25,99 €

Mehr erfahren.

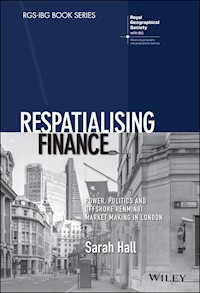

- Herausgeber: John Wiley & Sons

- Kategorie: Wissenschaft und neue Technologien

- Serie: RGS-IBG Book Series

- Sprache: Englisch

RESPATIALISING FINANCE 'In Respatialising Finance Sarah Hall uses the internationalisation of the Chinese Renminbi (RMB) to work through a sympathetic conceptual and empirical critique of prevailing analyses of International Financial Centres (IFCs). Her conceptual (re)framing stresses the politics, institutions and economics of IFCs and will be essential reading for all social scientists interested in the dynamism of contemporary finance and financial centres.' Professor Jane Pollard, Centre for Urban and Regional Development Studies (CURDS), Newcastle University, UK 'Through detailed study of Chinese RMB internationalisation and combining analytical insights from economic geography, sociology, and international political economy, Sarah Hall shows why offshore networks anchored in territories such as the City of London are both core to global monetary and financial landscapes, and provide a key terrain for state power and politics.' Professor Paul Langley, Department of Geography, Durham University, UK Respatialising Finance is one of the first detailed empirical studies of how and why London became the leading western financial centre within the wider Chinese economic and political project of internationalising its currency, the renminbi (RMB). This in-depth volume examines how political authorities in both London and Beijing identified the potential value of London's international financial centre in facilitating and legitimising RMB internationalisation, and how they sought to operationalise this potential through a range of market-making activities. The text features original data from on-the-ground research in London and Beijing conducted with financial and legal professionals working in RMB markets and offers an original theoretical approach that brings economic geography into closer dialogue with international political economy. Recent work on territory illustrates how financial centres are not simply containers and facilitators of global financial flows - rather they serve as territorial fixes within the dynamic and crisis-prone nature of global finance.

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 379

Veröffentlichungsjahr: 2021

Ähnliche

RGS-IBG Book Series

For further information about the series and a full list of published and forthcoming titles please visit www.rgsbookseries.com

Published

Respatialising Finance: Power, Politics and Offshore Renminbi Market Making in London

Sarah Hall

Bodies, Affects, Politics: The Clash of Bodily Regimes

Steve Pile

Home SOS: Gender, Violence, and Survival in Crisis Ordinary Cambodia

Katherine Brickell

Geographies of Anticolonialism: Political Networks Across and Beyond South India, c. 1900–1930

Andrew Davies

Geopolitics and the Event: Rethinking Britain’s Iraq War Through Art

Alan Ingram

On Shifting Foundations: State Rescaling, Policy Experimentation And Economic Restructuring In Post-1949 China

Kean Fan Lim

Global Asian City: Migration, Desire and the Politics of Encounter in 21st Century Seoul

Francis L. Collins

Transnational Geographies Of The Heart: Intimate Subjectivities In A Globalizing City

Katie Walsh

Cryptic Concrete: A Subterranean Journey Into Cold War Germany

Ian Klinke

Work-Life Advantage: Sustaining Regional Learning and Innovation

Al James

Pathological Lives: Disease, Space and Biopolitics

Steve Hinchliffe, Nick Bingham, John Allen and Simon Carter

Smoking Geographies: Space, Place and Tobacco

Ross Barnett, Graham Moon, Jamie Pearce, Lee Thompson and Liz Twigg

Rehearsing the State: The Political Practices of the Tibetan Government-in-Exile

Fiona McConnell

Nothing Personal? Geographies of Governing and Activism in the British Asylum System

Nick Gill

Articulations of Capital: Global Production Networks and Regional Transformations

John Pickles and Adrian Smith, with Robert Begg, Milan Buček, Poli Roukova and Rudolf Pástor

Metropolitan Preoccupations: The Spatial Politics of Squatting in Berlin

Alexander Vasudevan

Everyday Peace? Politics, Citizenship and Muslim Lives in India

Philippa Williams

Assembling Export Markets: The Making and Unmaking of Global Food Connections in West Africa

Stefan Ouma

Africa’s Information Revolution: Technical Regimes and Production Networks in South Africa and Tanzania

James T. Murphy and Pádraig Carmody

Origination: The Geographies of Brands and Branding

Andy Pike

In the Nature of Landscape: Cultural Geography on the Norfolk Broads

David Matless

Geopolitics and Expertise: Knowledge and Authority in European Diplomacy

Merje Kuus

Everyday Moral Economies: Food, Politics and Scale in Cuba

Marisa Wilson

Material Politics: Disputes Along the Pipeline

Andrew Barry

Fashioning Globalisation: New Zealand Design, Working Women and the Cultural Economy

Maureen Molloy and Wendy Larner

Working Lives – Gender, Migration and Employment in Britain, 1945–2007

Linda McDowell

Dunes: Dynamics, Morphology and Geological History

Andrew Warren

Spatial Politics: Essays for Doreen Massey

Edited by David Featherstone and Joe Painter

The Improvised State: Sovereignty, Performance and Agency in Dayton Bosnia

Alex Jeffrey

Learning the City: Knowledge and Translocal Assemblage

Colin McFarlane

Globalizing Responsibility: The Political Rationalities of Ethical Consumption

Clive Barnett, Paul Cloke, Nick Clarke & Alice Malpass

Domesticating Neo-Liberalism: Spaces of Economic Practice and Social Reproduction in Post-Socialist Cities

Alison Stenning, Adrian Smith, Alena Rochovská and Dariusz S´wia˛tek

Swept Up Lives? Re-envisioning the Homeless City

Paul Cloke, Jon May and Sarah Johnsen

Aerial Life: Spaces, Mobilities, Affects

Peter Adey

Millionaire Migrants: Trans-Pacific Life Lines

David Ley

State, Science and the Skies: Governmentalities of the British Atmosphere

Mark Whitehead

Complex Locations: Women’s geographical work in the UK 1850–1970

Avril Maddrell

Value Chain Struggles: Institutions and Governance in the Plantation Districts of South India

Jeff Neilson and Bill Pritchard

Queer Visibilities: Space, Identity and Interaction in Cape Town

Andrew Tucker

Arsenic Pollution: A Global Synthesis

Peter Ravenscroft, Hugh Brammer and Keith Richards

Resistance, Space and Political Identities: The Making of Counter-Global Networks

David Featherstone

Mental Health and Social Space: Towards Inclusionary Geographies?

Hester Parr

Climate and Society in Colonial Mexico: A Study in Vulnerability

Georgina H. Endfield

Geochemical Sediments and Landscapes

Edited by David J. Nash and Sue J. McLaren

Driving Spaces: A Cultural-Historical Geography of England’s M1 Motorway

Peter Merriman

Badlands of the Republic: Space, Politics and Urban Policy

Mustafa Dikeç

Geomorphology of Upland Peat: Erosion, Form and Landscape Change

Martin Evans and Jeff Warburton

Spaces of Colonialism: Delhi’s Urban Governmentalities

Stephen Legg

People/States/Territories

Rhys Jones

Publics and the City

Kurt Iveson

After the Three Italies: Wealth, Inequality and Industrial Change

Mick Dunford and Lidia Greco

Putting Workfare in Place

Peter Sunley, Ron Martin and Corinne Nativel

Domicile and Diaspora

Alison Blunt

Geographies and Moralities

Edited by Roger Lee and David M. Smith

Military Geographies

Rachel Woodward

A New Deal for Transport?

Edited by Iain Docherty and Jon Shaw

Geographies of British Modernity

Edited by David Gilbert, David Matless and Brian Short

Lost Geographies of Power

John Allen

Globalizing South China

Carolyn L. Cartier

Geomorphological Processes and Landscape Change: Britain in the Last 1000 Years

Edited by David L. Higgitt and E. Mark Lee

Respatialising Finance

Power, Politics and Offshore Renminbi Market Making in London

Sarah Hall

This edition first published 2021

© 2021 Royal Geographical Society (with the Institute of British Geographers)

This Work is a co-publication between The Royal Geographical Society (with the Institute of British Geographers) and John Wiley & Sons Ltd.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by law. Advice on how to obtain permission to reuse material from this title is available at http://www.wiley.com/go/permissions.

The right of Sarah Hall to be identified as the author of this work has been asserted in accordance with law.

Registered Office

John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, USA

John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, UK

Editorial Office

9600 Garsington Road, Oxford, OX4 2DQ, UK

For details of our global editorial offices, customer services, and more information about Wiley products visit us at www.wiley.com.

Wiley also publishes its books in a variety of electronic formats and by print-on-demand. Some content that appears in standard print versions of this book may not be available in other formats.

Limit of Liability/Disclaimer of Warranty

The contents of this work are intended to further general scientific research, understanding, and discussion only and are not intended and should not be relied upon as recommending or promoting scientific method, diagnosis, or treatment by physicians for any particular patient. In view of ongoing research, equipment modifications, changes in governmental regulations, and the constant flow of information relating to the use of medicines, equipment, and devices, the reader is urged to review and evaluate the information provided in the package insert or instructions for each medicine, equipment, or device for, among other things, any changes in the instructions or indication of usage and for added warnings and precautions. While the publisher and authors have used their best efforts in preparing this work, they make no representations or warranties with respect to the accuracy or completeness of the contents of this work and specifically disclaim all warranties, including without limitation any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives, written sales materials or promotional statements for this work. The fact that an organization, website, or product is referred to in this work as a citation and/or potential source of further information does not mean that the publisher and authors endorse the information or services the organization, website, or product may provide or recommendations it may make. This work is sold with the understanding that the publisher is not engaged in rendering professional services. The advice and strategies contained herein may not be suitable for your situation. You should consult with a specialist where appropriate. Further, readers should be aware that websites listed in this work may have changed or disappeared between when this work was written and when it is read. Neither the publisher nor authors shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Library of Congress Cataloging-in-Publication Data

Names: Hall, Sarah (Professor of economic geography), author.

Title: Respatialising finance: power, politics and offshore renminbi market making in London / Sarah Hall.

Description: Hoboken, NJ: John Wiley & Sons, 2021. | Includes bibliographical references and index.

Identifiers: LCCN 2020049759 (print) | LCCN 2020049760 (ebook) | ISBN 9781119385486 (hardback) | ISBN 9781119386049 (paperback) | ISBN 9781119386001 (pdf) | ISBN 9781119385547 (epub) | ISBN 9781119386018 (ebook)

Subjects: LCSH: Renminbi. | Renminbi—England—London. | Finance—China.

Classification: LCC HG1285 .H33 2021 (print) | LCC HG1285 (ebook) | DDC 332.4/50941—dc23

LC record available at https://lccn.loc.gov/2020049759

LC ebook record available at https://lccn.loc.gov/2020049760

Cover image: © Gabriel Perez /Getty Images

Cover design by Wiley

Set in 10/12 pt Plantin Std by Integra Software Services Pvt. Ltd, Pondicherry, India

The information, practices and views in this book are those of the author and do not necessarily reflect the opinion of the Royal Geographical Society (with IBG).

Contents

Cover

Series page

Title page

Copyright

List of Figures

List of Tables

List of Abbreviations

Series Editors’ Preface

Acknowledgements

Chapter 1: Global Monetary Transformation and Respatialising the Geographies of Finance

Part I: Theorising Changing Monetary and Financial Geographies

Chapter 2: thinking geographically about states, power and politics in the global monetary system

Chapter 3: thinking geographically about the international financial system

Part II: The Geographies of RMB Internationalisation in London

Chapter 4: respatialising research in international financial centres

Chapter 5: london’s financial centre as a territorial fix within rmb internationalisation

Chapter 6: chinese financial labour markets in london’s financial centre

Chapter 7: respatialising financial regulation through offshore rmb market making in london

Chapter 8: RMB Internationalisation in Retrospect and Prospect: For Revitalised Geographies of Money and Finance

Index

End User License Agreement

List of Figures

Chapter 4

Figure 4.1 Monetary form, geographical reach and policy basis of RMB internation...

Chapter 5

Figure 5.1 Renminbi business of UK monetary financial institutions (2015–...

Figure 5.2 RMB foreign exchange daily turnover in London by instrument (2015...

Figure 5.3 Timeline of London’s development as an offshore RMB centre

Chapter 6

Figure 6.1 National insurance registrations of Chinese nationals by London borou...

Figure 6.2 Location of Chinese financial and related professional service firms ...

List of Tables

Chapter 4

Table 4.1 Attributes of leading offshore RMB centres.

Table 4.2 List of interviewees.

Chapter 5

Table 5.1 Factors accounting for the identification of London as the first Weste...

Chapter 6

Table 6.1 Big four Chinese commercial state-owned banks operating in London, by ...

Chapter 7

Table 7.1 RQFII licences issued in London 2013–2014 (RMBbn).

Table 7.2 Allocated and used RQFII quotas by country, March 2020 (US$bn).

Guide

Cover

Series page

Title page

Copyright

Table of Contents

List of Figures

List of Tables

List of Abbreviations

Series Editors’ Preface

Acknowledgements

Begin Reading

Index

End User License Agreement

Pages

i

ii

iii

iv

v

vi

vii

viii

ix

x

xi

xii

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

List of Figures

Figure 4.1 Monetary form, geographical reach and policy basis of RMB internationalisation

Figure 5.1 Renminbi business of UK monetary financial institutions (2015–2020, £m)

Figure 5.2 RMB foreign exchange daily turnover in London by instrument (2015–2020, £m)

Figure 5.3 Timeline of London’s development as an offshore RMB centre

Figure 6.1 National insurance registrations of Chinese nationals by London borough 2002–2016

Figure 6.2 Location of Chinese financial and related professional service firms in London’s financial district

List of Tables

Table 4.1 Attributes of leading offshore RMB centres

Table 4.2 List of interviewees

Table 5.1 Factors accounting for the identification of London as the first western offshore RMB centre

Table 6.1 Big four Chinese commercial state-owned banks operating in London, by Tier 1 capital

Table 7.1 RQFII licences issued in London 2013–2014 (RMBbn)

Table 7.2 Allocated and used RQFII quotas by country (US$bn)

List of Abbreviations

AIIB

Asian Infrastructure Investment Bank

CBRC

Chinese Banking Regulatory Commission

GFCI

Global Financial Centres Index

ICBC

Industrial and Commercial Bank of China

IFCs

International financial centres

IMF

International Monetary Fund

IPE

International political economy

OFCs

Offshore financial centres

PBOC

People’s Bank of China

RMB

An abbreviation of renminbi, the official currency of the People’s Republic of China

RQFII

Renminbi Qualified Foreign Institutional Investor Program

Series Editors’ Preface

The RGS-IBG Book Series only publishes work of the highest international standing. Its emphasis is on distinctive new developments in human and physical geography, although it is also open to contributions from cognate disciplines whose interests overlap with those of geographers. The Series places strong emphasis on theoretically-informed and empirically-strong texts. Reflecting the vibrant and diverse theoretical and empirical agendas that characterize the contemporary discipline, contributions are expected to inform, challenge and stimulate the reader. Overall, the RGS-IBG Book Series seeks to promote scholarly publications that leave an intellectual mark and change the way readers think about particular issues, methods or theories.

For details on how to submit a proposal please visit:

www.rgsbookseries.com

Ruth Craggs, King’s College London, UK

Chih Yuan Woon, National University of Singapore

RGS-IBG Book Series Editors

David Featherstone

University of Glasgow, UK

RGS‐IBG Book Series Editor (2015–2019)

Acknowledgements

The research that underpins this book draws on an extensive period of fieldwork conducted with policymakers and financiers working in London and Beijing dating back to 2015. I would like to thank all the people I interviewed who gave up their time to be interviewed and talked me through the issues they were facing in their everyday work with care and patience. As a result, I learnt more about the intricacies of RMB internationalisation and London’s role within it than I could have ever done through reading secondary sources. Over the course of the research, I shared these insights with Fenghua Pan, and I would like to express thanks for Fenghua for sharing his incredible knowledge of the Chinese banking and financial system with me and hosting me at the early stages of the project at Beijing Normal University.

The research would not have been possible without the financial support of The British Academy through a Mid-Career Fellowship (award number MD 13006) and a period of research leave from the School of Geography at the University of Nottingham that gave me the time to learn about RMB internationalisation and London’s role within it. My colleagues at the University of Nottingham have been extremely supportive in terms of giving me the time to undertake this work and I would particularly like to thank Louise Crewe, Shaun French and Andrew Leyshon who have supported me through the good times and the trickier ones. The arguments presented here have benefited from conference audiences at a number of events where I presented preliminary ideas. I would particularly like to thank those at the Universities of Durham, Manchester, Cambridge and Newcastle as well as colleagues who attended meetings of the Royal Geographical Society with the Institute of British Geographers, the American Association of Geographers, the Global Conference in Economic Geography and the Global Network on Financial Geography. Through these events, I’m lucky to be supported by a wider network of financial and economic geographers that I feel very lucky to be a part of. Comments throughout the project from Karen Lai, Kean Fan Lim, Paul Langley and Adam Leaver have been incredibly helpful in refining the arguments in the book.

I would also like to acknowledge the support and patience of David Featherstone and Jacqueline Scott within the RGS-IBG book series team for their support and above all patience as I tried to complete this text. This has been particularly true as the final revisions to the book coincided with the coronavirus pandemic in the UK. As I tried to juggle completing the revisions with looking after my children the book would not have been possible without the support of my family (especially Mike, who has heard more about RMB internationalisation than he ever wanted to) and friends at home in looking after Raffi, Clemmie and Gus. This is for the three amigos.

Chapter OneGlobal Monetary Transformation and Respatialising the Geographies of Finance

Respatialising Finance positions international financial centres as vital – but often overlooked – analytical lenses through which to understand the changing position of Chinese finance within the international financial system and specifically the internationalisation of its currency, the renminbi (RMB). In so doing, I develop a revitalised reading of financial centres that places questions of the state, politics and power more centrally in both their own internal dynamics and in their role in shaping global finance. Since the 2007–2008 financial crisis, the growing internationalisation of the RMB has been one of the most significant developments within global monetary relations. Indeed, in 2014, Deutsche Bank argued that the internationalisation of the RMB was the most significant development in international monetary affairs since the launch of the euro in 1999 (Deutsche Bank 2014). It refers to the relatively rapid and recent transformation in the geography of the Chinese currency facilitated through Chinese state support in the form of the People’s Bank of China in particular. This geography has been transformed from a situation in the early 2000s in which flows of RMB in and out of mainland China were heavily restricted to one in which, by July 2020, it was the fifth most commonly used currency for payments internationally behind the US dollar, sterling, the euro and the yen (SWIFT 2020). Meanwhile, the growing international status of the RMB was also reflected in the International Monetary Fund including the RMB in its basket of special drawing rights (SDR) from October 2016 together with the US dollar, the euro, the yen and sterling. Kirshner (2014: 220) provides a valuable summary of the early motivations and uncertainties surrounding RMB internationalisation:

“Prior to the global financial crisis RMB internationalization was already a gleam in the eye of elites in China, but it was understood that the yuan was a long way off from serving as an important international currency. The dominant position of the dollar, the emergence of the euro, and the fragility of China’s sheltered, murky domestic financial sector (in contrast with the venerable institutions and market powerhouses to be found in the West) tempered expectations about how quickly the RMB might take its place as a currency widely used in international transactions, let alone held as a reserve asset. Nevertheless, such ambitions, however distant, were clearly harboured, and as China continued its rise to great power status it was natural to assume that a greater international role for a maturing RMB would be part of that process”

Although the future of RMB internationalisation is uncertain and has slowed since 2015, there are a number of indicators which point to marked changes in the position of the currency internationally, and by extension the role of China within the international financial system (Chey and Vic Li 2020). For example, China now holds the largest foreign currency reserves of any country. These are used to support the pegging of the renminbi (RMB) to the US dollar. These stockpiles are also used to support China’s international trade policy. Increases in Chinese holdings of US dollars raises the value of the US dollar compared with the RMB, meaning that Chinese exports become cheaper than their US counterparts. Moreover, its exchange rate policy is closely monitored internationally, often shaping the exchange rate policy of other countries (Helleiner and Kirshner 2014). Meanwhile, significant infrastructure spending arising from the Belt and Road initiative (BRI) that spans central Asia, Central Africa and Eastern Europe involves financing from state-owned banks, sovereign wealth funds such as the China Investment Corporation as well as multilateral investment funds such as the Silk Road Fund. In so doing, the BRI therefore raises important questions about how these rapidly evolving financial institutions sit alongside and potentially reshape international financial relations (on which see Lim 2010, for example).

Respatialising Finance argues that the financial centre provides a valuable but hitherto comparatively neglected entry point into understanding RMB internationalisation. Indeed, in many ways, the lack of sustained engagement with financial centres in relation to RMB internationalisation is surprising because it has developed through a distinctive spatial footprint comprising a network of offshore (beyond mainland China) financial centres. Echoing Hong Kong’s position as an experimental site for the reform and internationalisation of the Chinese economy more generally (Chen and Cheung 2011), Hong Kong became the first such centre in mid-2010 (Walter and Howie 2011). Since then, a small number of other financial centres, including Singapore, Taiwan and London, have developed significant RMB financial markets (Hall 2017). These offshore RMB centres can be defined as a financial centre ‘outside [mainland] China that conducts a wide variety of financial services denominated in RMB’ (ASIFMA 2014: 20) that connects with onshore financial services in mainland China (Subacchi and Huang 2012). These centres host a designated RMB clearing bank, hold sizable, although varying, amounts of RMB deposits and have seen the development of a range of RMB markets. They are supported by a number of offshore financial RMB hubs (such as Paris, Luxembourg and Frankfurt) that access mainland China partly through the offshore RMB centres. Hong Kong remains the largest offshore RMB centre and has been the most widely studied to date (see Fung and Yau 2012).

However, less attention has been paid to how and why financial centres beyond mainland China become enrolled within RMB internationalisation. Respatialising Finance responds to this by examining how and why London became the leading Western financial centre within the wider Chinese economic and political project of RMB internationalisation. My analysis is based on a research project dating back to 2015 that focused on the growth of wholesale Chinese finance in London’s financial district. Echoing my earlier work on financial labour markets (Hall 2009), my initial interest lay in examining the growth of elite Chinese migration into London’s financial district. However, I rapidly realised that, as with earlier rounds of financial labour market transformation in London, the growth of Chinese financiers and related professionals in London signalled a more profound and structural set of changes in terms of the place of Chinese finance in London’s financial district. This was reflected in the popular discourse of the time. For example, in October 2015, the Financial Times ran the headline ‘Chinese financial institutions grow closer to the heart of London’ (Stafford 2015). The article documented London’s rise as the first and leading western offshore centre (beyond mainland China) for financial products and markets denominated in the Chinese currency – the renminbi. The article was accompanied by a picture of the Chinese flag flying in the centre of London’s historic financial district, close to the Bank of England, with the financial offices of Canary Wharf in the background. This suggested to me that marked changes were taking place in relation to the place of Chinese finance globally, and in London in particular.

As such, it quickly became apparent that my research would need to explore a range of different actors, including not only the individuals working in Chinese finance but also institutions, including banks, financial firms and regulators. By combining analysis of official data sources on RMB internationalisation in conjunction with in-depth research with people working in financial markets in London and Beijing, the arguments presented in this book identify the key actors involved in initiating and shaping RMB internationalisation. In particular, these findings reveal how state actors and regulators in both Beijing and London were critical in facilitating and promoting the development of RMB markets in London. For Beijing in particular, in many ways this finding is not surprising given the carefully planned nature of economic development in China that has increasingly been applied to its international economic development aspirations (Lim 2018). However, my analysis shows that intervention from the UK government, particularly through the then Prime Minister David Cameron and Chancellor George Osborne, was also important.

This analysis demonstrates the need for economic geographical research, and work in cognate social sciences, to place questions of the state, politics and power more centrally within work on the geographies of money and finance. Responding to this challenge forms the conceptual contribution of the book. Here, I argue that the meso scale of the international financial centre, bringing together the predominately macro-economic concerns of international political economy research on monetary transformation with the micro scale analysis of cultural economy approaches to financial market making, provides a valuable way of doing this. Before setting out the content of the subsequent chapters, I expand on this conceptual contribution made in Respatialising Finance.

Chinese Finance and the Geographies of Money

Narratives of monetary change and transformation, as well as work on international financial centres such as London, are by no means new within geographical research on money and finance. Respatialising Finance takes this literature as its starting point. Indeed, in many ways, processes of change and transformation have always characterised the development of the international financial system. For example, the collapse of the gold standard in the early 1970s and the associated move to floating exchange rates was a transformative moment in global finance and, as such, acted as a key development around which heterodox social scientists mobilised to create several of the key texts and seminal understandings of the contemporary international financial system (Corbridge et al. 1994; Leyshon and Thrift 1997; Strange 1986). One of the most significant insights to be developed within this work was an approach to the international financial system that emphasised its networked properties from a distinctly geographical perspective. In this work, the international financial system is understood as a series of networks of people, money, expertise, policy and regulation that are choreographed through a small number of international financial centres (Cassis and Wójcik 2018; Sassen 2001). This work is reflected in work in a range of social scientific disciplines adopting networks as a metaphor, theoretical approach and methodology to the study of money and finance including in geography (Pollard and Samers 2007), political economy (Fichtner et al. 2017) and cultural economy approaches to money and finance (MacKenzie 2004).

Influenced by wider thinking on networks drawing on actor network theory as well as assemblage thinking (Callon 1986; DeLanda, 2016), network approaches to global finance emphasise the range of actors, institutions and materialities, and crucially the interdependencies between them, in shaping the international financial system. Most importantly for my focus on international financial centres (IFCs), a considerable body of work has developed that emphasises the role of financial districts within global cities in choreographing international financial networks (Castells 2009; Friedmann 1986; Lavery et al. 2018; Sassen 2001). In order to fulfil this role in shaping a range of different types of global financial networks, these international financial districts contain significant clusters of financial and related advanced producer services firms notably law, accountancy and insurance firms. They also typically include a range of regulatory functions that shape the nature of financial processes and practices (Hall 2018). Given the significance of IFCs to the contemporary international financial system, a range of different literatures have developed that includes examining: the changing nature of their elite labour markets (Beaverstock and Boardwell 2000; Hall 2009; McDowell 1997); detailed accounts of everyday working life within these centres (Thrift 1994); and understandings of their political economic power beyond the realm of financial markets (Augar 2001).

Whilst the power of IFCs within global finance clearly pre-dates the 2007–2008 financial crisis, these centres serve to crystallise and reveal some of the most profound changes taking place within global finance. For example, during the 2000s, a focus on the financial labour markets within IFCs revealed a growing trend for quantitatively skilled financiers capable of working on the securitised financial markets that were central to both the period of finance-led growth in the 2000s and the ensuing financial crisis (Hall 2006; Hall and Appleyard 2009). Building on this work on elite financial labour markets, the initial motivation for the research project that underpins this book came from a growing recognition that the geographical composition of these labour markets was changing quite profoundly. In particular, I was struck by the growth of Chinese nationals working in IFCs, notably in London from the early 2010s onwards. This became the subject of several national newspaper headlines as headhunters struggled to recruit the number of mandarin speaking financiers demanded in London’s financial district and Chinese state-owned banks began operating in the heart of London’s international financial district (see, for example, Stafford 2015). Previous work has clearly demonstrated how other waves of internationalisation have shaped London as an IFC and by extension the international financial system, most notably the rise of investment banking business models led by US and later European banks at the expense of British merchant banking (Kynaston 2002). However, in the mid-2010s, very little had been written about the rise of Chinese financial institutions in London.

In Respatialising Finance, I explore how work on the changing nature of international finance as read through IFCs can be used to understand how and why London’s financial centre became the partner of choice for both Chinese state policy regarding RMB internationalisation and Chinese financial institutions who sought to benefit from it. In so doing, I use the case of RMB internationalisation in London to develop a sympathetic critique of existing work in economic geography and more widely within the social sciences on international financial centres. This work has done much to explain how and why a small number of financial districts play a vital role in shaping global monetary and financial relations. However, processes of RMB internationalisation reveal that more attention needs to be paid to the political as well as the economic relations that underpin international financial centres. As the analysis in the rest of this book shows, it is very hard to understand RMB internationalisation without studying the role of the Chinese state and the People’s Bank of China in particular in initiating the process, and through regulatory decisions, continuing to shape the parameters of its size and scope. As such, whilst private sector advanced producer services firms are involved in the process, actors which are heavily studied within extant work on IFCs, the case of RMB internationalisation suggests that a broader range of actors – including policymakers and regulators as well as the political contexts in which financial markets are made – need to be given more attention than has typically been the case hitherto.

The case of RMB internationalisation also indicates how work on the spatial imaginaries of IFCs themselves can also be helpfully developed. In much of the work on IFCs to date, they are assumed, albeit implicitly, to be facilitators of global financial flows through the networks of advanced producer service (APS) firms that cluster within them. However, if we attend to the politics of these networks, by extension the analysis in Respatialising Finance calls for a more active understanding of IFCs beyond that of more passive containers. This approach draws attention to the ways in which IFCs themselves are changed by as well as changing global finance.

Politics, Power and Respatialising Understandings of International Financial Centres

In order to develop understandings of IFCs within RMB internationalisation, I locate my analysis within work on international political economy that has been centrally concerned with RMB internationalisation. Indeed, whilst the geographical literature had paid relatively little attention to the process of RMB internationalisation and Chinese financial market reform more widely, there is a growing literature led by international political economy (IPE) scholars (Eichengreen 2012; Prasad 2017). This literature draws on wider debates in international political economy that are broadly concerned with the intersection between money and state power (and interestingly, whilst recent geographical scholarship on international finance has typically focused on finance, IPE work has tended to focus on money). This work explores how currency competition contributes to the changing distribution of power internationally (Cohen 1998).

Although the title of Benjamin Cohen’s book is The Geography of Money, it is striking that this focus on the international political, economic and social relations of money have not been widely studied within recent work economic geography. This comes despite the fact that earlier work on the geographies of money and finance draws heavily on insights from international political economy in the study of some of the key transformations in global finance such as the implications of the collapse of Bretton Woods and the associated ending of the gold standard for the international financial system (Leyshon and Thrift 1997; Leyshon and Tickell 1994; Strange 1986). Whilst economic geography research on money and finance turned its attention increasingly to financial centres and financialisation, for scholars working in an IPE tradition, a key concern remained as to how increased cross-border monetary flows prompted changes in state power within the international financial system (Cerny 2010; Cohen 2017). More recent work has explored how such power constraints are particularly acute for developing countries because of their relative inability to borrow from global financial markets (Alami 2018). However, whilst it is in IPE that the fullest engagement by social sciences with RMB internationalisation can be found, the research presented in this book points to two limitations of this literature.

First, IPE work on global monetary relations has, over the past 20 years, become increasingly focused on national monetary and financial policy concerns with less attention being paid to the processes and politics of change at the macro, international level (Cohen 2017). Whilst this provides an important analytical framework with which to understand the domestic policy context within China, which has given rise to the process of RMB internationalisation, it provides far fewer insights into how this domestic policy agenda has been rendered mobile and expanded internationally, the drivers for this outside of China and the economic and political relations between states and financial markets that have subsequently given substantive form to the process of RMB internationalisation.

Second, and following on, IPE work on money and finance, including that on RMB internationalisation, remains largely focused at the national scale and has placed particular emphasis on the potential endpoints of RMB internationalisation as found in debates concerning the ability of the RMB to challenge the US dollar as the global reserve currency. In some ways this echoes the limited geographical imaginations that have, until recently, dominated work on financialisation, which again have focused on particular scales of analysis (particularly the firm and the nation state) with much less attention being paid to other sites such as the household or the region (French et al. 2011). These foci did not provide me with the theoretical and methodological tools to examine how practices at the subnational level, namely within international financial centres such as London, become enrolled within and shape the process of RMB internationalisation. Questions therefore remained about why London’s financial sector and its policymakers and regulators were committed to becoming part of the RMB internationalisation process? What was the process that led to the mobility of RMB financial policy into London? And what can these changes tell us both about the changing nature of global finance as China seeks to become more fully involved (albeit on its own terms) and the implications of this for established international financial centres such as London.

These questions are shared with other scholars who raise concerns about whether this literature is too focused on the economic dimensions of RMB internationalisation, thereby neglecting its multifaceted and particularly its political dimensions. As Helleiner and Kirshner (2014: 2) argue:

“To date, the study of China’s increasingly important role in the international monetary system was focused primarily on economic questions and technical issues, with much less detailed attention given to the politics of China’s international monetary relations”

In response, Respatialising Finance takes the changing international political economy of global financial networks as its starting point but argues that the financial district, or what are often known as international financial centres, provide an analytically and empirically valuable concrete entry point into understanding how global finance is as much a political as it is an economic relation (see also Hall 2017). In so doing, a focus on IFCs provides a valuable corrective to nation-state centrism that dominates other disciplinary work on finance, particularly that in IPE. As a result, a key contribution of this book is to rethink the conceptual and analytical purchase afforded to us by IFCs as well as the empirical challenge of placing and understanding London’s role within RMB internationalisation in particular. In terms of work on IFCs from an IPE perspective, work has been increasingly attentive to the reciprocal interaction between domestic institutions and transnational processes (Farrell and Newman 2014) but it continues to offer very limited engagement with questions of spatiality, frequently overlooking the importance of the urban scale when thinking about global transformation.

The financial district and the financial centre are one of the central leitmotifs of geographical work on money and finance. However, and certainly more recently, this literature is characterised by an emphasis on the economic, social and cultural dimensions of money and finance. For example, as Cassis (2010) notes, the majority of work has centred on the identification of external economies of scale available to firms and financial institutions beyond their firm boundaries through being co-located with each other including: highly liquid financial markets; the development of ‘buzz’ (Storper and Venables 2004) between financiers within financial clusters that facilitated processes of innovation in the production of financial products; and the deep and dense highly skilled labour markets within financial districts (Beaverstock and Hall 2012). As a result, less has been written at the scale of the financial district or centre on the politics and power relations that shape their activities.

However, whilst questions of power and political relations have not been studied widely through work that explicitly focuses on IFCs, the same is not true of wider interdisciplinary work on contemporary changes in the international financial system, including within geography (see for example Agnew 2012). For example, there is growing interest from scholars working in a heterodox economics tradition in the ways in which currencies are tied into the international financial system in asymmetric ways such that the power of some currencies is structurally limited because of their inter-state relations with other currencies (Kaltenbrunner 2015; Kaltenbrunner and Painceira 2018).

Beyond this work, there is also a growing interest amongst economic geographers in state capitalism (Alami and Dixon 2019; Lim 2018). As Alami and Dixon (2019) make clear, whilst this work has done much to remind us of the connections between capitalism firms and the state, including in relation to the increasingly international orientation of China, it has been criticized for being eclectic and wide ranging in its focus, and as a result can lack analytical precision. In Respatialising Finance, I use work on state capitalism to remind us that state capitalist arrangements are always temporary and hence, in many ways, the analysis of London as an IFC reflects the times at which the research was undertaken – in some ways the high point in Sino-UK relations in the mid-2010s as the state capitalist relations between the UK and China have become more strained and politicized since the research in this book was completed. I also suggest that the IFC represents an important space in which state capitalism can be located and a space in which many of its logics as they relate to financial policy and practice are enacted.

Theorising Global Finance from Financial Centres

In Respatialising Finance, I build on these interventions by demonstrating the value of the site of the IFC as an analytical entry point into the economic, social and political dimensions of global finance. I do this by arguing that IFCs offer a way of developing understandings of global finance from the meso scale of the IFC that offers a sympathetic critique of the macro-scale focus of IPE. By focusing on how RMB markets were made in practice in London, I argue that using IFCs as analytical entry points into global finance provides a valuable way of examining how challenges to existing power and authority within the international financial system are developed, what the implications are of this for different types of actors within global finance, and the implications of this for continuity and change within the financial system.

I do this by drawing on work on the cultural economy of market making (in order to understand the ‘work’ and practices within IFCs that go on to make up the international financial system) and the recent renewed interest on territoriality within economic geography (in order to understand how IFCs as places become enrolled in and are changed by global finance). Taking the interdisciplinary literature on the cultural economy of market making within financial centres first, the advantage of drawing on this work is that it emphasises the everyday practices through which financial markets are made at the micro scale (for summaries see MacKenzie 2003a, 2003b, 2005; Muniesa 2007). In so doing, the uncertainties and fragilities of making new RMB markets are revealed in ways that are not clear within the IPE approach. However, by drawing on this work, it becomes clear that the space of the financial district is not an inert backdrop through which financial markets globally are controlled. Rather, the space of the financial district is being remade through the process of making new forms of financial markets (in this case those associated with offshore RMB finance).

In order to conceptualise this, I argue more attention can fruitfully be paid to the territoriality of financial centres. Drawing on the increasing interest in territory in economic geography and beyond (see Christophers 2014; Elden 2005, 2010; Sassen 2008), I demonstrate how the territorial construction of London’s financial district, understood as the (re)production of the space of London’s financial district through state intervention in setting the institutional and regulatory parameters of legitimate financial activity is vitally important in both respatialising our understandings of financial centres but also in understanding and explaining empirically the development of offshore RMB markets in London.

This work understands territory as a way of making and managing space through legal and other regulatory frameworks (Elden 2005, 2010). In terms of work on the geographies of finance, this approach has been developed through the long-standing interest in offshore finance that emphasizes the ways in which offshore space is constructed through the variation of state sovereignty across space (Palan 2006; Roberts 1995). Meanwhile, Pike and Pollard (2010: 38) argue that the vast literature on financialisation needs to remain attentive to the ‘tensions between territorial and relational conceptions of space and place’. Christophers (2014: 755) has taken this analysis a stage further by examining how:

“Modern capitalism is constantly in the process of enacting territorial fixes: constituting, segmenting, differentiating and extracting value from actively territorialized markets at a range of geographical scales”

This provides a valuable extension of Harvey’s (1982) understanding of spatial fixes by demonstrating how capitalism seeks to overcome its crisis-prone tendencies not only through spatial expansion but also through the remaking of space through regulatory and other political interventions.

By integrating work in IPE on monetary transformation with cultural economy literatures on market making and the growing interest in territory as found in the state rescaling literature, the central conceptual contribution made in Respatialising Finance is its insistence that financial centres need to be seen as territorial fixes. The remaking of their regulatory, political, economic and epistemic space aims to (re)produce their institutional arrangements of rules, informal customs