Erhalten Sie Zugang zu diesem und mehr als 300000 Büchern ab EUR 5,99 monatlich.

- Herausgeber: epubli

- Kategorie: Fachliteratur

- Sprache: Englisch

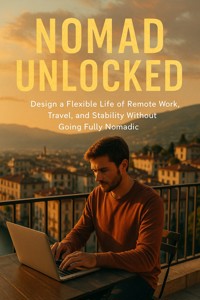

Passive Income Ideas for Beginners Are you tired of trading your time for money, day after day, with little to show for it? What if you could create income that flows quietly in the background—without clocking in, reporting to a boss, or constantly hustling? Passive Income Ideas for Beginners is your practical roadmap to building income streams that work for you, long after the initial effort is done. This book breaks down the real methods everyday people are using to generate income from home, online, or with smart investments. Whether you're starting with zero experience or you're exploring new ways to grow your earnings, you'll gain the mindset, strategies, and tools needed to make passive income a lasting part of your life. You won't find hype here—just clear guidance, powerful ideas, and long-term strategies that actually work. From understanding the basics to setting realistic goals and avoiding costly traps, every chapter is crafted to help you take confident action, even if you're starting from scratch. Inside This Book, You'll Discover: The truth about what passive income really is—and what it's not Why starting small gives beginners a hidden advantage How dividend stocks let your money grow while you sleep How to profit from real estate with or without owning property How affiliate marketing and digital products unlock endless earning potential What tools to use for automating your income and saving time The scams and pitfalls most beginners never see coming—until it's too late By the end, you'll not only know where to begin—you'll know how to build a diverse, sustainable income portfolio that creates freedom on your terms. Scroll Up and Grab Your Copy Today!

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 104

Veröffentlichungsjahr: 2025

Das E-Book (TTS) können Sie hören im Abo „Legimi Premium” in Legimi-Apps auf:

Ähnliche

Passive Income Ideas for Beginners

Make Money Online with Low Startup Costs Using AI, Digital Products, Affiliate Marketing & More

Hannah Brooks

Table of Content

The Road to Financial Freedom: What Is Passive Income?

Active vs. Passive Income: Knowing the Difference

The Mindset Shift: Thinking Like an Income Builder

How Much Can You Really Make? Setting Realistic Goals

Start Small, Scale Smart: The Beginner’s Advantage

Dividend Stocks: Making Money While You Sleep

Real Estate Rentals: Bricks, Mortar, and Monthly Checks

REITs and Crowdfunding: Real Estate Without the Headaches

Print-on-Demand: Create Once, Earn Forever

Affiliate Marketing: Promote and Prosper

YouTube, Blogs, and Podcasts: Building Content That Pays

Automating Your Income Streams: Tools and Tips

Avoiding Scams and Pitfalls: What Not to Do

Building a Long-Term Passive Income Portfolio

Conclusion

© Copyright [2025] [Hannah Brooks] All rights reserved.

- No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the publisher, except for brief quotations in a review or scholarly article.

- This is an original work of fiction [or non-fiction] by [Hannah Brooks]. Any resemblance to actual persons, living or dead, or actual events is purely coincidental.

Legal Notice:

The reader is solely responsible for any actions taken based on the information contained in this book. The author and publisher expressly disclaim any responsibility or liability for any damages or losses incurred by the reader as a result of such actions.

Disclaimer:

This book is intended for educational purposes only. The information contained within is not intended as, and should not be construed as medical, legal, or professional advice. The content is provided as general information and is not a substitute for professional advice or treatment.

This declaration is made for the purpose of asserting my legal ownership of the copyright in the Work and to serve as proof of ownership for any legal, publishing, or distribution purposes. I declare under penalty of perjury that the foregoing is true and correct.

The dream of earning money while you sleep isn’t just a fantasy anymore—it’s a reality that thousands of people are living every day. Whether it's a YouTube channel generating ad revenue, a rental property collecting monthly checks, or a digital product quietly selling around the clock, passive income has become one of the most powerful ways to reclaim time, build financial independence, and design a life on your terms. But behind every success story lies strategy, commitment, and a clear understanding of how the pieces come together. This book is designed to guide you through that process—step by step, idea by idea.

Passive Income Ideas for Beginners is more than just a list of tactics. It’s a roadmap for creating lasting income streams that don’t require trading time for money. It begins by helping you shift your mindset—from being an active earner to thinking like a long-term builder. You’ll discover the difference between active and passive income, understand the importance of setting realistic expectations, and learn why starting small is one of your greatest advantages as a beginner.

From there, the chapters walk you through real, actionable income streams. You’ll learn how dividend stocks can reward you with regular payouts, how real estate rentals create wealth through property ownership, and how REITs and crowdfunding allow you to tap into real estate without managing tenants. You’ll explore how to launch print-on-demand products, monetize affiliate marketing, and create digital assets like eBooks and courses that generate income again and again. Each idea is broken down with clarity, giving you a strong foundation to take action—even if you’re starting from zero.

But this book doesn’t just show you how to earn—it shows you how to protect what you build. You’ll dive into common scams and pitfalls that trap new investors, and how to avoid them with confidence. You’ll learn how to use automation tools to reduce effort and maximize efficiency. And as you near the end of the journey, you’ll discover how to weave everything together into a long-term passive income portfolio that grows stronger year after year.

No matter your background, experience, or budget, there’s something in this book that you can start today. Passive income isn’t about being lucky or gifted—it’s about learning how to think like a creator, taking consistent steps, and building assets that serve you long after the initial work is done.

The pages ahead are filled with practical strategies, real-world examples, and mindset shifts that will change the way you think about money and opportunity. This is not a get-rich-quick manual—it’s a long-term guide to freedom, flexibility, and financial growth.

Let’s begin your journey to earning more by doing less—intelligently, ethically, and sustainably. The tools are here. The ideas are here. Now it’s your turn to make them real.

The Road to Financial Freedom: What Is Passive Income?

The journey toward financial freedom often begins with a simple, powerful question: What is passive income, and how can it change my life? For many, the idea of earning money without constant effort sounds like a fantasy—something reserved for the ultra-wealthy or the lucky few who win the entrepreneurial lottery. But passive income isn’t a dream; it’s a strategy. It’s a mindset. And most importantly, it’s achievable. To understand its true power, you must first unlearn the traditional definition of work. For most of us, income has always been tied directly to time and labor. We clock in, we perform tasks, we get paid. End of story. But passive income turns that story upside down. It introduces a model where money flows not from your daily grind but from systems you’ve set up in advance, assets you own, or content you’ve created.

At its core, passive income is money earned with minimal effort or active involvement after the initial setup. That last part—after the initial setup—is important, because it’s not completely effortless. It might take weeks or even months of hard work to get a passive income stream flowing, but once it’s running, the maintenance required is often minimal. Think of it like planting a tree. You nurture it in the beginning, water it, care for it—but eventually, it bears fruit year after year with only basic upkeep. That’s the appeal: a system that continues to give long after the heavy lifting is done.

One of the most compelling aspects of passive income is that it frees you from the linear limitations of hourly wages or fixed salaries. With active income, your earnings are capped by time. There are only so many hours in a day, and only so much energy to go around. But passive income removes that ceiling. You can earn while sleeping, traveling, or spending time with your family. It allows you to detach income from effort, giving you more control over your time, which is arguably the most valuable asset of all.

But the true magic of passive income goes beyond just money. It’s about flexibility, autonomy, and long-term security. When you don’t have to constantly trade hours for dollars, you gain the freedom to live life on your own terms. You can pursue passion projects, travel more freely, or simply enjoy a slower, more intentional pace of life. You gain resilience in times of economic uncertainty. And you begin to build wealth in a way that’s sustainable and scalable, rather than reactive and limited.

Still, it’s important to dispel the myth that passive income is “easy money.” Many beginners fall into this trap, lured by flashy ads promising thousands of dollars a month from doing virtually nothing. But real passive income requires planning, consistency, and often some upfront capital or skill development. Writing a best-selling eBook, creating a successful blog, investing in dividend-paying stocks—none of these are overnight wins. They require commitment, patience, and a willingness to learn. Yet the payoff, both financially and personally, is well worth the effort.

In the modern age, the number of passive income opportunities has exploded. The internet has made it possible for anyone to create and monetize digital assets. Platforms like YouTube, Amazon, Teachable, Etsy, and countless others allow creators, educators, and entrepreneurs to generate income from their work without being bound to a single employer or office. You don’t need a business degree or a six-figure investment to get started—just curiosity, consistency, and a willingness to start small. That’s the beauty of this path: it’s wide open for anyone with the vision to pursue it.

There’s also a deeper transformation that takes place when you start building passive income. You begin to shift from being a consumer to being a creator. From being reactive with your finances to being strategic. You start to see money not just as something to earn and spend, but as a tool to create more freedom and impact in your life. Every dollar you make passively becomes a little vote for independence—a step closer to a life where you choose how your days unfold.

Many people don’t realize how close they are to changing their financial future. They think passive income is reserved for real estate moguls or Silicon Valley tech wizards. But the truth is, even a modest stream of $200 or $500 per month in passive income can make a meaningful difference. It might pay your utility bills, cover your grocery budget, or fund a family trip. And once you see the first taste of that freedom, it becomes addictive. You start thinking, What else can I create? How can I grow this? That curiosity drives momentum, and momentum creates breakthroughs.

Understanding passive income also requires a shift in how we think about risk. Working a 9-to-5 job might feel secure, but it's often an illusion of safety. Layoffs happen. Companies close. Health issues can force us to stop working. If your only income stream is tied to your time and presence, you're vulnerable. Passive income, on the other hand, builds in layers of protection. The more streams you create, the less dependent you become on any single source. That’s not just smart financially—it’s empowering on a personal level.

The journey to financial freedom is not a straight line. It’s full of trial and error, experimentation, and learning. But understanding what passive income is—and what it isn't—is the first step on that journey. It’s about laying the foundation for a different kind of life. One where you control your time, your energy, and your destiny. It's not about escaping work altogether, but about designing a life where work serves you, not the other way around.

So if you’re just starting out, don’t be discouraged by how far you think you have to go. Every successful passive income earner once stood where you are now—curious, unsure, maybe even skeptical. What separates those who succeed is not luck, but action. Starting with small steps. Building one stream at a time. Learning as you go. And never underestimating the power of consistent effort compounded over time.

This is your invitation to begin that journey. To explore what’s possible beyond the paycheck. To discover income sources that don’t demand your daily presence. To create assets that keep working for you, long after you’ve built them. The road to financial freedom starts with a single decision: to take ownership of your income, your time, and your future. Passive income is not a destination—it’s a tool. One that, if used wisely, can reshape your life in extraordinary ways.

Active vs. Passive Income: Knowing the Difference

When people first hear about passive income, their minds often leap to the idea of effortless wealth, unlimited freedom, and the dream of never having to work again. But to truly appreciate what passive income can do, one must first understand how it differs from the more traditional concept of active income. These two streams of earnings operate on fundamentally different principles, and knowing the distinction is not just academic—it’s essential if you’re serious about reshaping your financial future.