9,99 €

Mehr erfahren.

- Herausgeber: 50Minutes.com

- Kategorie: Fachliteratur

- Serie: Management & Marketing

- Sprache: Englisch

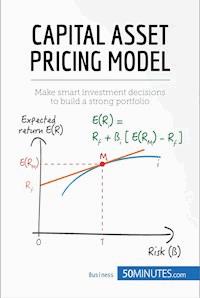

Make smart investment decisions to build a strong portfolio

This book is a practical and accessible guide to understanding and implementing the capital asset pricing model, providing you with the essential information and saving time.

In 50 minutes you will be able to:

• Understand the uses of the capital asset pricing model and how you can apply it to your own portfolio

• Analyze the components of your current portfolio and its level of efficiency to assess which assets you should retain and which you should remove

• Calculate the level of risk involved in new investments so that you make the right decisions and build the most efficient portfolio possible

ABOUT 50MINUTES.COM | Management & Marketing

50MINUTES.COM provides the tools to quickly understand the main theories and concepts that shape the economic world of today. Our publications are easy to use and they will save you time. They provide elements of theory and case studies, making them excellent guides to understand key concepts in just a few minutes. In fact, they are the starting point to take action and push your business to the next level.

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Seitenzahl: 28

Veröffentlichungsjahr: 2015

Ähnliche

Capital asset pricing model

Key information

Names: Capital asset pricing model, CAPM.Uses: The CAPM is a mathematical method for estimating the profitability of any financial asset. The return forecast is calculated according to the risk that the asset entails.Why is it successful? The CAPM is one of the most popular risk assessment methods for financial assets. However, its effectiveness has been criticised by economists such as Richard Roll (American economist, born in 1939).Key words:Capital market: A meeting place between supply and demand for capital. Supply corresponds to savings (the surplus of available capital) made available to those wishing to borrow. Those who borrow constitute the demand (the need for financing). Balance in this market is crucial.Financial asset: An asset is a security or a contract that gives the holder the opportunity to obtain a gain in return for a given risk. For example: I buy shares (a financial asset), in the hope that in time their value will increase and I can sell them to earn a profit. However, if the share value decreases, I will make a loss on my purchase. Interest rate: The interest rate represents the cost of money. It therefore allows me to calculate the costs involved in borrowing or investing money. The interest rate can also be defined as the remuneration obtained in the case of investments.Portfolio: All the transferable securities (in particular stocks and bonds) held by a person, a company, a bank, etc.Returns: The profitability of an amount invested. If I invest my money with an interest rate of 7% and a friend invests the same amount with a 4% interest rate, I can say that my return on capital invested is better than his.Stock exchange: A public or private institution that allows exchanges of assets and transactions of securities (such as shares) to take place. In other words, it is a financing and investment market where the price is set according to supply and demand.Introduction

In the 1950s, the financial markets developed and became the ideal intermediary for balancing the capacities and funding requirements of various economic agents. Their aim was to ensure the financing of the economy through a range of means (savings, security purchases, asset purchases, etc.). Two closely related variables are involved in the investment of a financial asset: returns and risk.

In order to better define these two variables, studies were carried out by various economists:

Frank Knight (American economist, 1885-1972) defined the concepts of ‘uncertainty’ and ‘risk’ in 1921.The work of Harry Markowitz (American economist, born in 1927) marked the beginning of the modern theory of diversification in 1950, known as modern portfolio theory since 1952. This theory puts forward a financial reflection on the use of diversification to optimise a portfolio. This is the most similar version to the current CAPM.Finally, in the 1960s and early 1970s, the American economists William Sharpe (born in 1934), John Lintner (1916-1983) and Fischer Black (1938-1995), and the Norwegian economist Jan Mossin (1936-1987), developed earlier financial models, giving rise to the CAPM.Definition of the model

The CAPM is used both on the financial markets and to solve financial problems in business. The calculation model is based on the measurement of systematic risk, expected profitability and interest rates. In other words, the CAPM enables the return on an asset, relative to its risk, to be estimated.