187,99 €

Mehr erfahren.

- Herausgeber: John Wiley & Sons

- Kategorie: Fachliteratur

- Sprache: Englisch

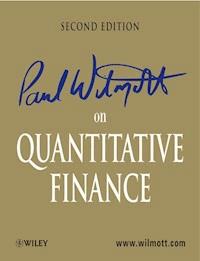

Paul Wilmott on Quantitative Finance, Second Edition provides a thoroughly updated look at derivatives and financial engineering, published in three volumes with additional CD-ROM.

Volume 1: Mathematical and Financial Foundations; Basic Theory of Derivatives; Risk and Return.

The reader is introduced to the fundamental mathematical tools and financial concepts needed to understand quantitative finance, portfolio management and derivatives. Parallels are drawn between the respectable world of investing and the not-so-respectable world of gambling.

Volume 2: Exotic Contracts and Path Dependency; Fixed Income Modeling and Derivatives; Credit Risk

In this volume the reader sees further applications of stochastic mathematics to new financial problems and different markets.

Volume 3: Advanced Topics; Numerical Methods and Programs.

In this volume the reader enters territory rarely seen in textbooks, the cutting-edge research. Numerical methods are also introduced so that the models can now all be accurately and quickly solved.

Throughout the volumes, the author has included numerous Bloomberg screen dumps to illustrate in real terms the points he raises, together with essential Visual Basic code, spreadsheet explanations of the models, the reproduction of term sheets and option classification tables. In addition to the practical orientation of the book the author himself also appears throughout the book—in cartoon form, readers will be relieved to hear—to personally highlight and explain the key sections and issues discussed.

Note: CD-ROM/DVD and other supplementary materials are not included as part of eBook file.

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 1857

Veröffentlichungsjahr: 2013

Ähnliche

Contents

Cover

Half Title page

Title page

Copyright page

Visual Basic Code

Prolog to the Second Edition

Part One: Mathematical and Financial Foundations; Basic Theory of Derivatives; Risk and Return

Chapter 1: Products and Markets

1.1 Introduction

1.2 The Time Value of Money

1.3 Equities

1.4 Commodities

1.5 Currencies

1.6 Indices

1.7 Fixed-income Securities

1.8 Inflation-Proof Bonds

1.9 Forwards and Futures

1.10 Summary

Further Reading

Chapter 2: Derivatives

2.1 Introduction

2.2 Options

2.3 Definition of Common Terms

2.4 Payoff Diagrams

2.5 Writing options

2.6 Margin

2.7 Market Conventions

2.8 The Value of the Option Before Expiry

2.9 Factors Affecting Derivatives Prices

2.10 Speculation and Gearing

2.11 Early Exercise

2.12 Put-Call Parity

2.13 Binaries or Digitals

2.14 Bull and Bear Spreads

2.15 Straddles and Strangles

2.16 Risk Reversal

2.17 Butterflies and Condors

2.18 Calendar Spreads

2.19 Leaps and Flex

2.20 Warrants

2.21 Convertible Bonds

2.22 Over the Counter options

2.23 Summary

Further Reading

Chapter 3: The Random Behavior of Assets

3.1 Introduction

3.2 The Popular Forms of ‘Analysis’

3.3 Why we Need a Model for Randomness: Jensen’s Inequality

3.4 Similarities Between Equities, Currencies, Commodities and Indices

3.5 Examining Returns

3.6 Timescales

3.7 Estimating Volatility

3.8 The Random Walk on a Spreadsheet

3.9 The Wiener Process

3.10 The Widely Accepted Model for Equities, Currencies, Commodities and Indices

3.11 Summary

Further Reading

Chapter 4: Elementary Stochastic Calculus

4.1 Introduction

4.2 A Motivating Example

4.3 The Markov Property

4.4 The Martingale Property

4.5 Quadratic Variation

4.6 Brownian Motion

4.7 Stochastic Integration

4.8 Stochastic Differential Equations

4.9 The Mean Square Limit

4.10 Functions of Stochastic Variables and Itô’s Lemma

4.11 Interpretation of Itô’s Lemma

4.12 Itô and Taylor

4.13 Itô in Higher Dimensions

4.14 Some Pertinent Examples

4.15 Summary

Further Reading

Chapter 5: The Black–Scholes Model

5.1 Introduction

5.2 A Very Special Portfolio

5.3 Elimination of Risk: Delta Hedging

5.4 No Arbitrage

5.5 The Black–Scholes Equation

5.6 The Black–Scholes Assumptions

5.7 Final Conditions

5.8 options on Dividend-Paying Equities

5.9 Currency options

5.10 Commodity options

5.11 options on Futures

5.12 Some Other Ways of Deriving the Black–Scholes Equation

5.13 Summary

Further Reading

Chapter 6: Partial Differential Equations

6.1 Introduction

6.2 Putting the Black–Scholes Equation into Historical Perspective

6.3 the Meaning of the Terms in the Black–Scholes Equation

6.4 Boundary and Initial/Final Conditions

6.5 Some Solution Methods

6.6 Similarity Reductions

6.7 Other Analytical Techniques

6.8 Numerical Solution

6.9 Summary

Further Reading

Chapter 7: The Black–Scholes Formulae and the ‘Greeks’

7.1 Introduction

7.2 Derivation of the Formulae for Calls, Puts and Simple Digitals

7.3 Delta

7.4 Gamma

7.5 Theta

7.6 Speed

7.7 Vega

7.8 Rho

7.9 Implied Volatility

7. 10 A Classification of Hedging Types

7.11 Summary

Further Reading

Chapter 8: simple generalizations of the Black–Scholes world

8.1 Introduction

8.2 Dividends, Foreign Interest and Cost of Carry

8.3 Dividend Structures

8.4 Dividend Payments and no Arbitrage

8.5 The Behavior of an Option Value Across a Dividend Date

8.6 Commodities

8.7 Stock Borrowing and Repo

8.8 Time-Dependent Parameters

8.9 Formulae for Power options

8.10 The Log Contract

8.11 Summary

Further Reading

Chapter 9: Early Exercise and American options

9.1 Introduction

9.2 The Perpetual American Put

9.3 Perpetual American call with Dividends

9.4 Mathematical Formulation for General Payoff

9.5 Local Solution for call with Constant Dividend Yield

9.6 Other Dividend Structures

9.7 One-Touch options

9.8 Other Features in American-Style Contracts

9.9 Other Issues

9.10 Summary

Further Reading

Chapter 10: Probability Density Functions and First-Exit Times

10.1 Introduction

10.2 The Transition Probability Density Function

10.3 A Trinomial Model for the Random Walk

10.4 The Forward Equation

10.5 The Steady-State Distribution

10.6 The Backward Equation

10.7 First-Exit Times

10.8 Cumulative Distribution Functions for First-Exit Times

10.9 Expected First-Exit Times

10.10 Another Example of Optimal Stopping

10.11 Expectations and Black–Scholes

10.12 A Common Misconception

10.13 Summary

Further Reading

Chapter 11: Multi-asset options

11.1 Introduction

11.2 Multi-Dimensional Lognormal Random Walks

11.3 Measuring Correlations

11.4 options on Many Underlyings

11.5 The Pricing Formula for European Non-path-dependent options on Dividend-Paying Assets

11.6 Exchanging one Asset for Another: A Similarity Solution

11.7 Quantos

11.8 Two Examples

11.9 Other Features

11.10 Realities of Pricing Basket options

11.11 Realities of Hedging Basket options

11.12 Correlation Versus Cointegration

11.13 Summary

Further Reading

Chapter 12: How to Delta Hedge

12.1 Introduction

12.2 What if Implied and Actual Volatilities are Different?

12.3 Implied Versus Actual; Delta Hedging but using Which Volatility?

12.4 Case 1: Hedge with Actual Volatility, σ

12.5 Case 2: Hedge with Implied Volatility ,

12.6 Portfolios when Hedging with Implied Volatility

12.7 Hedging when Implied Volatility Is Stochastic

12.8 How Does Implied Volatility Behave?

12.9 Summary

Further Reading

Appendix: Derivation of Results

Chapter 13: Fixed-income Products and Analysis: Yield, Duration and Convexity

13.1 Introduction

13.2 Simple Fixed-income Contracts and Features

13.3 International Bond Markets

13.4 Accrued Interest

13.5 Day-Count Conventions

13.6 Continuously and Discretely Compounded Interest

13.7 Measures of Yield

13.8 The Yield Curve

13.9 Price/Yield Relationship

13.10 Duration

13.11 Convexity

13.12 An Example

13.13 Hedging

13.14 Time-Dependent Interest Rate

13.15 Discretely Paid Coupons

13.16 Forward Rates and Bootstrapping

13.17 Interpolation

13.18 Summary

Further Reading

Chapter 14: Swaps

14.1 Introduction>

14.2 The Vanilla Interest Rate Swap

14.3 Comparative Advantage

14.4 The Swap Curve

14.5 Relationship Between Swaps and Bonds

14.6 Bootstrapping

14.7 Other Features of Swaps Contracts

14.8 Other Types of Swap

14.9 Summary

Further Reading

Chapter 15: The Binomial Model

15.1 Introduction

15.2 Equities can go down as well as up

15.3 The Option Value

15.4 Which Part of our ‘Model’ Didn’t we Need?

15.5 Why Should this ‘Theoretical Price’ Be the ‘Market Price’?

15.6 How did I Know to Sell of the Stock for Hedging?

15.7 How does this Change if Interest Rates are Non-zero?

15.8 Is the Stock Itself Correctly Priced?

15.9 Complete Markets

15.10 The Real and Risk-Neutral Worlds

15.11 And now Using Symbols

15.12 An Equation for the Value of an Option

15.13 Where did the Probability p Go?

15.14 Counterintuitive?

15.15 The Binomial Tree

15.16 The Asset Price Distribution

15.17 Valuing Back Down the Tree

15.18 Programming the Binomial Method

15.19 The Greeks

15.20 Early Exercise

15.21 The Continuous-Time Limit

15.22 No Arbitrage in the Binomial, Black–Scholes and ‘Other’ Worlds

15.23 Summary

Further Reading

Appendix: Another Parameterization

Chapter 16: How Accurate is the Normal Approximation?

16.1 Introduction

16.2 Why we Like the Normal Distribution: The Central Limit Theorem

16.3 Normal Versus Lognormal

16.4 Does my Tail Look Fat in This?

16.5 Use a Different Distribution, Perhaps

16.6 Serial Autocorrelation

16.7 Summary

Further Reading

Chapter 17: Investment Lessons from Blackjack and Gambling

17.1 Introduction

17.2 The Rules of Blackjack

17.3 Beating the Dealer

17.4 The Distribution of Profit in Blackjack

17.5 The Kelly Criterion

17.6 Can you win at Roulette?

17.7 Horse Race Betting and no Arbitrage

17.8 Arbitrage

17.9 How to bet

17.10 Summary

Further Reading

Chapter 18: Portfolio Management

18.1 Introduction

18.2 Diversification

18.3 Modern Portfolio Theory

18.4 Where do I want to be on the Efficient Frontier?

18.5 Markowitz in Practice

18.6 Capital Asset Pricing Model

18.7 The Multi-index Model

18.8 Cointegration

18.9 Performance Measurement

18.10 Summary

Further Reading

Chapter 19: Value at Risk

19.1 Introduction

19.2 Definition of Value at Risk

19.3 Var for a Single Asset

19.4 Var for a Portfolio

19.5 Var for Derivatives

19.6 Simulations

19.7 Use of Var as a Performance Measure

19.8 Introductory Extreme Value Theory

19.9 Coherence

19.10 Summary

Further Reading

Chapter 20: Forecasting the Markets?

20.1 Introduction

20.2 Technical Analysis

20.3 Wave Theory

20.4 Other Analytics

20.5 Market Microstructure Modeling

20.6 Crisis Prediction

20.7 Summary

Further Reading

Chapter 21: A Trading Game

21.1 Introduction

21.2 Aims

21.3 Object of the Game

21.4 Rules of the Game

21.5 Notes

21.6 How to Fill in Your Trading Sheet

Part Two: Exotic Contracts and Path Dependency

Chapter 22: An Introduction to Exotic and Path-dependent Derivatives

22.1 Introduction

22.2 Option Classification

22.3 Time Dependence

22.4 Cashflows

22.5 Path Dependence

22.6 Dimensionality

22.7 The Order of an Option

22.8 Embedded Decisions

22.9 Classification Tables

22.10 Examples of Exotic options

22.11 Summary of Math/Coding Consequences

22.12 Summary

Further Reading

Chapter 23: Barrier options

23.1 Introduction

23.2 Different types of Barrier options

23.3 Pricing Methodologies

23.4 Pricing Barriers in the Partial Differential Equation Framework

23.5 Other Features in Barrier-Style options

23.6 First-exit Time

23.7 Market Practice: What Volatility Should I Use?

23.8 Hedging Barrier options

23.9 Slippage Costs

23.10 Summary

Further Reading

Appendix: More Formulae

Chapter 24: Strongly Path-dependent Derivatives

24.1 Introduction

24.2 Path-Dependent Quantities Represented by an Integral

24.3 Continuous Sampling: The Pricing Equation

24.4 Path-Dependent Quantities Represented by an Updating Rule

24.5 Discrete Sampling: The Pricing Equation

24.6 Higher Dimensions

24.7 Pricing via Expectations

24.8 Early Exercise

24.9 Summary

Further Reading

Chapter 25: Asian options

25.1 Introduction

25.2 Payoff Types

25.3 Types of Averaging

25.4 Solution Methods

25.5 Extending the Black–Scholes Equation

25.6 Early Exercise

25.7 Asian options in Higher Dimensions

25.8 Similarity Reductions

25.9 Closed-Form Solutions and Approximations

25.10 Term-Structure Effects

25.11 Some Formulae

25.12 Summary

Further Reading

Chapter 26: Lookback options

26.1 Introduction

26.2 Types of Payoff

26.3 Continuous Measurement of the Maximum

26.4 Discrete Measurement of the Maximum

26.5 Similarity Reduction

26.6 Some Formulae

26.7 Summary

Further Reading

Chapter 27: Derivatives and Stochastic Control

27.1 Introduction

27.2 Perfect Trader and Passport options

27.3 Limiting the Number of Trades

27.4 Limiting the Time Between Trades

27.5 Non-optimal Trading and the Benefits to the Writer

27.6 Summary

Further Reading

Chapter 28: Miscellaneous Exotics

28.1 Introduction

28.2 Forward-start options

28.3 Shout options

28.4 Capped Lookbacks and Asians

28.5 Combining Path-dependent Quantities: The Lookback-asian etc.

28.6 The Volatility Option

28.7 Correlation Swap

28.8 Ladders

28.9 Parisian options

28.10 Yet More Exotics

28.11 Summary

Further Reading

Chapter 29: Equity and FX Term Sheets

29.1 Introduction

29.2 Contingent Premium Put

29.3 Basket options

29.4 Knockout options

29.5 Range Notes

29.6 Lookbacks

29.7 Cliquet Option

29.8 Passport options

29.9 Decomposition of Exotics into Vanillas

Part Three: Fixed-income Modeling and Derivatives

Chapter 30: One-factor Interest rate Modeling

30.1 Introduction

30.2 Stochastic Interest Rates

30.3 the Bond Pricing Equation for the General Model

30.4 What Is the Market Price of Risk?

30.5 Interpreting the Market Price of Risk, and Risk Neutrality

30.6 Tractable Models and Solutions of the Bond Pricing Equation

30.7 Solution for Constant Parameters

30.8 Named Models

30.9 Equity and FX Forwards and Futures When Rates are Stochastic

30.10 Summary

Further Reading

Chapter 31: Yield Curve Fitting

31.1 Introduction

31.2 Ho & Lee

31.3 the Extended Vasicek Model of Hull & White

31.4 Yield-Curve Fitting: for and Against

31.5 Other Models

31.6 Summary

Further Reading

Chapter 32: Interest Rate Derivatives

32.1 Introduction

32.2 Callable Bonds

32.3 Bond options

32.4 Caps and Floors

32.5 Range Notes

32.6 Swaptions, Captions and Floortions

32.7 Spread options

32.8 Index Amortizing Rate Swaps

32.9 Contracts with Embedded Decisions

32.10 When the Interest Rate Is Not the Spot Rate

32.11 Some Examples

32.12 More Interest Rate Derivatives

32.13 Summary

Further Reading

Chapter 33: Convertible Bonds

33.1 Introduction

33.2 Convertible Bond Basics

33.3 Market Practice

33.4 Converts as options

33.5 Pricing CBS with Known Interest Rate

33.6 Two-Factor Modeling: Convertible Bonds with Stochastic Interest Rate

33.7 a Special Model

33.8 Path Dependence in Convertible Bonds

33.9 Dilution

33.10 Credit Risk Issues

33.11 Summary

Further Reading

Chapter 34: Mortgage-backed Securities

34.1 Introduction

34.2 Individual Mortgages

34.3 Mortgage-Backed Securities

34.4 Modeling Prepayment

34.5 Valuing Mbss

34.6 Summary

Further Reading

Chapter 35: Multi-factor Interest Rate Modeling

35.1 Introduction

35.2 Theoretical Framework for Two factors

35.3 Popular Models

35.4 The Market Price of Risk as a Random factor

35.5 The Phase Plane in the Absence of Randomness

35.6 The Yield Curve Swap

35.7 General Multi-factor Theory

35.8 Summary

Further Reading

Chapter 36: Empirical Behavior of the Spot Interest Rate

36.1 Introduction

36.2 Popular one-factor spot-rate models

36.3 Implied Modeling: One factor

36.4 the Volatility Structure

36.5 the Drift Structure

36.6 the Slope of the Yield Curve and the Market Price of Risk

36.7 What the Slope of the Yield Curve Tells Us

36.8 Properties of the Forward Rate Curve ‘on Average’

36.9 Implied Modeling: Two factor

36.10 Summary

Further Reading

Chapter 37: The Heath, Jarrow & Morton and Brace, Gatarek & Musiela Models

37.1 Introduction

37.2 The Forward Rate Equation

37.3 The Spot Rate Process

37.4 The Market Price of Risk

37.5 Real and Risk Neutral

37.6 Pricing Derivatives

37.7 Simulations

37.8 Trees

37.9 the Musiela Parameterization

37.10 Multi-factor Hjm

37.11 Spreadsheet Implementation

37.12 A Simple One-factor Example: Ho & Lee

37.13 Principal Component Analysis

37.14 options on Equities etc.

37.15 Non-infinitesimal Short Rate

37.16 the Brace, Gatarek and Musiela Model

37.17 Simulations

37.18 Pving the Cashflows

37.19 Summary

Further Reading

Chapter 38: Fixed-income Term Sheets

38.1 Introduction

38.2 Chooser Range Note

38.3 Index Amortizing Rate Swap

Part Four: Credit Risk

Chapter 39: Value of the Firm and the Risk of Default

39.1 Introduction

39.2 the Merton Model: Equity as an Option on a Company’s Assets

39.3 Modeling with Measurable Parameters and Variables

39.4 Calculating the Value of the Firm

39.5 Summary

Further Reading

Chapter 40: Credit Risk

40.1 Introduction

40.2 Risky Bonds

40.3 Modeling the Risk of Default

40.4 the Poisson Process and the Instantaneous Risk of Default

40.5 Time-Dependent Intensity and the Term Structure of Default

40.6 Stochastic Risk of Default

40.7 Positive Recovery

40.8 Special Cases and Yield Curve Fitting

40.9 A Case Study: The Argentine Par Bond

40.10 Hedging the Default

40.11 Is There any Information Content in the Market Price?

40.12 Credit Rating

40.13 A Model for Change of Credit Rating

40.14 The Pricing Equation

40.15 Credit Risk in CBs

40.16 Modeling Liquidity Risk

40.17 Summary

Further Reading

Chapter 41: Credit Derivatives

41.1 Introduction

41.2 What are Credit Derivatives?

41.3 Popular Credit Derivatives

41.4 Derivatives Triggered by Default

41.5 Derivatives of the Yield Spread

41.6 Payment on Change of Rating

41.7 Using Default Swaps in CB Arbitrage

41.8 Term Sheets

41.9 Pricing Credit Derivatives

41.10 An Exchange Option

41.11 Default only When Payment is Due

41.12 Payoff on Change of Rating

41.13 Multi-Factor Derivatives

41.14 Copulas: Pricing Credit Derivatives with Many Underlyings

41.15 Collateralized Debt Obligations

41.16 Summary

Further Reading

Chapter 42: Riskmetrics and Credit Metrics

42.1 Introduction

42.2 The Riskmetrics Datasets

42.3 Calculating the Parameters the Riskmetrics way

42.4 The Creditmetrics Dataset

42.5 The Creditmetrics Methodology

42.6 A Portfolio of Risky Bonds

42.7 Creditmetrics Model Outputs

42.8 Summary

Further Reading

Chapter 43: Crash Metrics

43.1 Introduction

43.2 Why do Banks go Broke?

43.3 Market Crashes

43.4 Crashmetrics

43.5 Crashmetrics for one Stock

43.6 Portfolio Optimization and the Platinum Hedge

43.7 The Multi-Asset/Single-Index Model

43.8 Portfolio Optimization and the Platinum Hedge in the Multi-Asset Model

43.9 The Multi-Index Model

43.10 Incorporating Time Value

43.11 Margin Calls and Margin Hedging

43.12 Counterparty Risk

43.13 Simple Extensions to Crashmetrics

43.14 The Crashmetrics Index (CMI)

43.15 Summary

Further Reading

Chapter 44: Derivatives **** Ups

44.1 Introduction

44.2 Orange County

44.3 Proctor and Gamble

44.4 Metallgesellschaft

44.5 Gibson Greetings

44.6 Barings

44.7 Long-Term Capital Management

44.8 Summary

Further Reading

Part Five: Advanced Topics

Chapter 45: Financial Modeling

45.1 Introduction

45.2 Warning: Modeling as it is Currently Practiced

45.3 Summary

Chapter 46: Defects in the Black–Scholes Model

46.1 Introduction

46.2 Discrete Hedging

46.3 Transaction Costs

46.4 Overview of Volatility Modeling

46.5 Deterministic Volatility Surfaces

46.6 Stochastic Volatility

46.7 Uncertain Parameters

46.8 Empirical Analysis of Volatility

46.9 Stochastic Volatility and Mean-Variance Analysis

46.10 Asymptotic Analysis of Volatility

46.11 Jump Diffusion

46.12 Crash Modeling

46.13 Speculating with options

46.14 Optimal Static Hedging

46.15 The Feedback Effect of Hedging in Illiquid Markets

46.16 Utility Theory

46.17 More About American options and Related Matters

46.18 Advanced Dividend Modeling

46.19 Serial Autocorrelation in Returns

46.20 Summary

Further Reading

Chapter 47: Discrete Hedging

47.1 Introduction

47.2 Motivating Example: The Trinomial Model

47.3 A Model for a Discretely Hedged Position

47.4 A Higher-Order Analysis

47.5 The Real Distribution of Returns and the Hedging Error

47.6 Total Hedging Error for the Real Distribution of Returns

47.7 Which Models Allow Perfect Delta Hedging

47.8 Summary

Further Reading

Appendix I: The Simplest Possible Derivation of the Black–Scholes Equation … Showing Where it Goes Wrong

Appendix 2: The Probability Density Function for the Chi-Squared Distribution

Chapter 48: Transaction Costs

48.1 Introduction

48.2 The Effect of Costs

48.3 The Model of Leland (1985)

48.4 The Model of Hoggard, Whalley & Wilmott (1992)

48.5 Non-single-signed Gamma

48.6 The Marginal Effect of Transaction Costs

48.7 Other Cost Structures

48.8 Hedging to a Bandwidth: The Model of Whalley & Wilmott (1993) and Henrotte (1993)

48.9 Utility-Based Models

48.10 Interpretation of the Models

48.11 Non-normal Returns

48.12 Empirical Testing

48.13 Transaction Costs and Discrete Hedging put Together

48.14 Summary

Further Reading

Appendix: Derivation of the Hoggard-Whalley-Wilmott Equation

Chapter 49: Overview of Volatility Modeling

49.1 Introduction

49.2 The Different Types of Volatility

49.3 Volatility Estimation by Statistical Means

49.4 Maximum Likelihood Estimation

49.5 Skews and Smiles

49.6 Different Approaches to Modeling Volatility

49.7 the Choices of Volatility Models

49.8 Summary

Further Reading

Appendix: How to Derive BS PDE, Minimum Fuss

Chapter 50: Deterministic Volatility Surfaces

50.1 Introduction

50.2 Implied Volatility

50.3 Time-Dependent Volatility

50.4 Volatility Smiles and Skews

50.5 Volatility Surfaces

50.6 Backing Out the Local Volatility Surface From European call Option Prices

50.7 A Simple Volatility Surface Parameterization

50.8 An Approximate Solution

50.9 Volatility Information Contained in an at-the-money Straddle

50.10 Volatility Information Contained in a Risk-Reversal

50.11 Time Dependence

50.12 a Market Convention

50.13 How do I use the Local Volatility Surface?

50.14 Summary

Further Reading

Appendix: Curve Fitting 101

Chapter 51: Stochastic Volatility

51.1 Introduction

51.2 Random Volatility

51.3 A Stochastic Differential Equation for Volatility

51.4 cthe Pricing Equation

51.5 The Market Price of Volatility Risk

51.6 The Value as an Expectation

51.7 An Example

51.8 Choosing the Model

51.9 Named/Popular Models

51.10 A Note on Biases

51.11 Stochastic Implied Volatility: The Model of Schönbucher

51.12 Summary

Further Reading

Chapter 52: Uncertain Parameters

52.1 Introduction

52.2 Best and Worst Cases

52.3 Uncertain Correlation

52.4 Nonlinearity

52.5 Summary

Further Reading

Chapter 53: Empirical Analysis of Volatility

53.1 Introduction

53.2 Stochastic Volatility and Uncertain Parameters Revisited

53.3 Deriving an Empirical Stochastic Volatility Model

53.4 Estimating the Volatility of Volatility

53.5 Estimating the Drift of Volatility

53.6 Out-of-sample Results

53.7 How to use the Model

53.8 Summary

Further Reading

Chapter 54: Stochastic Volatility and Mean-Variance Analysis

54.1 Introduction

54.2 The Model for the Asset and its Volatility

54.3 Analysis of the Mean

54.4 Analysis of the Variance

54.5 Choosing Δ to Minimize the Variance

54.6 The Mean and Variance Equations

54.7 How to Interpret and use the Mean and Variance

54.8 Static Hedging and Portfolio Optimization

54.9 Example: Valuing and Hedging an up-and-out call

54.10 Static Hedging

54.11 Other Definitions of ‘Value’

54.12 Summary

Further Reading

Chapter 55: Asymptotic Analysis of Volatility

55.1 Introduction

55.2 Fast Mean Reversion and High Volatility of Volatility

55.3 Conditions on the Models

55.4 Examples of Models

55.5 Notation

55.6 Asymptotic Analysis

55.7 Vanilla options: Asymptotics for Values

55.8 Vanilla options: Implied Volatilities

55.9 Summary

Further Reading

Chapter 56: Volatility Case Study: The Cliquet Option

56.1 Introduction

56.2 The Subtle Nature of the Cliquet Option

56.3 Path Dependency, Constant Volatility

56.4 Results

56.5 Code: Cliquet with Uncertain Volatility, in Similarity Variables

56.6 Summary

Further Reading

Chapter 57: Jump Diffusion

57.1 Introduction

57.2 Evidence for Jumps

57.3 Poisson Processes

57.4 Hedging When There are Jumps

57.5 Hedging the Diffusion

57.6 Hedging the Jumps

57.7 Hedging the Jumps and Risk Neutrality

57.8 The Downside of Jump-Diffusion Models

57.9 Jump Volatility

57.10 Jump Volatility with Deterministic Decay

57.11 Summary

Further Reading

Chapter 58: Crash Modeling

58.1 Introduction

58.2 Value at Risk

58.3 a Simple Example: The Hedged Call

58.4 A Mathematical Model for a Crash

58.5 An Example

58.6 Optimal Static Hedging: Var Reduction

58.7 Continuous-Time Limit

58.8 A Range for the Crash

58.9 Multiple Crashes

58.10 Crashes in a Multi-Asset World

58.11 Fixed and Floating Exchange Rates

58.12 Summary

Further Reading

Chapter 59: Speculating with options

59.1 Introduction

59.2 A Simple Model for the Value of an Option to a Speculator

59.3 More Sophisticated Models for the Return on an Asset

59.4 Early Closing

59.5 To Hedge or Not to Hedge?

59.6 Other Issues

59.7 Summary

Further Reading

Chapter 60: Static Hedging

60.1 Introduction

60.2 Static Replicating Portfolio

60.3 Matching a ‘Target’ Contract

60.4 Vega Matching

60.5 Static Hedging: Non-linear Governing Equation

60.6 Non-linear Equations

60.7 Pricing with a Non-linear Equation

60.8 Optimal Static Hedging: The Theory

60.9 Calibration?

60.10 Hedging Path-Dependent options with Vanilla options, Non-linear Models

60.11 The Mathematics of Optimization

60.12 Summary

Further Reading

Chapter 61: The Feedback Effect of Hedging in Illiquid Markets

61.1 Introduction

61.2 The Trading Strategy for Option Replication

61.3 cthe Excess Demand Function

61.4 Incorporating the Trading Strategy

61.5 The Influence of Replication

61.6 The Forward Equation

61.7 Numerical Results

61.8 Attraction and Repulsion

61.9 Summary

Further Reading

Chapter 62: Utility Theory

62.1 Introduction

62.2 Ranking Events

62.3 The Utility Function

62.4 Risk Aversion

62.5 Special Utility Functions

62.6 Certainty Equivalent Wealth

62.7 Maximization of Expected Utility

62.8 Summary

Further Reading

Chapter 63: More About American options and Related Matters

63.1 Introduction

63.2 What Derivatives Week Published © 1999 Institutional

63.3 Hold These Thoughts

63.4 Change of Notation

63.5 And Finally, the Paper …

63.6 Introduction

63.7 Preliminary: Pricing and Hedging

63.8 Utility-Maximizing Exercise Time

63.9 Profit from Selling American Options

63.10 Concluding Remarks

References

63.11 Who Wins and who Loses?

63.12 Faq

63.13 Another Situation Where the Same Idea Applies: Passport options

63.14 Summary

Further Reading

Chapter 64: Advanced Dividend Modeling

64.1 Introduction

64.2 Why do we Need Dividend Models?

64.3 Effects of Dividends on Asset Prices

64.4 Stochastic Dividends

64.5 Poisson Jumps

64.6 Uncertainty in Dividend Amount and Timing

64.7 Summary

Further Reading

Chapter 65: Serial Autocorrelation in Returns

65.1 Introduction

65.2 Evidence

65.3 The Telegraph Equation

65.4 Pricing and Hedging Derivatives

65.5 Summary

Further Reading

Chapter 66: Asset Allocation in Continuous time

66.1 Introduction

66.2 One Risk-Free and one Risky Asset

66.3 Many Assets

66.4 Maximizing Long-Term Growth

66.5 A Brief Look at Transaction Costs

66.6 Summary

Further Reading

Chapter 67: Asset Allocation Under Threat of a Crash

67.1 Introduction

67.2 Optimal Portfolios Under the Threat of a Crash: The Single Stock Case

67.3 Maximizing Growth Rate Under the Threat of a Crash: n Stocks

67.4 Maximizing Growth Rate Under the Threat of a Crash: an Arbitrary Number of Crashes and Other Refinements

67.5 Summary

Further Reading

Chapter 68: Interest-rate Modeling Without Probabilities

68.1 Introduction

68.2 What do I Want from an Interest Rate Model?

68.3 A Non-probabilistic Model for the Behavior of the Short-Term Interest Rate

68.4 Worst-case Scenarios and a Non-linear Equation

68.5 Examples of Hedging: Spreads for Prices

68.6 Generating the ‘Yield Envelope’

68.7 Swaps

68.8 Caps and Floors

68.9 Applications of the Model

68.10 Summary

Further Reading

Chapter 69: Pricing and Optimal Hedging of Derivatives, the Non-probabilistic Model Cont’d

69.1 Introduction

69.2 A Real Portfolio

69.3 Bond options

69.4 Contracts with Embedded Decisions

69.5 The Index Amortizing Rate Swap

69.6 Convertible Bonds

69.7 Summary

Chapter 70: Extensions to the Non-probabilistic Interest-rate Model

70.1 Introduction

70.2 Fitting Forward Rates

70.3 Economic Cycles

70.4 Interest Rate Bands

70.5 Crash Modeling

70.6 Liquidity

70.7 Summary

Chapter 71: Modeling Inflation

71.1 Introduction

71.2 Inflation-Linked Products

71.3 Pricing, First Thoughts

71.4 What the Data Tell us

71.5 Pricing, Second Thoughts

71.6 Analyzing the Data

71.7 Can we Model Inflation Independently of Interest Rates?

71.8 Calibration and Market Price of Risk

71.9 Non-linear Pricing Methods

71.10 Summary

Further Reading

Chapter 72: Energy Derivatives

72.1 Introduction

72.2 The Energy Market

72.3 What’s so Special About the Energy Markets?

72.4 Why Can’t we Apply Black–Scholes Theory to Energy Derivatives?

72.5 The Convenience Yield

72.6 The Pilopović Two-Factor Model

72.7 Energy Derivatives

72.8 Summary

Further Reading

Chapter 73: Real options

73.1 Introduction

73.2 Financial options and Real options

73.3 An Introductory Example: Abandonment of a Machine

73.4 Optimal Investment: Simple Example #2

73.5 Temporary Suspension of the Project, Costless

73.6 Temporary Suspension of the Project, Costly

73.7 Sequential and Incremental Investment

73.8 Ashanti: Gold Mine Case Study

73.9 Summary

Further Reading

Chapter 74: Life Settlements and Viaticals

74.1 Introduction

74.2 Life Expectancy

74.3 Actuarial Tables

74.4 Death seen as Default

74.5 Pricing a Single Policy

74.6 Pricing Portfolios

74.7 Summary

Further Reading

Appendix: The Age of Quants

Chapter 75: Bonus Time

75.1 Introduction

75.2 One Bonus Period

75.3 the Skill factor

75.4 Putting Skill into the Equation

75.5 Summary

Further Reading

Part Six: Numerical Methods and Programs

Chapter 76: Overview of Numerical Methods

76.1 Introduction

76.2 Finite-Difference Methods

76.3 Monte Carlo Methods

76.4 Numerical Integration

76.5 Summary

Further Reading

Chapter 77: Finite-Difference Methods for One-factor Models

77.1 Introduction

77.2 Overview

77.3 Grids

77.4 Differentiation using the Grid

77.5 Approximating θ

77.6 Approximating Δ

77.7 Approximating Γ

77.8 Example

77.9 Final Conditions and Payoffs

77.10 Boundary Conditions

77.11 The Explicit Finite-Difference Method

77.12 Convergence of the Explicit Method

77.13 The Code # I: European Option

77.14 The Code # 2: American Exercise

77.15 The Code # 3: 2-D Output

77.16 Bilinear Interpolation

77.17 Upwind Differencing

77.18 Summary

Further Reading

Chapter 78: Further Finite-Difference Methods for One-factor Models

78.1 Introduction

78.2 Implicit Finite-Difference Methods

78.3 The Crank-Nicolson Method

78.4 Comparison of Finite-Difference Methods

78.5 Other Methods

78.6 Douglas Schemes

78.7 Three time-level Methods

78.8 Richardson Extrapolation

78.9 Free Boundary Problems and American options

78.10 Jump Conditions

78.11 Path-Dependent options

78.12 Summary

Further Reading

Chapter 79: Finite-Difference Methods for Two-factor Models

79.1 Introduction

79.2 Two-Factor Models

79.3 The Explicit Method

79.4 Calculation Time

79.5 Alternating Direction Implicit

79.6 the Hopscotch Method

79.7 Summary

Further Reading

Chapter 80: Monte Carlo Simulation

80.1 Introduction

80.2 Relationship Between Derivative Values and Simulations: Equities, Indices, Currencies, Commodities

80.3 Generating Paths

80.4 Lognormal Underlying, no Path Dependency

80.5 Advantages of Monte Carlo Simulation

80.6 Using Random Numbers

80.7 Generating Normal Variables

80.8 Real Versus Risk Neutral, Speculation Versus Hedging

80.9 Interest Rate Products

80.10 Calculating the Greeks

80.11 Higher Dimensions: Cholesky factorization

80.12 Calculation Time

80.13 Speeding up Convergence

80.14 Pros and Cons of Monte Carlo Simulations

80.15 American options

80.16 Longstaff & Schwartz Regression Approach for American options

80.17 Basis Functions

80.18 Summary

Further Reading

Chapter 81: Numerical Integration

81.1 Introduction

81.2 Regular Grid

81.3 Basic Monte Carlo Integration

81.4 Low-Discrepancy Sequences

81.5 Advanced Techniques

81.6 Summary

Further Reading

Chapter 82: Finite-Difference Programs

82.1 Introduction

82.2 Kolmogorov Equation

82.3 Explicit One-Factor Model for a Convertible Bond

82.4 American call, Implicit

82.5 Explicit Parisian Option

82.6 Passport options

82.7 Chooser Passport Option

82.8 Explicit Stochastic Volatility

82.9 Uncertain Volatility

82.10 Crash Modeling

82.11 Explicit Epstein–Wilmott Solution

82.12 Risky-Bond Calculator

Chapter 83: Monte Carlo Programs

83.1 Introduction

83.2 Monte Carlo Pricing of a Basket

83.3 Quasi Monte Carlo Pricing of a Basket

83.4 Monte Carlo for American options

Appendix A: All the Math You Need… and No More (An Executive Summary)

A.1 Introduction

A.2 The Different Types of Mathematics Found in Finance

A.3 E

A.4 Log

A.5 Differentiation and Taylor Series

A.6 Expectation and Variance

A.7 Another Look at Black–Scholes

A.8 Summary

Bibliography

Index

Wiley End User License Agreement

Paul Wilmott On Quantitative Finance

© 2006 Paul WilmottPublished by John Wiley & Sons, Ltd

Registered officeJohn Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO198SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with the respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. It is sold on the understanding that the publisher is not engaged in rendering professional services and neither the publisher nor the author shall be liable for damages arising herefrom. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

Library of Congress Cataloging-in-Publication Data

Wilmott, Paul.Paul Wilmott on quantitative finance.—2nd ed.p. cm.Includes bibliographical references and index.ISBN 13 978-0-470-01870-5 (cloth/cd : alk. paper)ISBN 10 0-470-01870-4 (cloth/cd : alk. paper)1. Derivative securities—Mathematical models. 2. Options (Finance)—Mathematical models. 3. Options (Finance)—Prices—Mathematical models. I. Title.HG6024.A3W555 2006332.64_53—dc222005028317

A catalogue record for this book is available from the British Library.

ISBN 978-0-470-01870-5

In memory of Detlev Vogel

visual basic code

Implied volatility, Newton–Raphson

Cumulative distribution for Normal variable

The binomial method, European option

The binomial method, American option

Double knock-out barrier option, finite difference

Instalment knock-out barrier option, finite difference

Range Note, finite difference

Lookback, finite difference

Index Amortizing Rate Swap, finite difference

Cliquet option, uncertain volatility, finite difference

Optimization subroutine

Setting up final condition, finite difference

Finite difference time loop, first example

European option, finite difference, three dimensions

American option, finite difference, three dimensions

European or American option, finite difference, two dimensions

Upwind differencing, interest rate

LU decomposition

Matrix solution

Successive over relaxation

Successive over relaxation, early exercise

Jump condition for discrete dividends

Jump condition for path-dependent quantities

Two-factor explicit finite difference

Convertible bond constraint

Box–Muller

Cholesky factorization

Numerical integration, Monte Carlo

Halton number generation

Kolmogorov equation, explicit finite difference

Convertible bond time stepping fragment, explicit finite difference

American option, implicit finite difference

Parisian option, explicit finite difference

Passport option, explicit finite difference

Chooser Passport option, explicit finite difference

Stochastic volatility, explicit finite difference

Uncertain volatility, gamma rule

Crash model, finite difference code fragment

Epstein–Wilmott model, finite difference

Risky bond, explicit finite difference

Basket option, Monte Carlo

Basket option, quasi Monte Carlo

American option, Monte Carlo

prolog to the second edition

This book is a greatly updated and expanded version of the first edition. The content continues to reflect my own interests and prejudices, based on my skills, such as they are. In the period between the first and second editions, the financial markets have expanded, the tools available to the modeler have expanded, and my girth has expanded. On a personal basis I have spent as much time being a practitioner in a hedge fund as being an independent researcher. Much of the new material therefore represents both my desire as a scientist to build the best, most accurate models, and my need as a practitioner to have models that are fast and robust and simple to understand. As I said, this book is a very personal account of my areas of expertise. Since the subject of quant finance has been galloping apace of late, I advise that you supplement this book with the specialized books that I recommend throughout, and in particular those in the quant library at the end.

I would like to re-thank those people I mentioned in the prolog to the first edition: Arefin Huq, Asli Oztukel, Bafkam Bim, Buddy Holly, Chris McCoy, Colin Atkinson, Daniel Bruno, Dave Thomson, David Bakstein, David Epstein, David Herring, David Wilson, Edna Hepburn-Ruston, Einar Holstad, Eli Lilly, Elisabeth Keck, Elsa Cortina, Eric Cartman, Fouad Khennach, Glen Matlock, Henrik Rassmussen, Hyungsok Ahn, Ingrid Blauer, Jean Laidlaw, Jeff Dewynne, John Lydon, John Ockendon, Karen Mason, Keesup Choe, Malcolm McLaren, Mauricio Bouabci, Patricia Sadro, Paul Cook, Peter Jäckel, Philip Hua, Philipp Schönbucher, Phoebus Theologites, Quentin Crisp, Rich Haber, Richard Arkell, Richard Sherry, Sam Ehrlichman, Sandra Maler, Sara Statman, Simon Gould, Simon Ritchie, Stephen Jefferics, Steve Jones, Truman Capote, Varqa Khadem, and Veronika Guggenbichler.

I would also like to thank the following people. My partners in various projects: Paul and Jonathan Shaw at 7city, unequaled in their dedication to training and their imagination for new projects. Also Riaz Ahmad and Seb Lleo who have helped make the Certificate in Quantitative Finance so successful, and for taking some of the pressure off me; Everyone involved in the magazine, especially Aaron Brown, Alan Lewis, Bill Ziemba, Caitlin Cornish, Dan Tudball, Ed Lound, Ed Thorp, Elie Ayache, Espen Gaarder Haug, Graham Russel, Henriette Präst, Jenny McCall, Kent Osband, Liam Larkin, Mike Staunton, Paula Soutinho and Rudi Bogni. I am particularly fortunate and grateful that John Wiley & Sons have been so supportive in what must sometimes seem to them rather wacky schemes; Thanks to Ron Henley, the best hedge fund partner a quant could wish for, “It’s just a jump to the left. And then a step to the right.’ And to John Morris of Fulcrum, interesting times: and to Nassim Nicholas Taleb for interesting chats.

Thanks to, John, Grace, Sel and Stephen, for instilling in me their values: values which have invariably served me well. And to Oscar and Zachary who kept me sane throughout many a series of unfortunate events!

Finally, thanks to my number one fan, Andrea Estrella, from her number one fan, me.

ABOUT THE AUTHOR

Paul Wilmott’s professional career spans almost every aspect of mathematics and finance, in both academia and in the real world. He has lectured at all levels, founded a magazine, the leading website for the quant community, and a quant certificate program. He has managed money as a partner in a very successful hedge fund. He lives in London, is married, and has two sons. His only remaining dream is to get some sleep.

More info about the particular meaning of an icon is contained in its ‘speech box.’

You will see this icon whenever a method is implemented on the CD.

CD content is now hosted on booksupport.wiley.com. Readers can search for it using the ISBN.

PART ONE

mathematical and financial foundations; basic theory of derivatives; risk and return

The first part of the book contains the fundamentals of derivatives theory and practice. We look at both equity and fixed income instruments. I introduce the important concepts of hedging and no arbitrage, on which most sophisticated finance theory is based. We draw some insight from ideas first seen in gambling, and we develop those into an analysis of risk and return.

The assumptions, key concepts and results in Part One make up what is loosely known as the ‘Black–Scholes world,’ named for Fischer Black and Myron Scholes who, together with Robert Merton, first conceived them. Their original work was published in 1973, after some resistance (the famous equation was first written down in 1969). In October 1997 Myron Scholes and Robert Merton were awarded the Nobel Prize for Economics for their work, Fischer Black having died in August 1995. The New York Times of Wednesday. 15th October 1997 wrote: ‘Two North American scholars won the Nobel Memorial Prize in Economic Science yesterday for work that enables investors to price accurately their bets on the future, a breakthrough that has helped power the explosive growth in financial markets since the 1970’s and plays a profound role in the economics of everyday life.’1

Part One is self contained, requiring little knowledge of finance or any more than elementary calculus.

Chapter 1: Products and Markets An overview of the workings of the financial markets and their products. A chapter such as this is obligatory. However, my readers will fall into one of two groups. Either they will know everything in this chapter and much, much more besides. Or they will know little, in which case what I write will not be enough.

Chapter 2: Derivatives An introduction to options, options markets, market conventions. Definitions of the common terms, simple no arbitrage, put-call parity and elementary trading strategies.

Chapter 3: The Random Behavior of Assets An examination of data for various financial quantities, leading to a model for the random behavior of prices. Almost all of sophisticated finance theory assumes that prices are random, the question is how to model that randomness.

Chapter 4: Elementary Stochastic Calculus We’ll need a little bit of theory for manipulating our random variables. I keep the requirements down to the bare minimum. The key concept is Itô’s lemma which I will try to introduce in as accessible a manner as possible.

Chapter 5: The Black–Scholes Model I present the classical model for the fair value of options on stocks, currencies and commodities. This is the chapter in which I describe delta hedging and no arbitrage and show how they lead to a unique price for an option. This is the foundation for most quantitative finance theory and I will be building on this foundation for much, but by no means all, of the book.

Chapter 6: Partial Differential Equations Partial differential equations play an important role in most physical applied mathematics. They also play a role in finance. Most of my readers trained in the physical sciences, engineering and applied mathematics will be comfortable with the idea that a partial differential equation is almost the same as ‘the answer,’ the two being separated by at most some computer code. If you are not sure of this connection I hope that you will persevere with the book. This requires some faith on your part; you may have to read the book through twice: I have necessarily had to relegate the numerics, the real ‘answer,’ to the last few chapters.

Chapter 7: The Black–Scholes Formulae and the ‘Greeks’ From the Black–Scholes partial differential equation we can find formulae for the prices of some options. Derivatives of option prices with respect to variables or parameters are important for hedging. I wall explain some of the most important such derivatives and how they are used.

Chapter 8: Simple Generalizations of the Black–Scholes World Some of the assumptions of the Black–Scholes world can be dropped or stretched with ease. I will describe several of these. Later chapters are devoted to more extensive generalizations.

Chapter 9: Early Exercise and American Options Early exercise is of particular importance financially. It is also of great mathematical interest. I will explain both of these aspects.

Chapter 10: Probability Density Functions and First-exit Times The random nature of financial quantities means that we cannot say with certainty what the future holds in store. For that reason we need to be able to describe that future in a probabilistic sense.

Chapter 11: Multi-asset Options Another conceptually simple generalization of the basic Black–Scholes world is to options on more than one underlying asset. Theoretically simple, this extension has its own particular problems in practice.

Chapter 12: How to Delta Hedge Not everyone believes in no arbitrage, the absence of free lunches. In this chapter we see how to profit if you have a better forecast for future volatility than the market.

Chapter 13: Fixed-income Products and Analysis: Yield, Duration and Convexity This chapter is an introduction to the simpler techniques and analyses commonly used in the market. In particular I explain the concepts of yield, duration and convexity. In this and the next chapter I assume that interest rates are known, deterministic quantities.

Chapter 14: Swaps Interest-rate swaps are very common and very liquid. I explain the basics and relate the pricing of swaps to the pricing of fixed-rate bonds.

Chapter 15: The Binomial Model One of the reasons that option theory has been so successful is that the ideas can be explained and implemented very easily with no complicated mathematics. The binomial model is the simplest way to explain the basic ideas behind option theory using only basic arithmetic. That’s a good thing, right? Yes, but only if you bear in mind that the model is for demonstration purposes only, it is not the real thing. As a model of the financial world it is too simplistic, as a concept for pricing it lacks the elegance that makes other methods preferable, and as a numerical scheme it is prehistoric. Use once and then throw away, that’s my recommendation.

Chapter 16: How Accurate is the Normal Approximation? One of the major assumptions of finance theory is that returns are Normally distributed. In this chapter we take a look at why we make this assumption, and how good it really is.

Chapter 17: Investment Lessons from Blackjack and Gambling We draw insights and inspiration from the not-unrelated world of gambling to help us in the treatment of risk, return, and money/risk management.

Chapter 18: Portfolio Management If you are willing to accept some risk how should you invest? I explain the classical ideas of Modern Portfolio Theory and the Capital Asset Pricing Model

Chapter 19: Value at Risk How risky is your portfolio? How much might you conceivably lose if there is an adverse market move? These are the topics of this chapter.

Chapter 20: Forecasting the Markets? Although almost all sophisticated finance theory assumes that assets move randomly, many traders rely on technical indicators to predict the future direction of assets. These indicators may be simple geometrical constructs of the asset price path or quite complex algorithms. The hypothesis is that information about short-term future asset price movements are contained within the past history of prices. All traders use technical indicators at some time. In this chapter I describe some of the more common techniques.

Chapter 21: A Trading Game Many readers of this book will never have traded anything more sophisticated than baseball cards. To get them into the swing of the subject from a practical point of view I include some suggestions on how to organize your own trading game based on the buying and selling of derivatives. I had a lot of help with this chapter from David Epstein who has been running such games for several years.

1 We’ll be hearing more about these two in Chapter 44 on ‘Derivatives **** Ups.’

CHAPTER 1

products and markets

In this Chapter …

the time value of money

an introduction to equities, commodities, currencies and indices

fixed and floating interest rates

futures and forwards

no-arbitrage, one of the main building blocks of finance theory

1.1 INTRODUCTION

This first chapter is a very gentle introduction to the subject of finance, and is mainly just a collection of definitions and specifications concerning the financial markets in general. There is little technical material here, and the one technical issue, the ‘time value of money,’ is extremely simple. I will give the first example of ‘no arbitrage.’ This is important, being one part of the foundation of derivatives theory. Whether you read this chapter thoroughly or just skim it will depend on your background; mathematicians new to finance may want to spend more time on it than practitioners, say.

1.2 THE TIME VALUE OF MONEY

The simplest concept in finance is that of the time value of money; $1 today is worth more than $1 in a year’s time. This is because of all the things we can do with $1 over the next year. At the very least, we can put it under the mattress and take it out in one year. But instead of putting it under the mattress we could invest it in a gold mine, or a new company. If those are too risky, then lend the money to someone who is willing to take the risks and will give you back the dollar with a little bit extra, the interest. That is what banks do, they borrow your money and invest it in various risky ways, but by spreading their risk over many investments they reduce their overall risk. And by borrowing money from many people they can invest in ways that the average individual cannot. The banks compete for your money by offering high interest rates. Free markets and the ability to change banks quickly and cheaply ensure that interest rates are fairly consistent from one bank to another.

I am going to denote interest rates by r. Although rates vary with time I am going to assume for the moment that they are constant. We can talk about several types of interest. First of all there is simple and compound interest. Simple interest is when the interest you receive is based only on the amount you invest initially, whereas compound interest is when you also get interest on your interest. Compound interest is the main case of relevance. And compound interest comes in two forms, discretely compounded and continuously compounded. Let me illustrate how they each work.

Suppose I invest $1 in a bank at a discrete interest rate of r paid once per annum. At the end of one year my bank account will contain

If the interest rate is 10% I will have one dollar and ten cents. After two years I will have

or one dollar and twenty-one cents. After n years I will have (1 + r)n dollars. That is an example of discrete compounding.

Now suppose I receive m interest payments at a rate of r/m per annum. After one year I will have

(1.1)

(I have dropped the $ sign, taking it as read from now on.)

I am going to imagine that these interest payments come at increasingly frequent intervals, but at an increasingly smaller interest rate: I am going to take the limit m → ∞. This will lead to a rate of interest that is paid continuously. Expression (1.1) becomes

This is a simple application of Taylor series when r/m is small. And that is how much money I will have in the bank after one year if the interest is continuously compounded. Similarly, after a time t I will have an amount

(1.2)

in the bank. Almost everything in this book assumes that interest is compounded continuously.

Another way of deriving the result (1.2) is via a differential equation. Suppose I have an amount M(t) in the bank at time t, how much does this increase in value from one day to the next? If I look at my bank account at time t and then again a short while later, time t + dt, the amount will have increased by

where the right-hand side comes from a Taylor series expansion of M(t + dt). But I also know that the interest I receive must be proportional to the amount I have, M, the interest rate, r, and the time step, dt. Thus

Dividing by dt gives the ordinary differential equation

the solution of which is

This equation relates the value of the money I have now to the value in the future. Conversely, if I know I will get one dollar at time T in the future, its value at an earlier time t is simply

The present value is clearly less than the future value.

Interest rates are a very important factor determining the present value of future cashflows. For the moment I will only talk about one interest rate, and that will be constant. In later chapters I will generalize.

Important Aside

What mathematics have we seen so far? To get to (1.2) all we needed to know about are the two functions e (or exp) and log, and Taylor series. Believe it or not, you can appreciate almost all finance theory by knowing these three things together with ‘expectations.’ I’m going to build up to the basic Black–Scholes and derivatives theory assuming that you know all four of these. Don’t worry if you don’t know about these things yet, take a look at Appendix A where I review these requisites and show how to interpret finance theory and practice in terms of the most elementary mathematics.

Just because you can understand derivatives theory in terms of basic math doesn’t mean that you should. I hope that there’s enough in the book to please the Ph.D.s1 as well.

1.3 EQUITIES

The most basic of financial instruments is the equity, stock or share. This is the ownership of a small piece of a company. If you have a bright idea for a new product or service then you could raise capital to realize this idea by selling off future profits in the form of a stake in your new company. The investors may be friends, your Aunt Joan, a bank, or a venture capitalist. The investor in the company gives you some cash, and in return you give him a contract stating how much of the company he owns. The shareholders who own the company between them then have some say in the running of the business, and technically the directors of the company are meant to act in the best interests of the shareholders. Once your business is up and running, you could raise further capital for expansion by issuing new shares.

This is how small businesses begin. Once the small business has become a large business, your Aunt Joan may not have enough money hidden under the mattress to invest in the next expansion. At this point shares in the company may be sold to a wider audience or even the general public. The investors in the business may have no link with the founders. The final point in the growth of the company is with the quotation of shares on a regulated stock exchange so that shares can be bought and sold freely, and capital can be raised efficiently and at the lowest cost.

Figures 1.1 and 1.2 show screens from Bloomberg giving details of Microsoft stock, including price, high and low, names of key personnel, weighting in various indices (see below) etc. There is much, much more info available on Bloomberg for this and all other stocks. We’ll be seeing many Bloomberg screens throughout this book.

Figure 1.1 Details of Microsoft stock.

Source: Bloomberg L.P.

Figure 1.2 Details of Microsoft stock continued.

Source: Bloomberg L.P.

In Figure 1.3 I show an excerpt from The Wall Street Journal Europe of 14th April 2005. This shows a small selection of the many stocks traded on the New York Stock Exchange. The listed information includes highs and lows for the day as well as the change since the previous day’s close.

Figure 1.3The Wall Street Journal Europe of 14th April 2005. Reproduced by permission of Dow Jones & Company, Inc.

The behavior of the quoted prices of stocks is far from being predictable. In Figure 1.4 I show the Dow Jones Industrial Average over the period January 1950 to March 2004. In Figure 1.5 is a time series of the Glaxo–Wellcome share price, as produced by Bloomberg.

Figure 1.4 A time series of the Dow Jones Industrial Average from January 1950 to March 2004.

Figure 1.5 Glaxo–Wellcome share price (volume below).

Source: Bloomberg L.P.

If we could predict the behavior of stock prices in the future then we could become very rich. Although many people have claimed to be able to predict prices with varying degrees of accuracy, no one has yet made a completely convincing case. In this book I am going to take the point of view that prices have a large element of randomness. This does not mean that we cannot model stock prices, but it does mean that the modeling must be done in a probabilistic sense. No doubt the reality of the situation lies somewhere between complete predictability and perfect randomness, not least because there have been many cases of market manipulation where large trades have moved stock prices in a direction that was favorable to the person doing the moving.

Figure 1.6 A simulation of an asset price path?

Figure 1.7 Simple spreadsheet to simulate the coin-tossing experiment.

1.3.1 Dividends

The owner of the stock theoretically owns a piece of the company. This ownership can only be turned into cash if he owns so many of the stock that he can take over the company and keep all the profits for himself. This is unrealistic for most of us. To the average investor the value in holding the stock comes from the dividends and any growth in the stock’s value. Dividends are lump sum payments, paid out every quarter or every six months, to the holder of the stock.

The amount of the dividend varies from year to year depending on the profitability of the company. As a general rule companies like to try to keep the level of dividends about the same each time. The amount of the dividend is decided by the board of directors of the company and is usually set a month or so before the dividend is actually paid.

When the stock is bought it either comes with its entitlement to the next dividend (cum) or not (ex). There is a date at around the time of the dividend payment when the stock goes from cum to ex. The original holder of the stock gets the dividend but the person who buys it obviously does not. All things being equal a stock that is cum dividend is better than one that is ex dividend. Thus at the time that the dividend is paid and the stock goes ex dividend there will be a drop in the value of the stock. The size of this drop in stock value offsets the disadvantage of not getting the dividend.

This jump in stock price is in practice more complex than I have just made out. Often capital gains due to the rise in a stock price are taxed differently from a dividend, which is often treated as income. Some people can make a lot of risk-free money by exploiting tax ‘inconsistencies.’

I discuss dividends in depth in Chapter 8 and again in Chapter 64.

1.3.2 Stock Splits

Stock prices in the US are usually of the order of magnitude of $100. In the UK they are typically around £1. There is no real reason for the popularity of the number of digits, after all, if I buy a stock I want to know what percentage growth I will get, the absolute level of the stock is irrelevant to me, it just determines whether I have to buy tens or thousands of the stock to invest a given amount. Nevertheless there is some psychological element to the stock size. Every now and then a company will announce a stock split (see Figure 1.8). For example, the company with a stock price of $900 announces a three-for-one stock split. This simply means that instead of holding one stock valued at $900, I hold three valued at $300 each.2

Figure 1.8 Stock split info for Microsoft.

Source: Bloomberg L.P.

1.4 COMMODITIES

Commodities are usually raw products such as precious metals, oil, food products etc. The prices of these products are unpredictable but often show seasonal effects. Scarcity of the product results in higher prices. Commodities are usually traded by people who have no need of the raw material. For example they may just be speculating on the direction of gold without wanting to stockpile it or make jewelry. Most trading is done on the futures market, making deals to buy or sell the commodity at some time in the future. The deal is then closed out before the commodity is due to be delivered. Futures contracts are discussed below.

Figure 1.9 shows a time series of the price of pulp, used in paper manufacture.

Figure 1.9 Pulp price.

Source: Bloomberg L.P.

1.5 CURRENCIES

Another financial quantity we shall discuss is the exchange rate, the rate at which one currency can be exchanged for another. This is the world of foreign exchange, or Forex or FX for short. Some currencies are pegged to one another, and others are allowed to float freely. Whatever the exchange rates from one currency to another, there must be consistency throughout. If it is possible to exchange dollars for pounds and then the pounds for yen, this implies a relationship between the dollar/pound, pound/yen and dollar/yen exchange rates. If this relationship moves out of line it is possible to make arbitrage profits by exploiting the mispricing.

Figure 1.10 is an excerpt from The Wall Street Journal Europe of 14th April 2005. At the top of this excerpt is a matrix of exchange rates. A similar matrix is shown in Figure 1.11 from Bloomberg.

Figure 1.10The Wall Street Journal Europe of 14th April 2005, currency exchange rates. Reproduced by permission of Dow Jones & Company, Inc.

Figure 1.11 Key cross currency rates.

Source: Bloomberg L.P.

Although the fluctuation in exchange rates is unpredictable, there is a link between exchange rates and the interest rates in the two countries. If the interest rate on dollars is raised while the interest rate on pounds sterling stays fixed we would expect to see sterling depreciating against the dollar for a while. Central banks can use interest rates as a tool for manipulating exchange rates, but only to a degree.

At the start of 1999 Euroland currencies were fixed at the rates shown in Figure 1.12.

Figure 1.12 Euro fixing rates.

Source: Bloomberg L.P.

1.6 INDICES

For measuring how the stock market/economy is doing as a whole, there have been developed the stock market indices. A typical index is made up from the weighted sum of a selection or basket of representative stocks. The selection may be designed to represent the whole market, such as the Standard & Poor’s 500 (S&P500) in the US or the Financial Times Stock Exchange index (FTSE100) in the UK, or a very special part of a market. In Figure 1.4 we saw the DJIA, representing major US stocks. In Figure 1.13 is shown JP Morgan’s Emerging Market Bond Index. The EMBI+ is an index of emerging market debt instruments, including external-currency-denominated Brady bonds, Eurobonds and US dollar local markets instruments. The main components of the index are the three major Latin American countries, Argentina, Brazil and Mexico. Bulgaria, Morocco, Nigeria, the Philippines, Poland, Russia and South Africa are also represented.

Figure 1.13 JP Morgan’s EMBI Plus.

Figure 1.14 shows a time series of the MAE All Bond Index which includes Peso and US dollar denominated bonds sold by the Argentine Government.

Figure 1.14 A time series of the MAE All Bond Index.

Source: Bloomberg L.P.