8,99 €

Mehr erfahren.

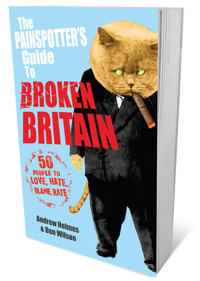

- Herausgeber: John Wiley & Sons

- Kategorie: Lebensstil

- Sprache: Englisch

Welcome to Broken Britain! MPs are blaming 'The System' for their thieving behaviour. Bankers have burnt through more cash than President Mugabe and still been bailed out. Britain is Broke. Only one thing's going to sort this mess out - some good old-fashioned finger pointing. It's time to take revenge... Painspotting style. Let the Painspotting commence! This book is more effective than Prozac and cheaper than therapy. You may be angry, you may be mad, you may even be institutionalised, but put the baseball bat away, hang up your lynching rope, and let the Painspotting commence! 50 of the best Love them, hate them, blame them, rate them: The Painspotter's Guide to Broken Britain introduces the 50 most frightful characters you'll meet in a financial crisis, so prepare to laugh out loud at the Frightened Fat Cat, the Miserable Middle Class, the Self-help Saddo and many more.

Sie lesen das E-Book in den Legimi-Apps auf:

Seitenzahl: 376

Veröffentlichungsjahr: 2012

Ähnliche

Table of Contents

Cover

Title page

Copyright page

Dedication

The end of boom and bust

Acknowledgements

Let the bad times roll

Recession 101

What goes up must come down

It’s not my fault, honest

Pay up and look big

Don’t despair … the perfect antidote is here

The About to Retire, Retiree

SYMPATHY RATING – 10

RARITY – 5

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ABOUT TO RETIRE, RETIREE:

The Bailout Beggar

SYMPATHY RATING – 6

RARITY – 9

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE BAILOUT BEGGAR:

The Buy-to-Let Basket Case

SYMPATHY RATING – 2

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE BUY-TO-LET BASKET CASE:

The Cash Finder

SYMPATHY RATING – 8

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE CASH FINDER:

The Celebrity Money Saver

SYMPATHY RATING – 4

RARITY – 4

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE CELEBRITY MONEY SAVER:

The Cohabiting Divorcee

SYMPATHY RATING – 9

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE COHABITING DIVORCEE:

The Conspicuous Consumer

SYMPATHY RATING – 1

RARITY – 1

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE CONSPICUOUS CONSUMER:

The Credit Crunch Crook

SYMPATHY RATING – 0

RARITY – 4

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE CREDIT CRUNCH CROOK:

The Credit Crunch Scrounger

SYMPATHY RATING – 5

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE CREDIT CRUNCH SCROUNGER:

The Deadbeat Debtor

SYMPATHY RATING – 2

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE DEADBEAT DEBTOR:

The Desperate Estate Agent

SYMPATHY RATING – 1

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE DESPERATE ESTATE AGENT:

The Disposed of Worker (previously known as Our Most Important Asset)

SYMPATHY RATING – 9

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE DISPOSED OF WORKER (PREVIOUSLY KNOWN AS OUR MOST IMPORTANT ASSET):

The Downwardly Mobile

SYMPATHY RATING – 9

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE DOWNWARDLY MOBILE:

The Dubai Deserter

SYMPATHY RATING – 2

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE DUBAI DESERTER:

The Economic Rioter

SYMPATHY RATING – 8

RARITY – 2

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ECONOMIC RIOTER:

The Economically Stressed

SYMPATHY RATING – 10

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ECONOMICALLY STRESSED:

The Elusive Tax Evader

SYMPATHY RATING – 0

RARITY – 1

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ELUSIVE TAX EVADER:

The Escaping Entrepreneur

SYMPATHY RATING – 9

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ESCAPING ENTREPRENEUR:

The Ex, Expat

SYMPATHY RATING – 7

RARITY – 5

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE EX, EXPAT:

The Extended (to breaking point) Family

SYMPATHY RATING – 10

RARITY – 3

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE EXTENDED (TO BREAKING POINT) FAMILY:

The Financial Oracle

SYMPATHY RATING – 4

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE FINANCIAL ORACLE:

The Frightened Fat Cat

SYMPATHY RATING – 2

RARITY – 3

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE FRIGHTENED FAT CAT:

The Good Lifer

SYMPATHY RATING – 4

RARITY – 3

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE GOOD LIFER:

The Gravy Train Politician

SYMPATHY RATING – 0

RARITY – 9

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE GRAVY TRAIN POLITICIAN:

The Grumpy Undergraduate

SYMPATHY RATING – 4

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE GRUMPY UNDERGRADUATE:

The Humbled (but still incredibly wealthy) Bank Boss

SYMPATHY RATING – 1

RARITY – 2

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE HUMBLED (BUT STILL INCREDIBLY WEALTHY) BANK BOSS:

The Irate Investor

SYMPATHY RATING – 7

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE IRATE INVESTOR:

The Living Big Loser

SYMPATHY RATING – 2

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE LIVING BIG LOSER:

The Low-Bonus Banker

SYMPATHY RATING – 0

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE LOW BONUS BANKER:

The Miserable Middle Class

SYMPATHY RATING – 6

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE MISERABLE MIDDLE CLASS:

The Newly Liberated

SYMPATHY RATING – 2

RARITY – 9

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE NEWLY LIBERATED:

The No Responsibility Regulator

SYMPATHY RATING – 0

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE NO RESPONSIBILITY REGULATOR:

The Not Quite Such a Master of the Universe

SYMPATHY RATING – 1

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE NOT SO QUITE MASTER OF THE UNIVERSE:

The Nuevo Altruist

SYMPATHY RATING – 3

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE NUEVO ALTRUIST:

The Organic Food Fly-by-night

SYMPATHY RATING – 4

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE ORGANIC FOOD FLY-BY-NIGHT:

The Out of Touch Politician

SYMPATHY RATING – 0

RARITY – 9

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE OUT OF TOUCH POLITICIAN:

The Outbound Immigrant

SYMPATHY RATING – 8

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE OUTBOUND IMMIGRANT:

The Petty Thief

SYMPATHY RATING – 3

RARITY – 3

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE PETTY THIEF:

The Pissed-off State Pensioner

SYMPATHY RATING – 9

RARITY – 8

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE PISSED-OFF STATE PENSIONER:

The Ponzi Schemer

SYMPATHY RATING – 1

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE PONZI SCHEMER:

The Pseudo Rich

SYMPATHY RATING – 1

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE PSEUDO RICH:

The Relegated Rich

SYMPATHY RATING – 1

RARITY – 1

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE RELEGATED RICH:

The Repossessed

SYMPATHY RATING – 6

RARITY – 5

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE REPOSSESSED:

The Savvy Squatter

SYMPATHY RATING – 6

RARITY – 3

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE SAVVY SQUATTER:

The Secure Civil Servant

SYMPATHY RATING – 0

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE SECURE CIVIL SERVANT:

The Self-help Sado

SYMPATHY RATING – 1

RARITY – 6

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE SELF-HELP SADO:

The Self-righteous Tightwad

SYMPATHY RATING – 3

RARITY – 4

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE SELF-RIGHTEOUS TIGHTWAD:

The Taxed to Death

SYMPATHY RATING – 9

RARITY – 10

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE TAXED TO DEATH:

The Unabashed Bankrupt

SYMPATHY RATING – 3

RARITY – 7

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE UNABASHED BANKRUPT:

The Worthless Degree Holder

SYMPATHY RATING – 4

RARITY – 9

WHAT ARE THEY DOING NOW?

AVOIDANCE / REVENGE STRATEGIES

THE WORTHLESS DEGREE HOLDER:

Afterword – The Blame Game

1. NEVER JUDGE A BOOK BY ITS COVER

2. DON’T PIGEONHOLE

3. DON’T BE TOO JUDGMENTAL

4. DON’T GET INTO ANY FIST-FIGHTS

5. LEARN TO LOVE YOUR PAIN

This edition first published 2009

© 2009 Andrew Holmes and Dan Wilson

Registered office

Capstone Publishing Ltd. (A Wiley Company), The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com.

The right of the author to be identified as the author of this work has been asserted in accordance with the Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books.

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold on the understanding that the publisher is not engaged in rendering professional services. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

The views expressed in this book are solely those of the authors and do not reflect the opinions of either Capstone Publishing or John Wiley & Sons Ltd.

Library of Congress Cataloguing-in-Publication Data (to follow)

9781906465711

A catalogue record for this book is available from the British Library.

To Gordon Brown – without whom this book would not have been necessary

The end of boom and bust

I have been watching this recession arrive for quite some time and I am certainly not surprised that it is here or indeed at its severity. For at least the last four years, I have been reading books, newspaper articles and blogs which have been warning of the impending doom. As time wore on these became more and more alarmist in their claims and predictions and although sometimes very enjoyable to read, they were clearly depressing. And unlike the apparent threat from ‘Y2K’ which was going to wipe out civilisation, this current economic turmoil may actually succeed.

It should have been obvious to anyone who has the reading age of an illiterate that things were getting out of hand. But clearly people cannot read or were just too busy spending like water and juggling their credit card debt to notice. But the supreme irony has been in the actions of our elected officials who have expertly demonstrated that not only are they out of touch with what is happening economically, but they are also patently unable to organise a bun fight in a bakery. Claiming to have banished boom and bust to ‘the dustbin of economic history’ is something that only a moron would do, or perhaps an alien from a distant galaxy newly arrived on planet Earth; at least they could be forgiven. Of course it gets worse, as having spent recklessly for a decade there is now nothing left in the coffers to get us out of this mess. So the answer is to saturate the markets with more cash (euphemistically known as ‘quantitative easing’) and saddle the next ten generations with massive amounts of debt, (tax, tax and more tax). Apart from the chosen few (the politicians, their friends, the mega-rich, high-rolling bankers and a few ex-CEOs of screwed up banks), no one is being spared the misery of their economic incompetence.

Of course, it is not only the politicians we have to blame. Celebrities, too, have much to answer for with their obsession for empty-headed wealth generation, an approach that most of the population has seemingly bought into, despite having no celebrity and very little wealth. The public’s spending spree has finally hit a brick wall. There are millions of people who have been caught with their pants down and have woken up to a massive debt hangover that even a good dose of Alka-Seltzer won’t cure. Many of course have only themselves to blame.

But no matter how bad it gets, the one thing we do have is the ability to laugh in the face of adversity; some good old fashioned ‘Blitz Spirit’, a bit of ‘Shadenfreude’, is what’s needed – it’s always good to laugh at other peoples’ misery rather than your own. So instead of taking that piece of razor wire to your femoral artery, please read this book. In it you will find the antidote to all your woes and if nothing else it will provide you with the comforting knowledge that you are not alone. It’s cheaper than Prozac and less addictive.

AH

Acknowledgements

This book would not have been possible without the incompetence, greed, stupidity and arrogance of so many people, way too many to mention. However, there a few I would like to thank from the bottom of my wallet, my empty pension pot and for my children’s hamstrung, debt ridden future. Without them this book would have never been possible. So, in no particular order I would like to thank Gordon Brown, Yvette Cooper, Alistair Darling, Alan Greenspan, George Bush, Bernie Madoff, Fred Goodwin, Jacqui Smith, New Labour, Lehman Brothers, AIG, The Royal Bank of Scotland (sorry, England), the G20, mortgage brokers, estate agents, the rocket scientists working in the investment banks, and everyone who’s lived well beyond their means for the last 20 years. I have appreciated your invaluable input.

There are of course a small number of people who are genuinely worthy of acknowledgement for their input, support and feedback during the writing of this book. Emma Swaisland and the Capstone team; it’s good to be back; Dan Wilson, who as always produces such superb images to complement the entries so well and which always make me laugh; Graham Guest and his interesting and now groundbreaking views on quantum finance; David Mitchell, with whom I laughed like a drain when we discussed potential entries; David Vaughan and Colin Woolgar, with whom I discussed the merits of abattoir sets for recently bereaved middle class girls who had to kiss goodbye to their beloved pony; and, of course, my family who are always delighted to see me back at my laptop writing yet another bloody book!

AH

Let the bad times roll

It’s only when the tide goes out that you learn who’s been swimming naked –Warren Buffett

Recession 101

During the 1980s when I was barely into my teenage years we found ourselves in the depth of a deep and very painful recession. The one thing that stuck out amongst it all, apart from the incessant strikes, riots and power cuts of course, was the way the news broadcasts would highlight the latest job cuts announced each day. The deadpan and serious delivery of the news, that another 7500 people had just been made redundant from a steelworks in the North of England, was accompanied by a colourful looking starburst which contained the jobless total carefully positioned over the approximate location where the redundancies took place. Alongside the map of the UK was a counter that would indicate the running total of those who were out of work. Up, up and up it went. Admittedly it looked a bit naff, but I guess that’s all they could do before PowerPoint. This time around the deadpan newsreader has been replaced by a pseudo-celebrity arm-waving cretin who can’t even speak in complete sentences and whose latest job losses announcement is accompanied by a satellite image zooming in from outer space, sometimes from beyond the solar system, pinpointing with extreme accuracy the precise location of the office where the redundancy letters were signed.

We have, of course, been subject to the vagaries of the economic cycle ever since we dragged ourselves out of the primordial soup. Back then, the cycle was defined by the availability of edible flora and fauna, whilst today it is principally about spending and debt. Even during the short time I have been alive there have been a few booms and busts, a couple of v-shaped recoveries as well as u-shaped and jobless recoveries too. There have been periods of high inflation and high interest rates and times when interest rates and inflation were low. I guess the only thing I have not lived through is a depression, but according to some we are heading that way so maybe I will be able to chalk that one up to experience too.

Recessions and indeed depressions come and go; some are long and some are short, but they are nearly always nasty in one way, shape or form. And although there are those who believe that they have solved the old problems associated with boom and bust, it is well known amongst the Scientologist community that it is only aliens from outer space who can do this type of thing and although the chancellor resembles an alien, he doesn’t act like one. Sometimes recessions are bad for a single cohort of society and occasionally they affect each and every one of us whether directly or indirectly. This one, however, seems to be especially bad and not only is it impacting most of the population (it doesn’t really matter if you are a homeowner, a pensioner, in work or out of work), but it is also likely to run and run and run.

We should remember that this is a global recession impacting countries across the world which is good news as it gives our leaders someone else to blame. What beggars belief, however, is that the supposed ‘experts’ and government officials who were on the economic frontline and meant to be monitoring the economy were not forecasting any downtown at all, and if they were, only a very shallow contraction. In doing so they have demonstrated that they are unfit for their jobs. But, as we know most of those who seek government office are self-centred, ego driven maniacs with no real concept of what is going on in the world outside the petty arguments and pointless debates that fill their day.

What goes up must come down

The boom since the last recession of the early 1990s seemed to be unstoppable, and despite the brief dip following the bursting of the Dotcom bubble continued unabated. However, it has now gone into reverse at an alarming speed. Starting with the collapse of Bear Sterns, the news around the world has got progressively worse. We have witnessed the failure of a significant number of banks who have either been subsumed by other institutions or have been bailed out and nationalised – it seems we are all bankers these days; what a terrible thought.

Any industry sector that relied on the out-of-control spending of consumers is suffering and experiencing double digit drops in demand, revenue and profits. And for some it has resulted in them going to wall in the most spectacular, and sadly inevitable, car crash that occurs when the music stops.

The financial markets have been decimated along with the pension pots and savings of millions who were told that the sure-fire investments they were making would see them right. Unemployment continues to ratchet up to levels we have not seen for many years and who knows which may yet reach levels not witnessed since the Great Depression. Companies and people are going bankrupt as their precarious financial positions have got to the point where only a big lottery win would get them out of the hole they’re in.

Times are likely to be tough for a very long while yet and far longer than the morons who have been running the country since 1997 would like us to believe. Even looking at it from the simple perspective of government debt, we are deep in the mire. Government borrowing started way back in 1692 and it took 300 years for this to reach £ 165 billion. It has taken New Labour barely 18 months to rack up the same level, which means that someone born today will be 23 before it is back to sustainable levels. Nice job.

It’s not my fault, honest

So who’s to blame? Well, the list is a long one, so I will keep it to a few of those who are worthy of special treatment.

There is no doubt that the idiots in power, the tax-obsessed left wing muppets who have wasted most of our taxes on pointless jobs, allowances for hardworking MPs and projects which were never going anywhere from the get-go, have a lot to answer for. They show no real concern about our plight and when they do they come across as arrogant, patronising and completely out of touch. They tell us that it will be alright and then tax us until we cough up blood, which they also tax. They talk about making efficiency savings across the bloated public sector, and then continue to increase it and pay themselves more.

Defeating Napoleon, Kaiser Wilhelm and Adolf Hitler almost bankrupted the country but the economic geniuses of New Labour look as though they will achieve what years of warfare failed to do; and still they smile, laugh and joke. It’s a real shame we don’t live in medieval times, as most of government would find themselves on the end of the tip of a very sharp sword or perhaps a blunt farm implement. Still it’s nice to fantasise about them queuing up to be eviscerated. It would certainly draw a large crowd and provide some much needed entertainment.

Next on the list is the banking community and especially those that were apparently paid very handsomely to run them. Driven by insatiable greed, they developed more and more risky approaches to squeezing every last drop of profit from their increasingly complex, rocket-scientist-developed products. When they dreamt up collateralised debt and the opportunity to slice and dice consumer and corporate loans and sell them off to unsuspecting investors across the world, the final nail in the coffin of the boom was hammered home. Once the house of cards started to collapse no one knew who owed what to whom and who would pay the debts that had been racked up by simpleton consumers and corporations and passed off as a great investment opportunity to the rich and wealthy. Then when bank losses skyrocketed and the big bosses floored, it was the bank of you and I that was left to pick up the pieces.

Third on the list, and I promise I won’t go on for much longer, is the general public. Now I grew up to believe that you had to live within your means and that it generally wasn’t a good idea to get yourself too much into debt. So, being a good boy, I always ensured that my mortgage was never more than three times my income and put aside some cash for my retirement and for a rainy day. I took on some debt when I had to, but again this was paid off as quickly as possible so that I didn’t feel burdened by it all. Such prudence (sorry to use a term often used to describe our former, now discredited chancellor and unelected prime minister) does in the long run pay off. I also believed in the good old protestant work ethic and that work was an unfortunate means to an end. However, to do all this meant shunning a bullshit celebrity culture in which everyone wants to be rich and famous, not going on crazy spending sprees buying overpriced tripe and not filling up my house with stuff I never needed in the first place. Clearly, few people did the same. As the television spewed-out more cheap reality TV shows and ‘talent’ competitions in which the witless and great unwashed tried to impress a bunch of cheesy and disinterested celebs with their (previously unrecognised) ability to tap dance or eat razor wire, the desire to work hard for a living went out the window. It became all about being the next Britney Spears or Paris Hilton. At the same time, those who clearly were talentless and would never become famous felt they shouldn’t miss out on the celebrity lifestyle either. They went on a decade-long spending binge, maxing-out on their credit cards and using their houses as convenient piggy banks. And what have they got to show for it? Apart from an out-of-town lock-up stuffed full of the crap they bought and never use, huge amounts of debt, no savings and plenty of sleepness nights.

Pay up and look big

And who pays? Yes you’ve guessed it, it’s us. With the government coffers running on empty and the public debt at unprecedented levels, ours, our children’s, our children’s, children’s and our children’s, children’s, children’s futures have been sold down the river. It will take generations to dig us out of the hole that we find ourselves in and we can only look forward to being taxed to death to pay for it. And don’t expect any respite soon; there will be no return to boom, just perpetual bust dressed up as ‘green shoots’. And when it comes to the cost of living and taxes, as Yaz said during the 1980’s recession, ‘The only way is up’.

Don’t despair … the perfect antidote is here

If you are anything like me, your blood must be boiling, but we all know that anger is not a helpful emotion because it has a range of detrimental effects. First and foremost, it forces your brain to shutdown as your Neanderthal need to beat the living daylights out of those to blame takes over from your higher performing frontal lobes which would allow you to have a reasonable discussion with Mr Brown, eruditely pointing out the error of his ways. Next, it does little for your long-term health as it plays all sorts of havoc with your blood pressure, leading to heart disease and strokes. Finally, it usually leads to a prison sentence, although I am sure in some cases your crimes will be looked upon in a sympathetic light by a judge who has also been taken to the cleaners.

So, now that we have established that it’s all gone ‘a bit Pete Tong’, it’s time to lighten up and use this very handy guide (at a true Credit Crunch beating price of course) to ease your pain and laugh at the sheer stupidity of it all. Consider it the like the latter day ‘Blitz Spirit’ when we could laugh like drains as the Luftwaffe dropped their latest payload of high explosives on the towns and cities of Britain.

In this book you will find fifty people who have either:

got us into this almighty mess;

been impacted by it all and never stop moaning;

got away without being unduly affected, but deserve our vitriol anyway;

or screwed up royally and are now in a terrible pickle.

For the experienced ‘Painspotters’ amongst the readership, you will know how to use this book. But for those who don’t, it is designed in a way that allows you to identify the people associated with the Credit Crunch and ensuing recession – whether it is those who have done the crunching or those who have been well and truly crunched – whilst enabling you to express your inner feelings in an acceptable way. I am writing what you are thinking. Thus, in the same way that bird spotters identify the lesser spotted warbler, this book helps you to spot the Gravy Train Politician, the Ponzi Schemer, the Pissed-off state Pensioner and the Secure Civil Servant. But it goes beyond that, it identifies how you can avoid them and seek your revenge; if you are brave enough.

Each entry includes:

Sympathy Rating – how much should we feel sorry for them? Extending from 0 (absolutely no sympathy whatsoever) to 10 (extreme sympathy to the point of tears, if not cash handouts).

Rarity – ranging from 1 (exceptionally rare) to 10 (all too common).

What are they doing now? That the recession is well and truly underway.

Avoidance / revenge strategies (with suitable escalation).

At the end of each entry I have also given you, the reader, the opportunity to record them, add your own sympathy rating if you believe I have been too harsh (or perhaps too lenient), and to decide who is ultimately blameworthy.

As with any ‘spotting’ pastime, you might choose to swap entries with your friends and families or, God forbid, your local MP. You might also choose to throw the book through the front windows of any fat cat residences that happen to be down your street. And I am sure that you will be ‘Twittering’ your thoughts and reactions online. And Dan and I hope to see you on the Painspotting website: www.Painspotting.co.uk

Sadly, you could be referring to this book over the many years this recession is likely to last, but I hope you will be using it to cheer yourself up. I would also recommend that you consider bequeathing this to your children or grandchildren, as I am sure they will be needing it too. Who needs self-help books, when armed with this tome, you can simply avoid the jerks, muppets and morons who make life such a drag?

Fellow Painspotters, let us begin …

The About to Retire, Retiree

Believe it or not, there are a few people out there who love the whole concept of work and believe that all retirement means is the long (or short) slide to death, filled with endless wood turning and existential discussions with the local vicar. I actually believe work is more like death than retirement could ever be. Let’s face it, being stuck in an office at your desk or the cockpit of a Boeing 777 doing the same thing day after day, after day is mind numbing and also pretty soul destroying. Ultimately work should be a means to an end which hopefully isn’t just death. Those who believe that work is the only thing that matters are seriously deluded and need psychological counselling. Retirement is and should be something to be looked forward to and savoured, ideally embarked upon at the earliest opportunity. Indeed, according to all the advertisements for pension savings, it is a time for renewal and the last opportunity to pursue all those hobbies and pastimes that you never could whilst working inhuman hours for a complete and utter bastard.

Just picture it. You have spent somewhere in the region of 30 or perhaps 40 years giving your life and soul to a single employer or perhaps a series of companies. You have worked hard, diligently meeting every target that’s ever been set. You have laughed at your boss’ crap jokes, perhaps even had sex with him or her to secure that much coveted promotion, suffered the backstabbing of your colleagues, watched as incompetent idiots climb the greasy pole as you and your supreme talents have been overlooked, and dealt with difficult clients who have treated you like rubbish. All this has been worth it because you knew that at some point in the future it would all come to an end. Then you could kick back and never have to deal with morons ever again, comfortable in the knowledge that you or your employer or perhaps both had squirreled enough cash aside to get you through to the inevitable death rattle. Well, so you thought.

The unfortunate thing for so many almost retired workers is that their seemingly sure-fire, concrete plans have turned to dust. Retirement for many is now no longer a fantasy but more like a fairytale. The problems which started with the collapse of Bear Sterns have worsened with every unfortunate lurch of the Credit Crunch and subsequent recession, from being fleeced by the likes of Bernie Madoff to companies going to the wall and refusing to pay out one dime of their pension pots. And, even if you have not lost absolutely everything to one of the many ‘Ponzis’ out there, your pension pot is likely to be a shadow of its former self. And although the investment management community loves to tell everyone that it is important to hang on, for many people approaching retirement, hanging on means a death sentence. As you would expect, the government has done us no favours – in truth, they screwed up pensions years ago. And let me think who that might have been …. ah yes, Gordon Brown, that ‘safe pair of hands’ and economic genius. With quantitative easing adding to the misery as it drives down annuity rates, things are unlikely to improve for the near-retiree or even distant-retiree anytime this side of the next millennium. The I’m About to Retire, Retiree typically wears a hangdog expression and rarely smiles. With their dreams in tatters you can see them on the train station platforms every morning looking depressed and resigned to another ten years of work. Their wives however, are delighted because they can continue to enjoy life, happy in the knowledge that their dull work-centric husband won’t be hanging around them like a stain for at least another decade.

Tales of poor 60–65 year old workers who can no longer afford to retire are everywhere. It won’t be long before we’ll see white haired rioters taking to the streets brandishing their walking sticks and bus passes, all in desperate need of the lavatory. I do, however, see two silver linings to the whole debacle. First, every near-retiree should seek a new job in a new company, and when they are turned down sue the pants of them so that they can replenish their pension pots and retire anyway. This of course is now possible with the new age discrimination legislation and if you can throw in a bit of sexual or racial discrimination too, then all the better. The second, which is aimed at those with a few years to run before they can retire, is that with so many old people in work and the associated delays to retirement, annuity rates are bound to increase as the time between retiring and death will become much shorter. I know it is a bit of a sacrifice, but it is important to think about the next generation. Indeed, I actually think this whole credit crunch thing has been deliberately engineered by governments across the world to avoid having to pay out the pensions of the gazillions of baby boomers who are on the cusp of retiring. Gordon, I take it all back, you are indeed a financial genius.

Tick here when you have spotted the About to Retire, Retiree

SYMPATHY RATING – 10

As someone who would love to retire tomorrow given the chance and who saves like crazy so that I will actually be able to retire in relative comfort, (assuming my pension pot recovers, of which there is no guarantee), I have enormous sympathy for anyone who has lost out due to the incompetence of the government and investment management community. What makes us really angry is that the bankers who brought down the finance system have walked away with massive payoffs and huge pensions so that they will never have to work again. Not that they could, why would anyone with a CV containing an entry such as ‘2004–2008 CEO of ABC Bank plc – over the course of my tenure at the bank, I destroyed the company’s capital base, took reckless risks with other people’s money and had to ask the government to nationalise the company because of my almighty cock-up’ be considered an asset ever again? Apart from a toxic asset, of course.

RARITY – 5

With the population visibly aging before our eyes and with the recession likely to run for the foreseeable future, the numbers of the About to Retire, Retirees will continue to rise. You will see them everywhere; shops, offices, train stations, all foaming at the mouth as they bitch about those bastard bankers and evil politicians who have destroyed their future. Even the ones who only saved £56 to fund their retirement can’t help but go off on one. I am not sure how this will impact the quality of service you might expect to receive from them, but I can only guess that it will be poor.

WHAT ARE THEY DOING NOW?

If not contemplating suicide or perhaps going berserk with an assault rifle, they are crying themselves to sleep as they flick through magazine pictures of tanned, grey-haired old men at the helms of their yachts knowing that will have to work at least another five or ten years and may never, ever be able to retire. The prospect of having to continue to work as they get increasingly infirm is not a wonderful one and once they finally finish it will be off to a grotty, publically funded care home where they will no doubt be beaten up by the staff. Hmm, maybe assisted suicide sounds like an option after all.

AVOIDANCE / REVENGE STRATEGIES

THE ABOUT TO RETIRE, RETIREE:

The Bailout Beggar

The Credit Crunch has clearly left a lot of people and a lot of companies in dire straits and ever since it started we have been inundated with headlines claiming that the whole capitalist system is on the brink of collapse and unless we act soon, the world will literally end. Well in fact it is going to end, but not until 2012. According to Mayan prophesies, which are based upon two millennia of astronomical observations, the world will cease to exist on 21 December 2012, which will probably coincide with the end of the recession. If it did, it would be a real bummer for everyone. Mind you, for those mired in debt, it will probably come as a wonderful release – no more bailiffs, as they will die too. I do wonder, though, if your debts and indeed the Credit Crunch itself can pass to the other side; I guess we’ll find out soon enough.

As things went from bad to worse and as politicians around the world stared into the headlights of economic Armageddon, there was a desperate need to do something, anything, to show that they were in control of events and not the other way around. Then, someone came up with a cunning plan and a cunning slogan – ‘BAILOUT’. That’s it they thought, rather than let everything go to the wall, let’s splash some cash and make all the problems just go away, leaving it to the next generation to figure out how to sort out the crap. As we ‘Generation X-ers’ have been well and truly shafted by the Baby Boomers, now it’s our turn to shaft the ‘Generation Y-ers’ – who kind of deserve it as few of them work, they spend all day on Facebook and like to complain that they have got it hard.

With the bailout a new beast was born: the Bailout Beggar. The Bailout Beggar is typically a company or corporation that has screwed up really, really, really badly to the point that if no one helped them they would go bust. So along they came, companies of all shapes and sizes, hands outstretched looking to get a few billion to tide them over and to help them pay a few bonuses to their overworked and underpaid staff. As the economic stimulus gathered pace and as governments pushed more and more money into the economy, the number of Bailout Beggars grew. It started-off with just the idiots who were at least 80% to blame for the mess in the first place – the banks. But they were soon joined by a whole bunch of CEOs, flying into Washington on their private jets to ask for a piece of the action. Some companies were left to die, and quite rightly so, as their business was rubbish anyway and should not have been allowed to continue. Others, like AIG were just too big to fail (or so we are told), as they really would have taken down the whole capitalist system and heralded the end of the world, much to the disgust of the Mayans no doubt. The money kept on flowing – a hundred billion for you, and a couple of billion for you. It was like Oliver Twist – ‘please Sir, can I have some more?’ and all we had to do was wait for Harry Secombe to break into song.

Banks were nationalised, insurance companies thrown lifelines and auto-manufacturers told to sod off. Then came the long line of beggars just like the ones who turn up on your doorstep when you’ve won the lottery. The major industries were joined by sewage companies, cattle farmers, old peoples’ homes, Wal-Mart and then, to top it all, the Porn Industry wanted to get some bailout cash as well. They didn’t want that much compared to the rest of the Bailout Beggars, just a mere $5 billion. The amount reflected the decline in US ‘adult industry’ revenue from a peak of $18 billion three years ago. Apparently it’s not only the economy that’s sagging these days, actors and performers are finding their customer bases (amongst other things) shrinking, and the rates which porn stars are being paid per scene has dropped significantly to $1200 from $2000 – a girl just can’t make a decent living lying on her back anymore. Clearly this industry is more deserving than the banks as it might be just what is needed to get the economy pumping again.

Of course, as soon as the money started flowing from central government, everyone, no matter how tenuous the link between their current predicament and the Credit Crunch really was, lined up to get some cash. Whether it was because they had invested their money in a bankrupt country like Iceland, or had gambled it away on hedge funds, it didn’t really matter. And of course everyone believes they are just as entitled to the money as the evil, greedy, good-for-nothing, high-living, jet-setting, money-grabbing, unrepentant bankers. What’s good for the goose is clearly good for the gander.

Tick here when you have spotted the Bailout Beggar

SYMPATHY RATING – 6

Most people are of course outraged that any company that has been as badly run as the banks or the auto manufacturers should be given a handout. Let them all fail, after all there are plenty of businesses going to the wall because of the Credit Crunch, and they get jack; just a blank expression from a government official. However, attempting to take a broader view of events, you can see the need to keep some of the companies going because they employ millions of people, and the systemic risk of them taking down the entire nation is a very real one. Still if I were you, I would be venting your spleen in one of the many riots that have been taking place across the world.

RARITY – 9

There are more Bailout Beggars than you can shake a stick at right now, and as long as the Credit Crunch and recession continues, companies will continue to queue up for their slice of the bailout pie. Heck, I might even try myself … if you don’t ask, you don’t get.