13,99 €

Mehr erfahren.

- Herausgeber: John Wiley & Sons

- Kategorie: Fachliteratur

- Sprache: Englisch

How to build wealth the smart way--slow and steady This book will show you how to take control of your finances and grow your wealth using nothing more than a few key principles and commonsense wisdom. It shows you how to let go of easy excuses, stop waiting around for magically simple solutions, set intelligent financial goals, and design an action plan that you can follow through to completion. Using a storytelling approach, it shares the financial experiences of the author and her clients, guiding readers through the tools and tactics necessary to effect positive financial change in their lives. Although focused on personal finance goals, the lessons here easily translate to life itself.

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 279

Veröffentlichungsjahr: 2012

Ähnliche

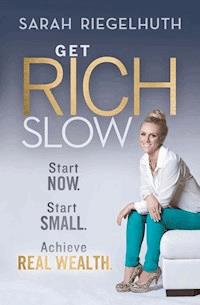

Get Rich Slow: Start Now. Start Small. Achieve Real Wealth.

Table of Contents

First published in 2013 by Wrightbooks an imprint of John Wiley & Sons Australia, Ltd 42 McDougall St, Milton Qld 4064

Office also in Melbourne

Typeset in ITC Berkeley Oldstyle Std 11/13

© Sarah Riegelhuth 2013

The moral rights of the author have been asserted

National Library of Australia Cataloguing-in-Publication entry:

Author: Riegelhuth, Sarah.

Title: Get rich slow: Start now. Start small. Achieve real wealth. / Sarah Riegelhuth.

ISBN: 9781118406168 (pbk.)

Notes: Includes index.

Subjects: Finance, Personal.

Dewey Number: 332.024

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All inquiries should be made to the publisher at the address above.

Internal design by Peter Reardon, pipelinedesign.com.au

Cover design by Paul McCarthy

Author image © Karen Woo

Printed in China by Printplus Limited

10 9 8 7 6 5 4 3 2 1

Disclaimer

The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the author and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information in this publication.

For Finn (my love) and Mark (my best mate) for both always, always believing in me.

About the author

Sarah Riegelhuth is the co-founder of award-winning financial advisory firm Wealth Enhancers and the highly successful League of Extraordinary Women, an organisation supporting the development of young female entrepreneurs nationally. She is passionately committed to helping women realise their potential, both financially and in all aspects of their lives.

Named as one of Melbourne’s Top 100 most influential, inspiring and creative citizens by The Age in 2011, Sarah is recognised as one of Australia’s leading female entrepreneurs. An accomplished keynote speaker, Sarah is also a popular blogger, writer and columnist for several online and print publications including Women’s Agenda and Money Management.

In 2010, Sarah became the youngest board member in the history of the Association of Financial Advisers (AFA) and helped the association launch the inaugural Female Excellence in Advice Award. The award has been more successful than any other award established by the AFA.

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!