8,22 €

Mehr erfahren.

2022 New Release in Wealth Management, Retirement Planning, Estates & Trusts, Personal Taxation, Money Management

CREATE A MEANINGFUL LEGACY WITHOUT SACRIFICING YOUR LIFESTYLE IN RETIREMENT!

Shouldn’t we expect more from our life’s work and savings than just a secure retirement?

Is traditional retirement planning failing families with short-sighted financial advice? Is this tunnel vision actually leaving your retirement and your family at risk? Avoid the retirement planning trap with this estate & financial planning strategy guide.

The Retirement Planning Trap: A retirement plan should consist of a mix of investments or financial products selected to merely not outlive your money.(FALSE!)

The Financial Planning Escape: A holistic approach to wealth management is a path towards protection from taxes, long-term healthcare costs, inflation, market fluctuations, and probate. Beyond income distribution, a holistic plan should provide for a surviving spouse, include wealth transfer strategies, and much more.(YES!)

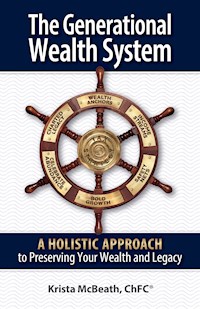

Highly acclaimed Financial Planner Krista McBeath has developed a clear and systematic approach towards generational wealth. Based upon a nautical ship’s wheel, The Generational Wealth Wheel illustrates the steps towards accumulating, protecting, and transferring wealth. Together with the central hub, each of the six spokes of the captain’s wheel represents critical steps for financial stability leading to generational wealth.

Wealth Anchors: These basic financial principles are the foundation for creating and preserving wealth from generation to generation.

Income Streams: A sustainable cash flow plan is essential towards maintaining a lifestyle and providing for family.

Safety Nets: Protect your retirement and legacy by learning how to identify and neutralize lurking threats to assets.

Bold Growth: Learn the keys successful investors use to invest for growth without fear.

Celebrate Abundance: How to enjoy the life you deserve while benefiting from ‘Giving while Living.’

Charted Legacy: Award-winning estate planning attorney shares the basics for sealing wishes and legally transferring assets.

Tax Strategy: A tax strategy incorporating the three major tax stages is the ‘hub’ for a systematic wealth management plan.

Krista McBeath developed this simple, systematic approach to financial stewardship out of love for her own family. With a passion for helping others, she shares the keys for living a life of abundance while protecting what’s most important to us.

“As I reflect on the journey to bringing this book public, I hope people see the passion behind it, especially with my personal stories. I know most wouldn’t read a book on money, but you’ll quickly find, at the heart of this book is love for family.”

The Generational Wealth System is not just about the size of the bank account and what to do with it. At the core, it’s for those concerned about the well-being of their spouse, children, and future generations. It’s for those who want to have a plan in place for a time when they may not be here to guide and care for their loved ones physically.

This book is for the legacy makers. It is for those who have family or causes dear to their heart and wish to make a difference.

Don’t place your estate in jeopardy by waiting. It’s time to start planning—after all, 2020 and 2021 have taught us that anything can happen. For the sake of what’s most precious to you, stabilize your retirement while securing your legacy. Get this book for your family, today!

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Seitenzahl: 227

Veröffentlichungsjahr: 2022

Ähnliche

Advisory services are offered through Landmark Wealth Management Inc, dba McBeath Financial Group, an Illinois Registered Investment Advisor firm. Insurance products and services are offered through McBeath Tax and Financial Services, LLC. McBeath Financial Group and McBeath Tax and Financial Services, LLC. are affiliated. The firm only conducts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

All expressions of opinion are subject to change. You should consult with a professional advisor before implementing any of the strategies discussed. Content should not be viewed as an offer to buy or sell any securities or products mentioned. Tax information provided is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. Tax laws, as well as Social Security rules and regulations, are subject to change at any time.

Different types of investments and products involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that a portfolio will match or exceed any particular benchmark. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

Projections are based on assumptions that may not come to pass. They do not reflect the impact that advisory fees and other investment-related expenses will have on the value of an investor’s portfolio.

McBeath Financial Group did not make any solicitation payments to the Pantagraph in order to be nominated or to qualify for nomination of the award of Pantagraph Reader’s Choice, Best Financial Planning Office, Best Investment Firm or Best Financial Planner-Krista McBeath.

Winners in each category were chosen by Pantagraph.com readers who were given the opportunity to nominate and then vote for businesses or individuals in each class. McBeath Financial Group did not make any solicitation payments to the Pantagraph in order to be nominated or to qualify for nomination of the award. The official rules were posted onsite by the Pantagraph.

Third-party rankings and recognition from rating services and publications do not guarantee future investment success. Working with a highly-rated advisor does not ensure that a client or prospective client will experience a higher level of performance. These ratings should not be viewed as an endorsement of the advisor by any client and do not represent any specific client’s evaluation. Please contact the advisor for more information regarding how these rankings and ratings were formulated.

Copyright 2021 by Krista McBeath, ChFC®

ISBN: 978-0-578-25689-4

All rights reserved. No part of this book may be reproduced, stored in retrieval system, or transmitted by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the author.

Printed in the United States of America. Design and layout by Zine (zinegraphics.com).

McBeath Financial Group203 Landmark Drive, Unit ANormal, IL 61761

(309) 808-2224www.McBeathFinancial.com

Acknowledgments

This book has been a dream of mine for years. However, I could not have done this without the tremendous support and assistance of my husband, Robert. Robert assists in many areas of our practice, but he does most of his work behind the scenes. With his help, the foundation and principles that I apply within my financial planning practice were translated into book form, creating The Generational Wealth System.

Our inspiration, as you will learn, came from my late father. I undoubtedly inherited my problem-solving skills, love of math, and desire to fix everything from my dad. My mom has greatly shaped my life as well. She has been an excellent role model, leading by example. I learned a lot about business, work ethic, and customer service by watching her and working with her at a young age. Having two self-employed parents helped contribute to my success as an entrepreneur.

I’d be remiss not to thank many fantastic employees. During the most significant expansion years of my business, my dear friend and employee Carol Ambler has been at my side. And over the last year and a half, Lauren Dennewitz has joined us and helped me undertake one of the most extensive changes I’ve ever made to my firm. I could not do what I do without these two women.

The principles I will discuss in this book are not unique to my firm. I have studied, pursued designations and licenses, and taken more professional exams than I care to count. I also had many mentors over the years who helped guide me, encourage me, and push me to expand my knowledge and areas of practice management.

After leaving my captive insurance agent position in 2007, I opened my own firm and partnered with an insurance marketing organization (IMO) called USA Tax and Insurance, Inc. This firm, led by Stephen Hand, was instrumental in my early years of success. Through their staff, training programs, and a network of peers nationwide, I honed my skills and education in the wealth preservation area. Through this relationship, I was also able to work with Brokers International, one of the oldest and most influential life insurance, annuity, and wealth planning organizations. In addition, one of my peers, Michael Terrio, became a mentor and friend in a much larger capacity when he later formed Motiv8 Advisors.

My story, and the ideas in this book, are a culmination of years of professional study, financial planning experience, professional relationships, and mentors. I am grateful to each of them.

I hope you enjoy this book and that it opens your eyes to new ideas.

A Special Bonus for Readers, from the Author!

Krista McBeath has recorded a video overview presentation of this book’s contents!

Access this free workshop presentation at www.McBeathFinancial.com/genwealth-seminar

Table of Contents

Introduction

Retirement Planning is Broken

The Generational Wealth Wheel

Wealth Anchors

Income Streams

Safety Nets

Bold Growth

Celebrate Abundance

Charted Legacy by Chad A. Ritchie, Esq.

Tax Strategy

Your Wealth Advisory Crew

Charitable Support

About the Authors

Introduction

I hate to admit it, but I was a financial advisor for years before I finally realized the driving purpose behind my career choice. I should have seen it all along. I don’t think my focus was completely without merit, considering my circumstances, so give me some grace as I explain my path to realizing the full significance and purpose behind my life’s endeavor.

I knew I had a calling to the financial services industry to help families. It was a result of seeing the hardship faced by my parents when my dad had health issues. I didn’t want other families to face the same thing. So, I made a choice during college to pursue a career in insurance.

When I first began my own company, I focused on financial services such as life insurance, annuities, and tax preparation. I felt it was important to protect people from financial difficulties, and I put my insurance degree to good use.

I also knew that helping people manage and grow their investments could give them greater freedom of choice and help protect their families. So, shortly after, I became an Investment Advisory Representative.

Then it evolved into helping my clients from outliving their retirement funds and giving them a sense of security. I could now help my clients with comprehensive financial planning.

Along the way, I found I had a soft spot for helping widows when they needed financial guidance the most. Then, when it happened to my own mom, I realized first-hand the importance of having someone there when you lose a spouse.

But it wasn’t until I became a mother that I understood the full magnitude of financial planning for families. My scope of concern had once consisted of merely being adequately insured and allocated appropriately for goals and time horizon. Suddenly, my perspective shifted, and I had a nagging feeling that insurance products and investment portfolios alone inadequately served my clients’ needs!

My wake-up moment occurred the first trip my husband and I took without our baby. Jillian was about six months old, and as we prepared to fly out to Las Vegas for an industry conference, I became stricken by panic. What if we didn’t make it back?

Yes, we were financially comfortable; we each had life insurance and a will. The basics were covered, but if something should happen, how would we really know our daughter was taken care of?

And as my mind raced, I reached an epiphany regarding my higher purpose. It’s about our children. It always has been; I just didn’t realize it.

From that moment, I knew I had to do better for her. I not only wanted to provide a secure life while we were here with her, but I also wanted to help prepare for a time – hopefully far in the future – when we wouldn’t be here. As I pondered this, I knew that it went even beyond financial and legal preparations. We needed a financial strategy and mentoring for that part of her life. We knew that a well-fleshed-out contingency plan was vital while she was young, but I felt it was also important to protect her from financial hardships later in life. If I could find a way to help her avoid the financial trials I had faced, why wouldn’t I?

Now, I know some would say facing financial challenges is important so that kids understand the value of money and don’t become spoiled brats. We must educate our children about money to help them not make mistakes when they are older, regardless of how many zeroes are in the bank account. What better lessons can we teach than stewardship and strong values for mastering money for ourselves, our family, and for the causes we believe in?

Others might say that by struggling financially, there’s a growth process that builds character. I can show plenty of examples of poor people that never experience such maturity. Likewise, there are endless examples of self-made millionaires with little integrity.

Finally, you may have your doubts, because it’s common for each new generation to want to provide for themselves and make their own way in the world. But why? Does it really make sense that every generation must start over from square one? Doesn’t that say more about the choices the parents and grandparents have made than it being a correct path? Why shouldn’t each new generation build on the predecessor’s successes?

I had gone about the growth in my business completely backward! And then I realized that’s how our industry is set up and how most people approach their finances!

Through my own journey, I discovered how backward – and broken – the established financial services industry is.

I knew that I had to provide better for my family first, then my clients and their families. Through writing this book, I hope that I can reach even more people who wish to provide a better foundation for future generations.

CHAPTER ONE

Retirement Planning is Broken

As an industry insider, I’ve come to the conclusion that many retirees have been systematically failed by the fundamental premise of ‘retirement planning.’

Hearing me say that may come as a shock, considering that for years I’ve been regarded as one of the most prominent financial advisors in my area. Locally I’m known as an instructor at a community college, and I frequently host workshops at the public library. As an author of monthly magazine articles and blog articles, I’ve been recognized as an authority in financial matters even beyond the local area. My company, McBeath Financial Group, has consistently been voted as the best Financial Planning Firm AND Investment Firm by our local newspaper’s readers. Although I still consider myself a young woman, I’ve got years of formal education and experience in the industry along with some letters behind my name, and I belong to all the right organizations. And yet, the more time I spend helping people prepare for retirement, the more I realize that our industry is often falling short in providing the real help many retirees need.

Before I continue, I want to be very clear. I am not painting individual financial advisors or firms as having bad intentions or even without merit in providing financial services. Whether we are talking about insurance salespeople, brokers, or investment advisors, I am overall proud of the industry of financial professionals I belong to. While there may be a few bad apples in our profession, just like any business, I know from my interactions that the majority are great people who have the best intentions for their clients.

Yet, I have an issue with the overall preconceived notions about how to approach retirement planning and the common belief about what kind of outcome should be expected. The primary (and often only) goal I’m referring to is, “Don’t outlive your savings.”

Worse, the prevalent answer to this pre-established goal is to administer a remedy that is based upon a financial product. And this is where you’ll find a division in the recommended product solution. Insurance salespeople are usually going to recommend “safe money” options like a guaranteed income solution with an annuity. Brokers will often offer mutual funds or a portfolio using asset allocation that is appropriate for their client’s time horizon. Either will often refer to this simple income distribution plan as a retirement plan. It may be comprised of an OK insurance (annuity) product. It may even be a sound investment plan, but it falls far from a comprehensive financial plan. It’s no wonder some retirees are misguided, as often these simplistic financial transactions are presented as a “financial plan.” Often, these “plans” resemble a sales proposal. How can it be considered an actual plan when it does not address an individual’s unique situation or the numerous variables that may impact future finances? Furthermore, as far as plans go, why would a plan be merely to sustain retirement?

Is this really the bar we’re setting as an industry? Aren’t we called to do more than just sell a product that, in the best-case scenario, ensures a couple doesn’t outlive their savings? Shouldn’t we set higher goals for the life’s work and savings of our clients? Of course we should make sure people don’t outlive their savings! But let’s look beyond that! By focusing on a “secure retirement,” we are missing so much more. I’m talking about opportunities for legacy planning as well as recognizing financial threats outside of standard’ income distribution planning’. It seems that all too often, families and the advisors they pay to help them are playing to not lose instead of planning to win for their clients and their families. And this approach has led to a repeating cycle.

THE REPEATING CYCLE

You might have heard the saying, “They made their money the old-fashioned way; they inherited it.” But did you know that began as a humorous take from an 80’s television commercial? Interestingly, it was an investment firm that had an actor end each plug with the statement, “They make their money the old-fashioned way; they earn it.”

I grew up like most do, believing that the wealthy were an elite crowd lucky enough to be born that way. I never questioned how the family was well off in the first place or why their families would continue to be prosperous for generations. But I did understand all too well the path that most of us would take; starting with nothing and earning our own way in the world.

We make all the responsible moves, just like we’re supposed to. We work hard in school so that we can get into a good college. We study in college and choose a career. We pour our heart and soul into a job for decades. Along the way, we sacrifice our time and save whatever we can. We endure life’s ups and downs, personally and on the job. We continue to trudge along no matter what challenges we face. Along the way, we pay our taxes, try to help our kids with college, live within our means, build our 401Ks, and generally speaking, do everything right. And when the grind is finally finished, our reward is a retirement that we’ve funded.

To ensure we have enough to live out our years, we seek professional advice. A man in a suit and tie tells us we’ve done well for ourselves, and he’ll ensure we don’t run out of money before we die. Sure enough, most of us that have saved and invested wisely will accomplish just that. We probably have some good years before we end up in an assisted living facility.

And during this final phase of life, everything we’ve worked so hard for is reduced to a smidgen. After inflation, taxes, and healthcare costs, there is little if anything left for our loved ones. That’s okay, we say, because our kids started from square one, just like us, and are doing fine. They’ll be able to fund their own retirement. Meanwhile, your grandkids are starting from square one, hoping to build the same life we had—the cycle repeats.

THE NOBLE CAUSE

I feel there is something noble and respectable for those that commit themselves to an education, a career, saving, and elevating their financial status. Most of my clients have built their wealth this way, and I’ve seen the results of their accomplishments. Many of them have made great sacrifices to provide a better way of life for their families. They have a great love for their spouses, children, and great causes they believe in. And yet, financial advisors settle for a comfortable retirement plan as the goal for the wealth they’ve accumulated.

Now, I’ve worked with people across all levels of economic means. I fully understand the value of assisting those with modest resources to make the best and enjoy as comfortable of a retirement as possible. It’s true, sometimes a lack of savings doesn’t allow or even justify much more than providing a little income to supplement social security.

But, multigenerational wealth planning isn’t just for the super-wealthy! There’s a misconception that financial planning beyond retirement is reserved for the uberwealthy. The reality is that I work with everyday people to help them make the most of the assets they have. They aren’t living in 10,000 square foot Hollywood mansions, driving Rolls Royces, or donating wings to colleges.

Their children and grandchildren probably won’t be what you’d consider “trust fund babies.” Yet, they do plan to protect their family from financial threats and wish to build a legacy. This often means they have plans to help future generations build on the foundation they’ve established.

So, why don’t most people insist upon financial goals beyond retirement? I believe it comes down to two main reasons; they don’t believe it’s possible for them, or they don’t know how.

Actually, This Book Probably Is For You

Chances are, if you’ve picked up this book and read this far, your instincts are correct, and there’s at least some guidance that can help you. Congratulations on taking a proactive approach to your finances and your family’s wellbeing. I think this book will help clarify.

But some may have doubts and wonder if their assets are sufficient for the wealth management approach I’ll be sharing. That’s a valid concern. I understand not all retirees have a nest egg that justifies complex estate planning. I wish I could say there was a well-defined figure to distinguish who should pursue a financial legacy plan. But the reality is, it’s very arbitrary. Starting on the low end of accumulated assets, I’ve had a few clients with under 6 figure savings that I’ve assisted with this process, primarily to protect the spouse. While it didn’t require every aspect of the system, their particular situation’s extenuating circumstances made it a good idea.

On the other end of the spectrum, those with a net worth over seven figures usually benefit from comprehensive financial planning, regardless of how close they are to retirement. Beyond just an investment plan, more assets require more extensive long-term tax planning. And of course, the reason behind this book, preserving wealth for the family should be a primary concern. I believe they will find great benefit from other financial management principles explained in this book, as well.

Outside of extenuating circumstance and a networth of over $1 Million, I often hesitate to do comprehensive planning for those who are years from retirement. While I may help with an investment plan, a complex financial plan likely isn’t necessary at this point. However, such individuals will benefit from many of the lessons in this book. It will help them lay a foundation for a time when a professional advisor is necessary.

Personally, whom I choose to work with depends on many factors, aside from the size of their investment accounts.

With that said, I wrote this book for a specific target audience that I serve. Generally speaking, those with a total net worth (not just investable assets) that begin around $600,000 will find the most benefit in my lessons. Those who find themselves with a current estate value exceeding $2 million dollars will find particular value in my chapters addressing tax planning and estate transfer strategies and the information provided by Estate Planning Attorney Chad Ritchie. When applying the estate planning principles of this book, it’s important to be cognizant that any current assets in the seven-figure range have the potential to face estate taxes. With years of portfolio growth, life insurance proceeds, real estate, on top of changing tax laws, more people than ever will need to plan for strategic wealth transfer.

But, it’s not just about the size of the bank account; this is really for those concerned about the well-being of their spouse, children, and future generations. It’s for those who want to have a plan in place for a time when they may not be here to guide and care for their loved ones physically. It’s also for those who have causes that are dear to their heart and wish to make a difference. They are the legacy makers.

This book is for those who may already feel confident they have enough to preserve their lifestyle in retirement, even if they don’t exactly know the best way to do so. They also have enough financial savvy to understand there are potential threats to their assets. There may be a calling to protect what they have earned, not just to preserve their own quality of life but also to better provide for those they may leave behind.

Often, they have questions regarding protection from taxes, long-term healthcare costs, inflation, market fluctuations, probate, surviving spouse’s income sustainability, wealth transfer strategies, and more! They need a systematic approach to tie it all together for peace of mind.

I’ve found that it’s when people are in the beginning stages of retirement or pre-retirement that they begin to concern themselves with long-range preparations. Therefore, the majority of the action steps will address those in the demographic of 55 and above. And yes, this includes people that have been successfully retired for years, as well.

But it’s never too early to begin laying a foundation. I’m always impressed by those in their 30 and 40s who are anxious to pursue the financial planning process. I believe the content I provide in this book will be even more valuable to this age group than if I made my comprehensive financial planning service available to them.

This Isn’t For Everyone

On the other hand, this book isn’t for everyone. Save yourself the time if you are convinced that just getting through retirement is the end goal. There are plenty of retirement planners all too happy to help meet that end. Or just as well, find a product on the internet that can offer a set income plan. Just one word of warning, an income solution based solely upon a product may be a risky venture.

Other than that, if you have no plans to have a family or causes you believe in, there’s little reason to go through a process with the goal to leave a legacy.

Finally, for those with a net worth that exceeds ten million dollars in assets, I would suspect that you already understand the principles I’ve outlined in this book. My intention is to provide my readers the same level of financial education that the ultra-wealthy already apply to their finances.

I believe it’s time that more of us applied a systematic approach to starting a new cycle of sustainable wealth for their families. The seven principles outlined in this book will help provide action steps towards generational wealth planning.

CHAPTER TWO

The Generational Wealth Wheel

Don’t we all wish we could go back in time and coach ourselves? When I began in the financial services industry so many years ago, there was so much I didn’t know. With my insurance background, it made sense to help people protect their retirement income with insurance products. To offer these insurance services as an independent agent, you must join a Field Marketing Organization (FMO).

FMO’s serve agents nationwide in marketing, selling, and distributing insurance products. I learned early on that much of the training was about how to host paid dinner seminars. The point of offering a free steak was to convince people they needed to make an appointment to come and buy an annuity or a life insurance policy. They gave all the agents the same PowerPoint presentation, which had been used for years. In fact, you’ve probably noticed, it continues today. Granted, the emergence of coronavirus has mandated an adjustment; instead of postcard mailers for a “Free Steak Dinner Seminar,” you’ll see Facebook ads promoting webinars.

THE RULES OF MONEY HAVE CHANGED

I’ve moved on, and my financial services practice has transformed. But looking back, I still remember the canned presentation topic, “The rules of money have changed.” I would say that still rings true—more than ever. Not to rehash old news, but as a nation, the way we pay for our retirement has experienced an enormous shift. While previous generations had a defined benefit plan, aka pension, it’s become almost universal that the risk of retirement now falls upon the back’s of the employees.

Generations past would spend their entire career with one company. And that loyalty was rewarded with a nice pension that the employee could count on until the day they died. Somewhere along the way, major corporations decided they could control costs by shifting the responsibility of retirement to the employee. 401K plans gradually replaced pensions.

The changing times may be a cloud, but there’s definitely a silver lining. While the masses could no longer count on their company benefits for their retirement, a whole new opportunity was created! People actually owned their retirement funds!