16,99 €

Mehr erfahren.

- Herausgeber: John Wiley & Sons

- Kategorie: Fachliteratur

- Serie: Little Books. Big Profits

- Sprache: Englisch

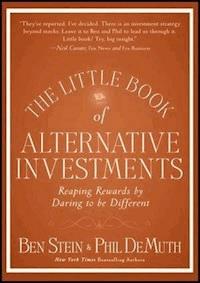

Praise For THE LITTLE BOOK OF ALTERNATIVE INVESTMENTS "Ben and Phil have done it again. Another lucid, insightful book, designed to enhance your wealth! In today's stock-addled cult of equities, there is a gaping hole in most investors' portfolios...the whole panoply of alternative investments that can simultaneously help us cut our risk, better hedge our inflation risk, and boost our return. This Little Book is filled with big ideas on how to make these markets and strategies a treasured part of our investing toolkit." --Robert Arnott, Chairman, Research Affiliates "I have been reading Ben Stein for thirty-five years and Phil DeMuth since he joined up with Ben ten years ago. They do solid work, and this latest is no exception." --Jim Rogers, author of A Gift to My Children "If anyone can make hedge funds sexy, Stein and DeMuth can, and they've done it with style in this engaging, instructive, and tasteful how-to guide for investing in alternatives. But you should read this Kama Sutra of investment manuals not just for the thrills, but also to learn how to avoid the hazards of promiscuous and unprotected investing." --Andrew Lo, Professor and Director, MIT Laboratory for Financial Engineering

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 253

Veröffentlichungsjahr: 2011

Ähnliche

Contents

Introduction

Chapter 1 : Everything You Know Is Wrong

Addicted to Stocks

Bye Bye Miss Portfolio Pie

Chapter 2 : Efficient Market Theory and Its Discontents

Exploiting Market Anomalies for Fun and Profit

Capture that Anomaly!

Bonds

A Risk-Balanced Bond Portfolio

All Together Now

Chapter 3 : Collectibles as Investments

Love and Pleasure

Buying and Selling

How Not to Make Money

Chapter 4 : More Alternatives We Don’t Love

Private Equity

“Buy/Write” Funds

Structured Products

130/30 Funds

Gold

Chapter 5 : Conventional Alternatives I: Commodities

Back to the Futures Market

How Do Investors Use Futures Markets?

So What?

Do Commodities Add Value to a Portfolio?

How Do We Invest in It?

Chapter 6 : Conventional Alternatives II: Real Estate

How Do Investors Use REITs?

How Do REITs Work?

Do REITs Add Value to a Portfolio?

How Do We Invest in It?

Chapter 7 : The Ultimate Alternative Investments

Say Whaa . . . ?

Exploiting Market Anomalies

Illusion versus Reality

It Gets Worse

Chapter 8 : So Why Invest in Hedge Funds?

Final Answer

Hedge Funds Meet Mutual Funds

Master Beta

Chapter 9 : A Field Guide to Hedge Funds, Part One

#1. Long/Short Equity

#2. Market Neutral Equity Funds

#3. Dedicated Short Bias

#4. Global Macro

#5. Managed Futures

Chapter 10 : A Field Guide to Hedge Funds, Part Deux

#6. Convertible Arbitrage

#7. Fixed-Income Arbitrage

#8. Event-Driven

#9. Emerging Markets

#10. Multi-Strategy

How They Stack Up

Chapter 11 : One-Fund Solutions

Hedge Fund Replicants

Fun, Fun, Funds ’til Her Daddy Takes the T-Bill Away

Multi-Strategy

Alternative: Roll Your Own Hedge Fund

Chapter 12 : Hedge Funds Pigs in Mutual Fund Blankets

Long/Short Funds

Market Neutral Equity Funds

Dedicated Short Bias Funds

Global Macro

Managed Futures

Convertible Arbitrage

Fixed-Income Arbitrage

Event-Driven

Emerging Markets

Chapter 13 : Adding Alternative Investments to Your Portfolio

Our Final Exam

Conventional Alternatives

The Hedge Fund Couch Potato Portfolio

A Deeper Dive

The Portfolio of the Future

Conclusion : Quest into the Unknown

Appendix : Fundamentals

Acknowledgments

About the Authors

Additional Praise for The Little Book of Alternative Investments

“In their Little Book of Alternative Investments, Ben Stein and Phil DeMuth bring their approachable style and wit to the investing world beyond stocks and bonds. For individual investors unfamiliar with the terminology and strategies of this part of the investing landscape, Stein and DeMuth provide an accessible overview, as well as suggesting ways that small investors can explore these realms. For everyone who has heard the hype and wondered what it all means, this book provides a readable and entertaining first step in coming to grips with alternative investment options.”

—Geoff Considine,

Ph.D., Quantext

Little Book Big Profits Series

In the Little Book BigProfits series, the brightest icons in the financial world write on topics that range from tried-and-true investment strategies to tomorrow’s new trends. Each book offers a unique perspective on investing, allowing the reader to pick and choose from the very best in investment advice today.

Books in the Little Book Big Profits series include:

The Little Book That Still Beats the Market by Joel Greenblatt

The Little Book of Value Investing by Christopher Browne

The Little Book of Common Sense Investing by John C. Bogle

The Little Book That Makes You Rich by Louis Navellier

The Little Book That Builds Wealth by Pat Dorsey

The Little Book That Saves Your Assets by David M. Darst

The Little Book of Bull Moves by Peter D. Schiff

The Little Book of Main Street Money by Jonathan Clements

The Little Book of Safe Money by Jason Zweig

The Little Book of Behavioral Investing by James Montier

The Little Book of Big Dividends by Charles B. Carlson

The Little Book of Bulletproof Investing by Ben Stein and Phil DeMuth

The Little Book of Commodity Investing by John R. Stephenson

The Little Book of Economics by Greg Ip

The Little Book of Sideways Markets by Vitaliy N. Katsenelson

The Little Book of Currency Trading by Kathy Lien

The Little Book of Valuation by Aswath Damodaran

The Little Book of Alternative Investments by Ben Stein and Phil DeMuth

Copyright © 2011 by Ben Stein and Phil DeMuth. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Stein, Benjamin, 1944–

The little book of alternative investments : reaping rewards by daring to be different / Ben Stein, Phil DeMuth.

p. cm. – (Little books. big profits; 31)

ISBN 978-0-470-92004-6 (hardback); (cloth); 978-1-118-07524-1 (ebk); 978-1-118-07525-8 (ebk); 978-1-118-07526-5 (ebk)

1. Investments. 2. Portfolio management. 3. Asset allocation. 4. Investment analysis. I. DeMuth, Phil, 1950– II. Title.

HG4521.S7552 2011

332.6—dc22

2011002035

For every man and woman who wears the uniform.

Introduction

Are You Alternative? Dare to Expose Yourself

Let’s talk about you.

Be honest—you’re tired of the same old up-and-down from your “missionary position” 60/40 stock and bond portfolio. You read about people who are experimenting with alternatives, and wonder—should you do it, too? Can it be wrong, if all the cool kids are doing it? Especially, the rich cool kids? Certainly you don’t want to get hurt, and you don’t want to hurt anyone else. But you’re curious. You’ve felt the attraction, and even though you’ve tried to fight it, it’s not letting you go.

If you wanted to give the alternative investing lifestyle a spin, where would you start? Most of these investments are complicated and confusing, especially if you skipped graduate school that year. Meanwhile, the managers who specialize in them all talk to each other but rarely to outsiders. By law, hedge funds aren’t even allowed to advertise, so they don’t have a massive advertising budget devoted to reaching out and educating the high-net-worth about features and benefits. It’s like you have to know somebody to get in.

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!

Lesen Sie weiter in der vollständigen Ausgabe!