmillan whom we met in the last chapter.

His gayness is actually relevant to his thought and the impact that this had on his times, since it provided an entrée, through a later lover Lytton Strachey, not just to the hugely influential Bloomsbury Group, but to its innermost circle: people such as Virginia Woolf, Clive and Vanessa Bell, Roger Fry and E.M. Forster. Moving in more distant orbits were the likes of Harold Nicolson (also gay, and husband to Vita Sackville-West), Duff Cooper and the Mitfords, and through them he had access to all the leading politicians of the day, including Winston Churchill.

Not that Keynes probably needed much help, for he rapidly became not just a member of the Apostles, a group to which only the intellectual elite of Cambridge University were invited, but also secretary of the Cambridge Union and president of its Liberal Party (then one of the two parties of government) association. His fellow Apostles’ faith in him was not misplaced; he graduated with a first in mathematics in 1904. Membership of the Apostles was for life, by the way, and Keynes maintained an active participation after he left Cambridge.

After a brief and un-enjoyable flirtation with life as a civil servant, during which one of his achievements was to become an expert on the Indian rupee, Keynes returned to Cambridge to concentrate on economics, becoming first a lecturer and then a Fellow. By the end of the First World War he was already established as an economist of repute and, having worked for the Treasury during the war, it was natural that he should have found himself a member of the large advisory team which accompanied the British delegation to the lengthy negotiations that would culminate in the Treaty of Versailles. It was, however, a frustrating experience for Keynes as he was sidelined by the two political heavyweights chosen to front the financial aspects of discussions, Lord Sumner, a Lord of Appeal, and Lord Cunliffe, who was the immediate past governor of the Bank of England, finding himself at odds with their views.

The story of the Treaty of Versailles is well known. Shortly before the end of the war President Wilson had unilaterally issued his ‘Fourteen Points’, on the basis of which he wished peace to be established and post-war society conducted. Britain and France were taken entirely by surprise, not having been consulted in advance, and the ground was then cut from under their feet when Germany sought peace directly from Wilson expressly on the basis of the Fourteen Points.

The most contentious aspects of the Fourteen Points were Wilson’s insistence on the establishment of a League of Nations, which he thought would render future war impossible, and a proposal for (though it was not couched in exactly these terms) self-determination as a general principle. His actual words were ‘the adjustment of all colonial claims’, which caused the British, with their extensive empire, great concern.

It quickly transpired though that Wilson had intended self-determination to apply only if you were white and European. Britain provided no separate representation for India, and Britain and France together effectively blocked an Arab delegation. Doubtless feeling that Wilson’s commitment to self-determinism was literally only skin deep, the Indian poet Tagore would in 1930 tell a US audience including Franklin Roosevelt and Henry Morgenthau that ‘a great portion of the world suffers from your civilisation’. Perhaps he was still sore from Wilson, whom he had met on an earlier trip, having rejected his proposed dedication of his book, Nationalism.

In similar vein, while in Paris Wilson refused to grant an audience to an importunate young kitchen worker in a borrowed suit who wanted to speak to him about self-determinism in Indochina. It might have saved a lot of trouble had he done so; the young man’s name was Ho Chi Minh.

The League of Nations caused Wilson no end of problems as well. Japan, one of the victorious Allies, asked for a racial equality clause, pointing out not unreasonably that this principle was already enshrined in the American constitution. Wilson, who strangely had not anticipated this point, was acutely embarrassed and eventually had them withdraw their request, sowing the first seeds of future US/Japanese discord. Japan became one of the four permanent council members, but would withdraw in 1933 after disagreements over Manchuria. Had the Japanese delegation known in 1919 that Wilson had at one stage told his cabinet that he thought America should stay out of the war ‘to keep the white race strong against the yellow’, they might perhaps have been less accommodating.

Ironically, since it was only Wilson who ever really wanted the League, in the event he was unable to persuade Congress to ratify the Treaty of Versailles and so America never became a member.

Crucially, while the Fourteen Points made specific proposals for the return of territory, including the long-disputed Alsace-Lorraine region to France, they were silent on the question of financial compensation and it was in this area that Keynes found himself in disagreement with Sumner and Cunliffe, who quickly became nicknamed ‘the heavenly twins’ because of the sky-high rates of reparations that they wished to inflict on Germany. In fairness, in doing so they were merely responding to popular sentiment in Britain, which was demanding that Germany ‘be squeezed until the pips squeak’, and may have felt that politically they had little choice but to go along with this – an early example of politics triumphing over economics.

The French agenda was clear. Having narrowly won the third round of the Franco–German conflict (the first two being the Napoleonic wars and the Franco–Prussian war, both of which France had lost), they were determined that there should never be a fourth. This strategy demanded that Germany be weakened, preferably by being split up into its former constituents such as Bavaria, Saxony and Prussia, by having territory taken away and given to other nations such as Poland and the newly-formed Czechoslovakia, and by swingeing financial obligations that would keep the German economy weak and unable to afford any attempt at rearmament.

In broad terms, a bargain was struck. Wilson was desperate for the League of Nations to be set up and, increasingly, to bring the interminable discussions to an end so he could return to America. He was dubious about reparations, being instinctively inclined to the balance of power, and seeing Germany as an important trading partner of the United States in the post-war world. Britain and France wanted reparations but were cool about the League of Nations. They were both extremely sensitive to his ‘adjustment of colonial claims’ point, not least because they had concluded the Sykes–Picot Agreement during the war, secretly dividing up the Middle East between them; exactly the sort of treaty that the Fourteen Points sought expressly to ban. They had also concluded a treaty with Italy by which, in return for Italy entering the war on the allied side, she would be given large territorial gains when peace came, largely at Austria’s expense. In the end they were unable to move Wilson on this latter point, leaving Italy too with a lasting sense of grievance. Incidentally, the Sykes–Picot Agreement was directly inconsistent with a separate treaty that Britain had signed with King Faisal and various of his Arab allies, which was why they were desperate to deny them a platform at Versailles and were hugely irritated when they attempted to gatecrash the proceedings in the company of their champion, Colonel T.E. Lawrence.

To cut a long story short, Wilson got his League, but Britain and France got their reparations. These were initially set at 226 billion marks, but reduced to 132 billion in 1921. To give some idea of the amounts involved, using figures later quoted by Keynes this was roughly approximate to between ten and fifteen times Germany’s post-war annual tax revenues.

To complicate matters further, many reparations were stipulated to be payable in specie, as lawyers say, literally in stuff, in things. For example, for many years Germany was obliged to make shipments of coal to France; indeed, France even occupied much of Germany’s coal mining region for a while to enforce compliance. Incidentally, one of the ‘things’ transferred by way of reparations was the patent and formula for aspirin, surely one of the most valuable pieces of intellectual property ever acquired.

As we will see, Germany would shortly find herself in a situation in which all available export goods were desperately needed as a source of foreign currency, yet she was hampered by the fact that a large part of her raw materials were already signed away.

Keynes disagreed deeply with this ‘squeeze until the pips squeak’ approach. In 1919 he published The Economic Consequences of the Peace, which became a best-seller not just in Britain (where it sold an astonishing hundred thousand copies in six months) but around the world, helping to convince many that it had been unwise to burden Germany so heavily. Incidentally, it is said that disenchantment with the Treaty of Versailles caused by the book’s publication in America was a major contributory factor in Congress refusing to ratify the Treaty in 1920.

The book was remarkable, not just for its prescience, nor just for its intellectual authority, nor even for its courage in daring to criticise the establishment in a conformist age, but for its style. Perhaps because of his Bloomsbury connections and cultural interests, Keynes wrote at times like a novelist, with moving phrases (‘men will not always die quietly’), pithy pen portraits (of Clemenceau: ‘he had only one illusion: France, and only one disillusion: mankind’) and purple passages (‘with what curiosity, anxiety and hope we sought a glimpse of the features and bearing of the man of destiny [Wilson] who, coming from the West, was to bring healing to the wounds of the ancient parent of his civilisation and lay for us the foundations of the future’).

Keynes saw the Treaty for what it was: an attempt to break Germany economically and keep her forever weak. He pointed out that this was not only in direct contravention of one of the Fourteen Points, but also a breach of a promise that Wilson had made to Congress that there should be no punitive damages.