7,99 €

Mehr erfahren.

- Herausgeber: The O'Brien Press

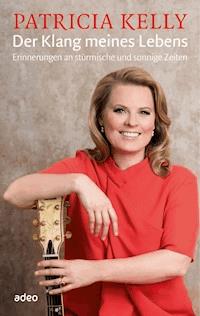

- Kategorie: Sachliteratur, Reportagen, Biografien

- Sprache: Englisch

Does this ring any bells? Mortgaged to the hilt, rising at 5.30 to commute across three counties to jobs in Dublin, fed-up, bleary-eyed and only in your thirties?Michael Kelly and his wife were classic Celtic Cubs. Then they simplified, down-sized, opted out. Now they live happily in a leaky cottage in Dunmore East, their ties with the capital severed and their careers as corporate drones abandoned. They grow vegetables and rear an ever-expanding coterie of animals: laying hens, a cock named Roger and pigs called Charlotte and Wilbur. And they don't hate Mondays anymore! This is an extremely humorous, thought provoking account of one couple's discovery that there is an alternative to the consumer driven lifestyle. As Michael Kelly describes the hilarious hazards of rural life as well as the advantages, he demonstrates how one brave decision can transform your life. A funny and inspiring account of the ups and downs of letting go of the Tiger. You can see Michael talking about the changes he has made to his life here (courtesy TV3): You can also read about Michael's continuing adventures with rural life on his website www.michaelkelly.ie.

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Veröffentlichungsjahr: 2012