14,99 €

Mehr erfahren.

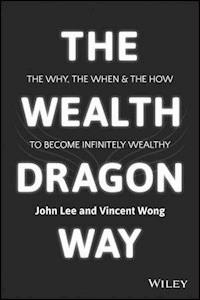

- Herausgeber: John Wiley & Sons

- Kategorie: Fachliteratur

- Sprache: Englisch

Stop procrastinating and become financially free, by building asset-based wealth and creating passive income. The Wealth Dragon Way: The Why, the When and the How to Become Financially Free is a practical guide to becoming financially free through building asset-based wealth and creating passive income. Part motivational, part informational, this guide will change your whole perspective on wealth and your personal growth potential. The book discusses both moral and monetary wealth, and looks at how we are easily misled and influenced by media-driven myths surrounding money, debunking notions such as the idea that there is no truly moral way to become wealthy, or the belief that the state will provide for us in retirement, and more. You'll discover new truths surrounding the subject of wealth, and get to the root of your own procrastination over planning for your financial future. You will learn how to tackle your fears and overcome the issues holding you back. You will also read real-life examples of how two property entrepreneurs built their significant portfolios using alternative strategies such as using lease options, and structuring and securing deals at below market value. Along the way, you'll learn what it means to become a Wealth Dragon, and the key principles to live by if you're ready to work towards achieving real financial freedom. You are far more likely to achieve personal wealth if you are one hundred percent clear as to why you want it. This book explores the psychology of our relationship with money and offers a practical advice for anyone who is determined to meet their goals and realize their dreams. * Bust the myths surrounding the subject of wealth * Start taking control of your financial future * Adopt the key Wealth Dragon principles * Discover your full potential for financial and personal growth The importance of taking control of your financial future cannot be overstated, especially in these economically uncertain times. Whether you want to quit the rat race, build some assets as security, or develop a branded business that will provide you with a passive income, The Wealth Dragon Way is your guide to building wealth and becoming financially free.

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 369

Veröffentlichungsjahr: 2015

Ähnliche

The Wealth Dragon Way

THE WHY, THE WHEN AND THE HOW TO BECOME INFINITELY WEALTHY

John Lee

Vincent Wong

Cover design: Wiley

Copyright © 2015 by John Wiley & Sons Singapore Pte. Ltd.

Published by John Wiley & Sons Singapore Pte. Ltd.

1 Fusionopolis Walk, #07-01, Solaris South Tower, Singapore 138628

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as expressly permitted by law, without either the prior written permission of the Publisher, or authorization through payment of the appropriate photocopy fee to the Copyright Clearance Center. Requests for permission should be addressed to the Publisher, John Wiley & Sons Singapore Pte. Ltd., 1 Fusionopolis Walk, #07-01, Solaris South Tower, Singapore 138628, tel: 65-6643-8000, fax: 65-6643-8008, e-mail: [email protected].

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor the author shall be liable for any damages arising herefrom.

Other Wiley Editorial OfficesJohn Wiley & Sons, 111 River Street, Hoboken, NJ 07030, USA John Wiley & Sons, The Atrium, Southern Gate, Chichester, West Sussex, P019 8SQ, United Kingdom John Wiley & Sons (Canada) Ltd., 5353 Dundas Street West, Suite 400, Toronto, Ontario, M9B 6HB, Canada John Wiley & Sons Australia Ltd., 42 McDougall Street, Milton, Queensland 4064, Australia Wiley-VCH, Boschstrasse 12, D-69469 Weinheim, Germany

ISBN 978-1-119-07783-1 (Paperback) ISBN 978-1-119-07785-5 (ePDF) ISBN 978-1-119-07784-8 (ePub) ISBN 978-1-119-07786-2 (oBook)

For Annika and Jennifer

Contents

Preface

Acknowledgments

About the Authors

Introduction: The Story of Wealth Dragons

PART I THE WHY

Chapter 1 What Is Wealth?

Chapter 2 The Moral Obligation to Be Wealthy

Chapter 3 Why a Wealth Dragon?

Chapter 4 Undesirable Truths

Chapter 5 Welcome to the Parallel Universe

The Value of Embracing Failure

The Learning Curve

You Don't Have to Be Bad to Be Rich!

Getting and Spending Money

What's the Limit to What You Can Achieve?

Living in Excuseville

Taking Action

PART II THE WHEN

Chapter 6 Get Rich Quick or Get Rich Forever?

Chapter 7 Who Is Stopping You?

Chapter 8 What Is Stopping You?

Chapter 9 The Trap of the Rat Race

Chapter 10 It's about Work, Stupid!

PART III THE HOW

Chapter 11 The Wealth Superhighway

Asset Building

Passive Income Generation

Business Creation and Brand Building

The Path to Infinite Wealth

Chapter 12 The More Money Mindset

Taking Control of Your Money

Your Design for Life

Your Wealth Education

Chapter 13 A Foolproof Guide to Property Investing?

The Golden Rules

Auctions: Caveat Emptor

Learn before You Earn

Deal Making

Lease Options

People before Property

Chapter 14 Property Investment in Practice

John's Property Stories

Vince's Property Stories

Chapter 15 Being a Wealth Dragon

Top 10 Wealth Dragon Principles

Additional Top Tips for Success

Conclusion: The Now

Final Word

Index

EULA

List of Illustrations

Chapter 2

Figure 2.1

A Pictorial View of the Relationship between Moral and Monetary Wealth

Chapter 5

Figure 5.1

The Learning Curve

Chapter 11

Figure 11.1

The Motorway of Wealth and Success

Figure 11.2

Maslow's Hierarchy of Needs

Guide

Cover

Table of Contents

Preface

Pages

ix

x

xi

xiii

xiv

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

27

28

29

30

31

32

33

34

35

36

37

38

39

41

42

43

44

45

46

47

48

49

50

51

52

54

55

56

57

58

59

60

61

62

63

64

65

67

68

69

70

71

72

73

74

75

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

95

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

151

152

153

154

155

156

157

158

159

160

161

162

163

165

167

168

169

170

171

172

173

174

175

176

177

179

180

181

182

183

184

185

187

189

190

191

192

193

194

Preface

We're going to discuss why to become wealthy extensively in this book, so we'd like to start by asking you this question: Why did you pick up this book? We're guessing it's because you'd like to have more money in your life. We can definitely show you how to achieve this, but why do you want more money in your life? We're assuming it's so you don't have to worry about whether you'll always be able to afford to pay the bills. Why do you want to be free of money worries? Presumably so that you're able to spend more time and energy on the things and people you value. So, when do you want to start living like this? That's a question only you can answer.

We started Wealth Dragons in 2009, hoping we could educate people about wealth creation and help them realize their full potential. Our specific expertise lies in different areas of the property business, but over the years we have explored other avenues of passive income generation and asset building as we have continued along the path of our own education. We pass on anything and everything new that we learn, that we believe will enrich the lives of others, in our seminars and educational programmes. We, like you, are constantly learning and growing. Since we started the company we have given countless seminars and have taught wealth creation programmes that are constantly evolving, all over the world.

One of our key ambitions has always been to reach as wide an audience as possible, and this is what inspired us to write a book. Our aim in this book is to give you, the reader, an overview of our philosophies about wealth creation, share with you our own personal stories, and inspire you to further your own wealth education.

Over the years we've received a great deal of positive feedback from our clients students and business associates. We hope this book will also remind them of why they chose us and why they stuck with us.

While we have written the book together, with a joint voice for the most part, we obviously have our individual stories and thoughts to share. This will be clearly indicated in the text.

If this is your first introduction to Wealth Dragons, we hope it inspires you and gives you plenty to think about. Of course, it goes without saying that we would love to hear from you, and we invite you to come and meet us at a seminar sometime in the future. You'll find all the relevant contact details at the back of the book.

We can't wait to meet you when you're ready to become a wealth dragon!

Acknowledgments

We are indebted to so many people who have helped make and shape this book. First, we are very grateful to the John Wiley & Sons team, including Kimberly Monroe-Hill, Jeremy Chia, Gladys Ganaden, and especially Nick Wallwork and Nazneen Halim, who championed the book from the start. To our families and friends, we extend our deepest gratitude for all their ongoing love and support. We wouldn't be where we are today without the hard work and support of our entire Wealth Dragons team, including our administration and sales teams, and our speakers, who all help make our business so successful and the daily grind so enjoyable. They are all a part of this journey, as they are the ones who really start the process of changing people's lives. We would also like to thank Miranda Leslau for all her expertise. But the people to whom we owe the greatest debt are those who have inspired so much of the material in this book . . . our students. They help us learn while we teach. This book is a testament to them. Many of them started out believing they didn't have choices in life. To anyone who has been told they can't achieve something, we have written this book to tell you that you can.

About the Authors

John Lee is the CEO and co-founder of Wealth Dragons. John started investing in property in his early twenties. By the time he was 27, John had achieved his goal of becoming a self-made millionaire. His experiences inspired him to share his knowledge with others and he was soon teaching seminars in property investment throughout the United Kingdom. He subsequently gained an international reputation as a motivational speaker and has shared stages with former US President Bill Clinton, Alan Sugar, Richard Branson, Jack Welch (ex-CEO of GE) and Randa Zuckerberg (co-founder of Facebook). John also trains people to become world-class public speakers. He has helped several of his students build highly successful businesses and achieve international acclaim. John's success came despite a humble start in life. He was born to Chinese parents who ran a takeaway restaurant in the north of England. All of John's achievements came as the result of endless hard work and unwavering tenacity. John is dedicated to showing others how they have the opportunity to do the same and is continually inspired by watching his students achieve the kind of success they thought they could only ever dream of.

* * *

Vincent Wong is the COO and co-founder of Wealth Dragons. Vince is one of the most dynamic and well-respected property entrepreneurs in the United Kingdom and internationally. As well as building his own multimillion-pound property portfolio, Vince has helped countless people source and structure property deals through his property companies. At the height of the financial crisis, Vince pioneered groundbreaking financing strategies and was successful in getting lease options legalized for residential property sales in the United Kingdom, Malaysia and the Netherlands (and is currently working with regulators on campaigns in Poland and Singapore). Vince personally mentors a number of property investors and business owners. He is an internationally recognized public speaker and expert in the property industry and he is regularly invited to speak to audiences of more than 1,000 at the prestigious Property Outlook Conference in Kuala Lumpur, Malaysia (the biggest property conference in Asia). Vince is a graduate of the University of London's School of Pharmacy and holds an MBA from Cass Business School.

Introduction: The Story of Wealth Dragons

In three words I can sum up everything I've learned about life: It goes on.

—Robert Frost

John: My rather ordinary, humble start in life took place in a small Lancashire town in the north of England, not far from the Yorkshire Dales. I was born in Burnley General Hospital in 1981 and grew up in Colne, a fairly remote and typically northern English town, where my parents owned and ran the local Chinese takeaway. They were both originally from Hong Kong and moved to the UK in the 1970s. They married shortly after meeting and started what was to become a family business. Many Chinese people born in Hong Kong moved to the UK in those days, taking advantage of the time during which Hong Kong was a British territory, which gave them the right to British nationality. The influx was responsible for a surge in Chinese takeaways. The British seemed to love the new, exotic, tasty (and relatively cheap) fast food, and many families built up successful small businesses as a result.

My parents, and their extended family members, worked long hours to keep the business up and running, and making a profit. It was a hard life and I hardly saw them while I was growing up. Colne has grown since the time I lived there, but during my childhood there were only a handful of shops and one primary school, where I was teased mercilessly for being the only Chinese boy in the school. I remember my nickname was Bruce Lee. This might have been a compliment within a big group of Chinese kids who worshipped the martial arts hero, but the way in which the local English kids used it when they directed it at me was definitely derogatory. They would do karate moves in front of me and laugh. I once got flying-kicked in the back so hard that it knocked me off my feet. When I took off my jacket I found there was the imprint of a shoe on it. I don't remember having any real friends at school and I don't think I went to more than two or three birthday parties throughout my entire school years. Even when I became a teenager and the kids in my area started going out to parties and local clubs, I missed out because my parents wouldn't allow me to go. Anytime I wasn't at school I was expected to work in the takeaway.

I started working in the takeaway—doing odd jobs, cleaning and carrying things around—at around the age of seven or eight years old. I got a little pocket money for the mundane jobs I did. Everyone worked in the family business, and I knew it was expected that my brother and I would take it over some day.

But I had other plans.

I had watched my parents work night and day in a business that gave them a modest living and prevented them from spending quality time with their children. They worked seven days a week, so my brother and I were mostly raised by our aunts and uncles. I always knew I wanted a different life. Not only did I want to give my future children more options (including the option to spend time with their father), but I also wanted to help my parents get more time to enjoy life without working every waking minute. I wanted to free them from the chains that bound them to their arduous existence.

By the time I started college I was working three different jobs. I was making money in every way I could, in every spare minute I could find. Along with working in the takeaway most evenings, I got a weekend job in a shoe shop. I also signed up for part-time telesales work, which was brutal. It involved cold-calling people listed in the Yellow Pages to sell them web sites. I got rejection after rejection; it was soul-destroying. But in hindsight it was invaluable experience as it instilled a high tolerance for rejection in me, which served me well later in life! My inspiration was my determination to break free from the future that had been laid out for me—a future identical to the life my parents led. I respected them, but I didn't want to live like them. I wanted to reach for more; I believed I could achieve more.

Those were some tough years. I had absolutely no life and no friends; at times I resented it, but I knew I had to keep going. I became obsessed with working, believing I could work my way to success. But I was frustrated by how much time it took to make a modest amount of money. Was I even doing anything different from my parents, in giving up all my time to make money? That feeling probably planted the first seed of my determination to find a way to buy back my time, to make significant money without it taking up all of my time. That growing feeling—the deep desire for the freedom to do what I wanted with my time, whilst still earning an income—helped motivate me in the years to come.

I did well enough at school to get into university; I got a place at the University of Hull to study computer animation. With what my parents had put aside for my higher education, and with the money I'd saved from all my jobs, I was able to study full-time without having to work to supplement my allowance. Being away from home and out of the grind of working in the takeaway for the first time in my life, I also had my first taste of a real social life. It was great. I made some good friends and found a little self-confidence. But money was still tight and I couldn't wait to graduate and move down south where I believed I could command a better salary than my peers.

My first job was close to London, in Guildford. My starting salary was £21,000, while most of my friends were in jobs that paid them around £15,000; I definitely felt their jealousy. However, I soon discovered that their jealousy was largely unfounded, because the reality of earning £21,000 was not as rosy as I thought it would be. By the time I'd paid my rent and all my living costs in the expensive London commuter belt, I had less money than I did when I was doing menial work in Yorkshire!

I lasted about a year in that first job and then jumped around doing some freelance contracts for a while before landing my next big job at an animation company called Criterion. I started on a salary of £26,000 and was convinced that this increase was going to change my life. But with more money coming in I was soon spending more on going out and enjoying myself, and it wasn't long before I found I had even less money left at the end of the month than before!

My next job was my dream job.

My best friend at university had been Darren Rodriguez. We had both been obsessed with working as hard as we could. We used to get up at 5 A.M. to wait outside the main building until the caretaker let us in. We were the first to get in and always the last to leave. We regularly told anyone who would listen that it was our ambition to get jobs at Framestore, the computer animation company that was fast on its way to working on Oscar-winning films such as the Harry Potter films and Avatar. All our fellow students thought we were being overly ambitious. Jobs at Framestore were highly coveted and competition was fierce, so no one believed we would get in there. Their negativity made us even more determined. We never gave up, and only a few years after we graduated, Darren landed his job there. I secured my position soon after leaving Criterion.

But as is so often the case when you realize your dream, after an initial honeymoon period we became bored and frustrated. We started to hate our purported dream jobs just like we'd ended up dissatisfied with all our other jobs. We were frustrated with the hours, the politics, and (again) that feeling that we never had enough money, despite the fact that we were both earning considerably more than most of our friends.

I started at Framestore on a salary of a whopping £36,000. This time I was sure I was fast on my way to living the high life. But, just as before, I soon discovered my pay cheque got eaten up pretty quickly. My travelling costs went up as I was now commuting from Guildford, where I still lived, into central London, plus I spent a proportionally higher amount on other expenses. I got a new car with a short-term loan, a laptop, some nice clothes, and suddenly I was back to square one…struggling (relatively speaking) to make ends meet. I couldn't believe I was burning through all my money. I worked out my monthly budget and discovered that, after deducting bills, I had £27 in disposable income that I could spend each day. One lunch in a nice restaurant in the city, or a round of drinks for a few friends (who perceived me as being much wealthier than them), would wipe that out in an hour.

Darren was equally frustrated. We used to meet in the canteen every lunchtime and during all our coffee breaks to plot our escape from the rat race. We were strategizing together, in order to figure out how we could literally buy back our time. We were two guys in our midtwenties who were already heavily disillusioned with life. Something was wrong with that picture!

One day, close to my birthday, Darren presented me with an early birthday present. It was a book. I will never forget the look of excitement on his face. He told me that this was it; this was how we were going to break free. He knew I was dyslexic, that it was a real struggle for me to read anything, but he begged me to read the book cover to cover, and as soon as I could. The book was Rich Dad, Poor Dad by Robert Kiyosaki.

I opened the book on the tube on the way home and didn't put it down for two days. I was gripped. It was my first introduction to the concept of passive income, and I became obsessed with it. Darren and I could not stop talking about how we were going to achieve our new goals of creating a passive income source that would allow us to keep building our wealth indefinitely. I could hardly believe that so much financial security and freedom was available to me and I became 100 percent focused on working out how I could make it happen.

During the months that followed, all Darren and I did was research the topic. We attended countless seminars and trawled the Internet looking for new strategies for building passive income. Of course the one that consistently stood out was earning a rental income from a property portfolio, so we concentrated our efforts on learning everything we could about property investment.

Suddenly my three-hour-round-trip commute became valuable learning time for me. I added a costly (at the time) 3G plan to my mobile phone package so that I could use a dongle on my laptop—smartphones still being fairly cost-prohibitive for the average person in those days—and carry on researching online during my commute. I would even walk through the West End to work rather than taking the tube, carrying my laptop and reading as I walked so that I could stay online.

And then the day came when I had a big choice presented to me. It was a crossroads of sort and would determine the direction of the next period of my life.

I had been listening to every motivational tape I could get my hands on. I was listening to Anthony Robbins on repeat, and I'd just discovered Dolf de Roos—the New Zealand property millionaire and best-selling author. I had been listening to an audiobook by de Roos on the day I received a call from a rival animation company that was trying to poach me away from Framestore. They were prepared to offer me a starting salary of £60,000. That same day I heard Dolf de Roos describe a moment in his life when he came to a crossroads. He was offered a job paying $30,000 on the same day that he made a $30,000 profit on a property. He asked himself why he should invest a year's worth of his time to earn $30,000 when he'd just made $30,000 in one day. He turned the job offer down and became a full-time property investor. His experience and decision inspired me; I called the other animation company, turned down the £60,000 job offer, and my fate was sealed. I now knew what I had committed myself to focusing on.

I will never forget that day, that moment, when I was listening to the Dolf de Roos audiobook and made that life-changing decision. I'd been listening to it in a café during a lunch break and on the way back to the office I ran into Darren. I told him that I'd come to a major decision; that I'd decided I was going to quit my job. He didn't believe me, so to prove it, as soon as I was back at my desk, I wrote an e-mail and sent it to the whole office. I said it was my last day at Framestore and anyone who felt like going for drinks after work should join me at the local pub so we could say our good-byes. My boss was at my desk in minutes, asking if it was a joke. I told him I was serious.

Because of the confidential nature of the projects we were working on at the time, Framestore had to give me a month's garden leave (which means you remain on the company payroll through your official notice period but are barred from coming into the office or working for another employer; you effectively have to sit at home!). Sending that e-mail did feel a little mad, but I knew it would force me into action, that there would be no going back, that I would have to go through with my plan. It was amazing how much freedom I felt immediately; it was like a weight lifting off me. I knew I'd done the right thing and I never looked back.

I remember waking up the day after I quit with a feeling of total euphoria. Suddenly I had what I wanted: I had my time back. The whole day stretched out in front of me; I could spend all that time continuing my research. I also knew that if I played my cards right, the rest of my life could be like this: being able to choose how I spent my time each day. No one owned my time anymore. It felt fantastic. I dedicated every waking moment to going to seminars and doing research on passive income generation. Of course I kept the fact I'd quit my job quiet from my friends and family for a while!

I knew I had to get started in property investment as soon as possible. I had a short window in which I still had a salary that I could use to secure a mortgage. In 2005 it was definitely easier to get a mortgage than it is today, but I still needed to prove my earnings; I had to get a mortgage while I was still on garden leave from Framestore. I started researching mortgage brokers. And that's how I came across Ying Tan.

Ying lived near me in Guildford so I went to see him, to speak to him about getting into the property business. He offered to mentor me. When I asked him how much he charged, he said £10,000. I nearly fell off my chair. I asked him how he could justify that price. He told me that what I would learn in two days would set me up for life; that he would show me a revolutionary way of buying property that could completely change my life. I instinctively felt I had to do it. But how was I going to get that much money? The only thing I had that was worth that much was my car. I had a Honda S2000 that I knew I could get around £10,000 for. The question was, should I use that £10,000 as a deposit for one property or pay Ying Tan to mentor me? I was young; I guess I was ready to live dangerously!

The few friends I mentioned my plan to thought I was crazy. They were convinced it was some scam and that I was about to be ripped off. But I kept talking to Ying and he kept reassuring me. In the end he offered me a deal. He said I could pay him half of the money up front and the other half when my first property deal went through. I was still petrified and I nearly pulled out several times. It seemed like such a huge sum of money. However, at one point I divided it by 365 days and realized it was around £27 a day, the exact sum I used to have as disposable income when I worked at Framestore. That made it more manageable to think about; it made it relatively acceptable, as if all I was doing was making the decision to go without a year's worth of expensive lunches! Doing that calculation somehow helped me to make my final decision to move forward.

I had never been so scared in my life. Handing over all that money was still incredibly painful. But the pain of the thought of having my newfound freedom taken away was greater. I never wanted to go back to being an employee. I wanted to be in control of how I spent my time for the rest of my life. I'd tasted that freedom and wasn't prepared to give it up again.

Ying was as good as his word. Through a loophole in property financing at the time, he'd figured out that if you bought a property at a significant discount and then immediately refinanced it, you could make an immediate cash sum. The banks subsequently closed this particular loophole, specifying that you have to own a property for six months before refinancing, but for a while there was a decent profit to be made by doing the type of deals Ying had taken advantage of.

My first property deal made me £9,000. Ying helped me find a property that was valued at £250,000. I managed to negotiate a discount with the owner/developer and agreed to buy it for £200,000, which I financed through a bridging loan. As soon as the property was mine, I refinanced it, taking out a mortgage of £212,500 (85 percent). This was a relatively quick and simple process. Before the global financial crisis hit, lenders were falling over themselves to offer mortgages to anyone, regardless of their means to pay it back. I paid off the £200,000 bridging loan and had £12,500 left over. After paying off my costs and a small amount of interest on the short-term bridging loan, I had around £9,000 left.

I appreciated everything Ying taught me. He was an expert at finding loopholes to make money from and I carried on using him to broker mortgages on my future properties. But I needed more; I wanted to explore every source of experience and information out there. I needed other skills if I was going to be as successful as I aimed to be. I needed expert marketing and negotiating skills. I wanted to soak up as much education as I could find. I discovered a property networking group that was offering a course costing £3,500. Even though my investment with Ying had paid off, I was apprehensive about risking a big chunk of money again, so I went to talk to my Uncle Chi.

Like my parents, and so many other Chinese people of his generation, my Uncle Chi had built up a successful Chinese takeaway business. I often hung out with him after he'd finished for the evening, having late-night conversations that went on into the early hours of the morning. He also worked long, hard hours and I felt sure he'd enjoy the kind of financial freedom I was striving for. So I told him about the networking group and asked if he'd lend me the £3,500 as an investment, telling him that he would also benefit from the skills and contacts I picked up. He was extremely sceptical; he was convinced it was a scam and he tried to talk me out of it. He said all the usual negative stuff about when something seems too good to be true, it usually is, and how property was not the safe investment people thought it was, that there were huge risks associated with property investment. Eventually, I persuaded him to sponsor me to go on a one-day course that this group held that cost £350. He was more comfortable with this amount.

It was an interesting psychological experiment for me. Of course I could afford the £350 myself, but by having my uncle sponsor me, I made myself accountable to him, too, and that somehow inspired me to work even harder to make the money back. I was more motivated to show him a return on his investment than I would have been if it had been my money invested. I was more determined than ever to make it all work. I also had no income stream at that point in time, only the money I'd made on my first property deal, so I felt somewhat vulnerable and wherever I could offset an expense by getting someone else to make the investment in me, I'd jump at the chance.

That one-day course really turned my head. I was surrounded by people talking about property deals, people who were regularly making big profits from doing deals on properties and who were living the life I wanted to live. The more I listened, the more it reaffirmed my commitment. I was soon convinced that I should invest some of my own money.

I joined the group and had a very interesting first year. I partnered up with people—some to a good end, some not. One particular guy screwed me out of a lot of money. He gave me a retainer of £2,000 a month to source deals, but when we made particularly big profits he didn't give me my fair share. It wasn't a nice experience, but I learnt to be choosier about who to go into business with and who to trust.

Uncle Chi was impressed with my success, and when I showed him the figures of some of the deals I'd made, he decided he wanted me to help him invest in property too. It was my chance to repay him for sponsoring me through that initial one-day course. I did a joint venture with him; I found a property in Manchester that was valued at £125,000. We offered £92,000, then borrowed £108,000 against it. Once we'd paid off our loan and costs, we had over £14,000 in our pockets. My uncle got half of that, plus revenue from the monthly rental on the property. I did all the work, but he deserved to share in my success as he was the first person to invest in me, to take a chance on me. He tells me it's the best £350 he ever spent! There's a little jealousy these days from family members who didn't invest in me at the beginning. I've always said if you're not there with me at the start, don't expect to be there with me at the end!

As I got deeper and deeper into the business of property investment, I started to join online forums and other networking groups. I knew I eventually wanted to have my own group and mentor people myself.

One day I came across a group of people criticizing a property investor who had suggested buying properties using lease options. The forum's general opinion was that lease options couldn't be applied to domestic property deals, but this guy was vehemently arguing that lease options were the way forward. He'd made several successful deals using lease options and got them legalized in the UK for the first time. I could see the sense in what he was saying and was eager to learn more, so I contacted him. Little did I know then that that moment marked the beginning of a long and fascinating journey of business and friendship with a certain Mr. Vincent Wong.

* * *

Vince: My first thought when John contacted me was, “There isn't room in this industry for two Chinamen!” But on this point, I'm happy to say I have been proved wrong. We're living proof of the notion that two heads are better than one, that 1 plus 1 equals 11. We work so closely and fiercely together that there are times when I almost forget John isn't my biological brother. This feeling tends to occur both at the best of times and the worst of times! When we disagree with each other, we're more like brothers than business partners. But we also support each other unconditionally. He's Uncle John to my kids; he's family. I guess it's the similarities in our backgrounds that contribute to our strong bond; and it's this, along with our shared experiences through the trials and tribulations of building an ever-evolving business, that keeps us going and will sustain our relationship for a long time into the future.

I was born in Liverpool in 1967. My parents, like John's, had emigrated from Hong Kong. Again, like many Chinese immigrants, they decided their best opportunity lay in the restaurant business, so they opened a place in Liverpool. They were very young when they arrived (only 21) and hadn't been married long. My elder sister had been born in Hong Kong shortly before they left and they soon had another child (me) on the way. They had very little business experience and were isolated from their families, so they had hardly any support. It was all much harder than they'd expected. They kept going for a few years, but the arrival of a new baby only exacerbated their struggle. In the end, life got so tough that they closed their restaurant and returned to Hong Kong. I was only a few months old. A couple of years later my younger sister was born.

Something about the fact that I was the only child who had been born in the UK, added to the fact that I was the only boy, made everyone treat me very differently from my sisters. I was spoilt, there's no doubt about that. I was put on a pedestal and worshipped, and no one was more obsessed with me than my mother. She was convinced I was special, that I was going to achieve great things. In Chinese society, favouritism towards the boy is tolerated; it's more or less expected. I was made to believe I was better than the girls and I felt that people had expectations of me. I was a very cute kid and was constantly told so. Looking back, I'm sure it had quite a negative effect on me. I feel embarrassed when I remember how precocious and arrogant I was at such a young age.

One day my mother saw an advert in the local paper for an open-call audition for child actors. TVB, Asia's biggest TV network, was recruiting young actors and presenters for its children's channel. My mother took my three-year-old sister and me along and we were both offered contracts.

My sister got a few acting roles and received a moderate amount of fame from them, but I was the one who, at the age of seven, took off as the big TV star. I became one of the biggest child actors of the time. I was involved in a whole array of programmes, even presenting some of them; I presented a live show every week. I was very famous within Hong Kong's relatively small community; I used to get spotted everywhere we went and would be followed by adoring fans.

My mother was immensely proud of me. She doted on me. I had far more money spent on me than was spent on my sisters. I got the best clothes, the latest gadgets and all the finest products. I was like a little child doll to her. It must have been hard for my sisters to watch because they were never given as much as I was. But it wasn't as great as it looked from the outside. Yes, I had a lot of fun and possessed many material things, but I craved a normal life at the same time. I was out on the road for long periods of time and sometimes worked long hours. There wasn't a huge amount of playtime. When I did have free time I had far too much money to burn, and by the time I was 12 years old I was a little monster, roaming the streets without supervision and spending money on whatever I wanted for myself and for my friends. For some reason that I cannot even fathom now, we still felt the need to go shoplifting, for kicks. We were terrible; we were like a Hong Kong Brat Pack. I also hung out with many adult friends from work who probably weren't the best influences on me. I remember being involved in some bad crowds. But my mother loved my fame. I was paraded around like a performing monkey, as if she saw my fame as some sort of status symbol. She certainly enjoyed the money I earned. While I'm sure a great deal of it was spent on me, in those days there were not the laws protecting the earnings of child actors that there are today, so I have no idea of exactly how much I earned or where it went.

There is one memory of this time, though, that makes me cringe more than any of the others…my hairstyle. I still can't believe what my mother did to my hair.

Most Chinese boys have the typical straight, jet-black hair. My mother, perhaps wanting me to stand out even further, decided I would have curly hair, so she took me to the hairdressers for a perm. I got a perm when I was only seven years old! I already had fairly light skin compared to the rest of my family. Without the typical Chinese colouring and with a perm on top of that, I stood out a mile. Quite frankly, I looked ridiculous! My dad absolutely hated it. He's a very practical man and he felt it was frivolous and vain. But my mother ignored his protests and took me for regular perms until we left Hong Kong, when I was 12 years old.

My parents' decision to leave Hong Kong was largely based on their desire to give us a British education in the UK. There were two great universities in Hong Kong that were based on the British system, but there was huge competition for places and you needed exceptional grades to get in. My parents felt we would all have a better chance of getting a good higher education if we went back to England and were educated there. My father was also concerned about the changes that might occur in 1997, when Hong Kong would be handed back to the Chinese. I was always going to be a British citizen, having been born in Liverpool, but people born in Hong Kong were unsure where they would stand in terms of citizenship once Hong Kong was no longer a British colony. My father's friend who worked in the immigration office suggested to him that the right to British citizenship, even for those who were born in Hong Kong under British rule, might get complicated. He didn't want to run the risk of being stuck in China.

So in 1979, with Britain on the brink of a historic shift in power led by the first female prime minister (the Conservatives under Margaret Thatcher had just won the general election), we arrived in Wembley. We moved into a new house and I started attending the London Oratory School, a grant-maintained Catholic boys' school in Fulham. My life changed forever. There was no more TV work, no more adoring fans; it was just a regular schoolboy's life. It was a huge adjustment for me. Plus I had to get used to a whole new look in the hair department…because no hairdresser in England would give a 12-year-old boy a perm!

For the first time in my life I really felt—and knew—I was different, and not in a good way. I stood out a mile at school because I looked so different from the other boys. It made me feel as if I were somehow ugly and substandard. I became very withdrawn because, like John, I got teased and bullied for being Chinese. I got called racist names and left out of social events. I never had girlfriends like all the other boys did. I had absolutely no confidence and very low self-esteem. It was like I had a complete loss of identity. My early teenage years were probably the lowest time of my life. I was thoroughly depressed.