9,59 €

Mehr erfahren.

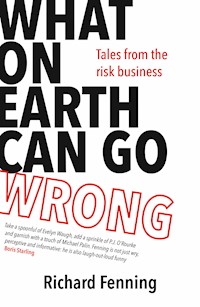

- Herausgeber: Eye Press

- Kategorie: Sachliteratur, Reportagen, Biografien

- Sprache: Englisch

'Beautifully written – a roller-coaster ride of risk' Sir Sherard Cowper-Coles 'A funny and personal account of life in the risk business'- Gideon Rachman After spending three decades advising multinational companies on geopolitics and security crises, Richard Fenning knows all about danger and intrigue. Kidnappings, terrorist attacks, coups d'état, corruption scandals, cyber attacks, earthquakes and hurricanes were all in a day's work in a career that coincided with the rise of China, the tumult of the Middle East wars, the resurgence of populism and the digital revolution. Amid chaos and upheaval, he also found humanity and humour. Often witty and always insightful, What on Earth Can Go Wrong takes us from the battlefields of Iraq to the back streets of Bogotá, from the steamy Niger Delta to the chill of Putin's Moscow. In a remarkable memoir of a life on the frazzled edge of globalisation, Fenning looks back with compassion and insight on the people and places he got to know, while offering some timely thoughts on the relationship between risk and fear in a profoundly volatile world.

Das E-Book können Sie in Legimi-Apps oder einer beliebigen App lesen, die das folgende Format unterstützen:

Veröffentlichungsjahr: 2021

Ähnliche

Born and brought up in the north of England, Richard Fenning spent 14 years as CEO of Control Risks, the global consultancy that specialises in helping businesses out of tight spots in difficult countries. He now works as a leadership coach and is a regular media commentator on world affairs. He lives in Sussex.

‘A fascinating insight into the space where politics and business meet, filled with wit and wisdom. Highly recommended’

Lord Sedwill, former UK Cabinet Secretary and National Security Adviser

‘A must-read for every student of geopolitics, amateur or academic, professional or private. This beautifully written memoir is much more than that: a roller-coaster ride of risk, full of insights and implied advice, more relevant than ever in today’s uncertain world. Richard’s sense of humour, and of irony, and his golden pen, make even the most appalling experiences enjoyable. Strongly recommended’

Sir Sherard Cowper-Coles, former British Ambassador to Israel, Saudi Arabia and Afghanistan

‘Take a spoonful of Evelyn Waugh, add a sprinkle of P.J. O’Rourke and garnish with a touch of Michael Palin. Fenning is not just wry, perceptive and informative: he is also laugh-out-loud funny, way more often than any CEO has a right to be’

Boris Starling, author of The Official History of Britain

Published by Eye Books

29A Barrow Street

Much Wenlock

Shropshire

TF13 6EN

www.eye-books.com

First edition 2021

Copyright © Richard Fenning 2021

Cover design by Nell Wood

Typeset in Times New Roman

All rights reserved. Apart from brief extracts for the purpose of review, no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without permission of the publisher.

Richard Fenning has asserted his right under the Copyright, Designs and Patents Act 1988 to be identified as author of this work.

British Library Cataloguing in Publication Data

A catalogue record for this book is available from the British Library

Printed by CPI Group (UK) Ltd, Croydon CR0 4YY

ISBN 9781785632242

ForRhoda and Leowho gave me roots and wings

Ozymandias

I met a traveller from an antique land,

Who said— ‘Two vast and trunkless legs of stone

Stand in the desert… Near them, on the sand,

Half sunk a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them, and the heart that fed;

And on the pedestal, these words appear:

‘My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!’

Nothing beside remains. Round the decay

Of that colossal Wreck, boundless and bare

The lone and level sands stretch far away.

Percy Bysshe Shelley

Contents

Foreword

1 Stepping out of the shadows

I The age of exploration

II The unholy trinity: war, terror and hubris

III The empire bytes back

2 Lost in frustration

3 By the rivers of Babylon

4 In the shadow of our former selves

5 Cocaine and Cornettos

6 Porn, corn and paranoia

7 Driving with the handbrake on

8 Functional dysfunctionality

9 Big, brash and brilliant

10 Hide your strength, bide your time

11 An insomniac on the Potomac

12 Risk, fear and the perils of prediction

13 Flying home

Acknowledgements

Foreword

It is one o’clock in the morning in Tripoli. I am sharing a bed with a colleague. We are bedfellows out of logistical necessity rather than carnal choice. He is lying next to me wearing nothing but a pair of skimpy green underpants. He is deeply and blissfully fast asleep, and snoring like Darth Vader eating broken glass. Outside, there is the near-constant sound of automatic machine-gun fire – the deadly, metallic tack-tack-tack of AK47s being fired with reckless abandon. Through the window I can see the night sky illuminated with terrible beauty by tracer rounds. Inside, the toilet in the bathroom is malfunctioning, flushing loudly and constantly. I am wide awake, edgy and nervous, sweating in the hot North African night. Listening to this extraordinary orchestral ensemble, a bizarre combination of the banal and the ballistic, I think to myself: how in the world did I get to be here?

The reason was that I spent nearly thirty years consuming a daily diet of kidnappings, terrorist attacks, coups d’état, massive frauds, corruption scandals, cyber-attacks, data breaches, earthquakes, hurricanes, pandemics and, in the case of Libya, promising revolutions that went horribly wrong. After a while, you start to think that this is all that happens in the world, that all we ever do is lurch from one major crisis to another. If your time is spent guiding people away from the rocks or helping rescue survivors, then you tend to see calm seas and sunny skies merely as the lull between storms.

My job was to help international companies stay safe, to peer around the corner and warn them of trouble ahead. When that was not possible or there was no room to dodge out of the way, then it was time to help them to gird their loins, stiffen their sinews, weather the storm and deploy all manner of mixed metaphors to keep the ship afloat and the show on the road.

For nearly three decades, I was on the move, living and working all around the world. I became adept at turning up somewhere strange, trying to figure out what had gone wrong, dispense some kind of solution and move on. It was a contrasting combination of feeling both energised and exhausted at the same time. Pepped up by the exhilaration and the challenge but drained by the jet lag and the tedium of near-constant travel.

It was an odd life on the frazzled edge of globalisation. I was a member of a peculiar species of weirdly evolved primates: laptop warriors who live their life in airplanes, airports and soulless beige hotels, for whom the notion of a work-life balance is an odd antiquated concept. Work was a way of living not just a way to earn your living, a notion largely unknown to previous generations of executives who were mostly spared the tyranny of twenty-four-hour global connectivity.

I have recorded here some of my observations, both of the many strange situations I found myself embroiled in and also my recollections of some of the places that I got to know. These range from the exotic to the familiar, from places you may choose for a family vacation to those that you probably never want to visit if you can possibly avoid it. Many will be familiar territory to travellers and tourists; others are more off the beaten track.

This is a book about a nearly three-decade journey into the deep recesses of the risk and security industry. Along the way, we will meet some strange folks in the backstreets of Rio and Delhi, some oddballs in Bogotá and Baghdad, be unnerved in Moscow and Nairobi, get lost in Lagos, become befuddled in Tokyo and Shanghai and stumped in Washington DC. We will see what happens when innocent people find themselves very much in the wrong place at the wrong time. But if you tire of the geo-drama and fancy having your prurience tickled, we will also have a close encounter with a retired porn star, hear a cautionary tale about the devastating consequences of toxic flatulence and have an uncomfortable brush with a penis enlargement operation that went sadly wrong.

This is not a book about greatness and heroism, nor is it a book about despair and dystopia. It is about setting forth and, on the way, becoming a tiny bit braver. It is about learning – through trial and error – to distinguish what to be scared of and what not. It is also a tale of becoming less sure, more uncertain and replacing simplicity with complexity, the paradox of learning more but understanding less. Or if that sounds a bit dispiriting and nihilistic, then it is about how the baffling kaleidoscope of humanity never fails to surprise and upend our preconceived notions of the world in ways that can frustrate, confound and delight us in equal measure.

I hope you may be occasionally intrigued, perhaps have some of your views challenged and hopefully, at times, be amused. In places my misgivings about Britain’s historical self-image will come to the fore, yet I have unfathomable reserves of affection for and pride in the country that moulded me and set me loose in the world. I hope that comes through.

My travels took me around the world on an annual repetitive loop. I met politicians of honest good-standing, others of dubious repute and some who should not be allowed to use scissors unsupervised. I encountered business leaders of the highest calibre and others of eye-watering incompetence. And given the nature of the work, I also had my fair share of brushes with the shadowy demi-monde of espionage and intrigue. Many of these people I liked enormously. Some gave me the creeps. And others scared the living daylights out of me.

I have had a few encounters worthy of some gratuitous name-dropping, including a very grumpy Margaret Thatcher at a drinks party in Tokyo. She had just taken part in a live television debate with the Japanese prime minister during which the cameras had started rolling before she was ready. The Japanese viewing public had seen her snapping at the poor sound engineer who was trying to adjust her earpiece while she was taking off her earrings. She had shooed him away like a naughty spaniel.

‘Prime Minister, I think it gave people the chance to see your human side’, I offered, trying to be helpful. She stared back at me, puzzled. She had understood each word I had said but had never heard them all in the same sentence before. ‘Yes’, she suddenly announced, wagging her index finger at me, ‘my human side, my human side’. She turned to her pugnacious press secretary, Bernard Ingham, and told him to write that down in his notebook.

That evening, Mrs. Thatcher was distracted, tired and seemingly diminished as she tried unsuccessfully to stop her stiletto heels from sinking into the soft grass on the embassy lawn. Henry Kissinger, by contrast, was anything other than diminished when I met him a few years later in New York. It was raw power with a hint of menace. Bill Clinton, meanwhile, was spellbinding. All folksy phraseology and quicksilver intellect.

Mostly my world has been about trying to tip the scales for people who are not rich and famous, enabling them to be safe and successful where otherwise they may have been defeated. It has been a privilege to have followed in the shadow of some remarkable colleagues. Men and women better able than I to absorb other people’s stress and anxiety and help them navigate to safety across treacherous terrain.

I am a regular kind of person who has had the good luck to do an unusual job. A job that changed me. Not in any profound, fundamental sense – a Yorkshire childhood and a Methodist education took care of the hard-wiring – but in ways that only now am I able to slowly discern. There has been the occasional brush with danger. I say that from the perspective of someone with a low threshold for risk. Faced with obvious peril, my instincts are to scarper quickly in the opposite direction. The primeval software that our early hominid ancestors relied on to prompt them to leg it back to the cave when they encountered a sabretooth tiger in the woods, is for me still in tip-top condition.

The chapters that follow start by looking at how the risk business has grown and developed over time. There are then ten chapters looking at specific countries, each of which illustrates something of the world I have got to know over the past thirty years. The book concludes with chapters on the nature of risk, including a look at how we have been facing the COVID-19 pandemic, and then a view on how risk and danger affects each of us individually.

I have tried my best to be fair, conscious that there are very few absolutely bad people and a similarly small number of the truly heroic. In places, my impartiality gives way to polemic. I make no apology for that. This is my personal response to the bizarre world I have experienced. The opinions are all mine and I take full responsibility for all the errors, of both fact and judgement. And while I have grown muddled and bewildered by what goes on out there and sceptical and cynical about power and those who wield it, I hope my faith in humanity and my optimism about the future are still alive and kicking.

1

Stepping out of the shadows

I The age of exploration

The modern risk business is widely regarded as starting in the early 1970s. Firms like Kroll Associates in New York and Control Risks in London, providing security and investigative advice to other businesses, were an entrepreneurial response to specific high-profile problems that were increasingly besetting ambitious global companies. Stolen money that needed tracking down across multiple jurisdictions or kidnapped executives languishing far from home in need of rescue – these were some of the headline-grabbing issues that needed fixing. In part, they were a private sector response to a public sector capability-deficit, as national governments faced constraints on the assistance that they could or were willing to offer to multinational companies keen to spread their global wings.

To be fair, this was less of a brand-new invention and more of a reimagining. Pinkerton detectives had been available for hire since Scotsman Allan Pinkerton set up shop in Chicago in 1850. Indeed, the origins of deploying the right kind of specialised talent to figure out how to get one step ahead of the competition, stay safe and sort out nasty situations goes back much further.

In fact, you could say it all began with Sir Francis Drake. When Queen Elizabeth I found herself heavily in debt, her country isolated by hostile European powers and her subjects riven by the religious turmoil wrought on them by her father’s break with Rome, she had an idea. She would invest in an emerging market fund.

She would not have used this kind of terminology. But that, in effect, was what she did. She needed to make some speculative high-risk investments. She staked most of what she had on the possibility of massive returns. Returns that would reflate the exchequer, allow her to build up the naval resources to deter the prospect of invasion and also distract her spiritually distressed people with a big wallop of jingoistic pride. It turned out to be a master stroke. And the man she called on to execute this bold plan was a little-known sea captain from Devon called Francis Drake.

At the time, Drake had grown bored of maritime life in England. He was in West Africa trying to muscle in on the Spanish monopoly in transporting African slaves across the Atlantic to the new Spanish territories in the Caribbean. On one of these voyages to the New World, Drake had started attacking the newly established Spanish ports in what we now call Panama. He would steal anything worth stealing, ransom off the wealthy merchants and then burn the place down before the Spanish navy had a chance to intervene and chop his head off. He started to get rich and came to the notice of the Spanish, who understandably loathed and feared El Draque, offering a reward of what would now be about $8 million for his capture or death. He had also come to the attention of the Queen and her chief spymaster, Sir Thomas Walsingham.

Had Drake been born a few hundred years later, he would have made a superb hedge-fund manager. He could spot an opportunity where others saw only risks, he could execute a plan quickly, discreetly and efficiently and he had a knack for persuading otherwise cautious people to back his incautious schemes. He also had an almost insatiable taste for adventure, was mostly devoid of any kind of moral conscience and was recklessly criminal. In short, he was just the man for the job.

Elizabeth, a canny judge of the male ego if ever there was one, decided to harness Drake’s formidable capabilities. She turned him from pirate to privateer. She backed his voyages both financially and officially and would later have him knighted. But he had to up his game. It was no longer sufficient just to be an irritant in Spain’s imperial side. He had to start the wholesale looting of the gargantuan amounts of gold and silver that Spain was systematically stealing and shipping back to Europe from Peru and Chile.

Drake was wildly successful. He accumulated a personal fortune and returned even greater sums to his investors, particularly his royal patron, the Queen. He also found fame as an explorer by becoming only the second person to circumnavigate the earth. And he became a national hero when he defeated the Spanish Armada – the fleet that the now totally exasperated Spanish king, Philip II, had dispatched to invade England.

He never lived long enough to enjoy the life of the modern master of the universe. He did not have the chance for a Damascene conversion and become the billionaire philanthropist dedicated to eradicating the very same vices that had made him rich in the first place. He never got to posture pretentiously at the Tudor equivalent of the World Economic Forum in Davos, wear tight-fitting pantaloons designed for a man half his age or indulge in nauseating egomania with the top lute-playing musicians of the day. He died of dysentery back in Panama, aged 55.

Drake’s status as one of Britain’s great national heroes is fragile. His involvement with the slave trade and his piratical ways do not stand up to modern, more enlightened scrutiny. But he started something. Drake understood that his success was dependent on three things: good intelligence, the right security and a cool calibration of the risks, enabling him to generate high returns in volatile parts of the world. This spirit, rather than the grim operational reality, continues to provide the inspiration for many people to opt for a life in the world of modern-day business risk. In pure, unmodified form, it is also responsible for the persistence of mercenary activity beyond the pale of acceptable commercial or moral behaviour. Yet that core, original spirit of adventure and calculated risk-taking, repurposed and adapted for contemporary ethical norms, is what still attracts large numbers of people to seek a professional path with more sizzle and spice than other more conventional career options.

Of course, the less savoury aspects of how Britain became the economic and political superpower it once was have long-since been glossed over. Where they have broken cover and blundered out into the open recently, they have been caught in the controversial, often toxic quagmire of historical moral relativity in which one person’s intrepid national hero is another person’s exploitative trader in human misery. Drake was both. Nevertheless, warts and all, one strand of Britain’s national story is dominated by that original Tudor innovation of seeking commercial advantage amid geo-political volatility.

The modern international company is no longer the extension of a single country’s prestige in corporate form that it once was. Instead, big businesses have tried to become stateless, globalised, shape-shifting entities floating on oceans of tradeable data, seeking arbitrage advantage between different parts of the world which they define as markets not as nation states. Modern politicians, eager for the sugar rush of cheap populism and pushing more nationalist agendas, may try to lasso them back into line and get them to pay more tax. But in the main, they have slipped the leash.

By the end of the Seventies, the risk business, this new version of an old industry, was up and running, just as the world was enjoying a significant uptick in international trade. Indeed, the world was about to change in ways that nobody could really anticipate as ambitious but often ill-prepared companies ventured into new and unfamiliar markets. New markets brought new problems.

By then, the era of the amoral merchant adventurer running amok at the intersection of red-blooded capitalism, espionage and other people’s politics was mostly over. While these new companies may have been able to trace their inspirational lineage back to the likes of Drake, they now had to play by a different set of rules. Business ethics had not yet become the obsession it is now, and corporate social responsibility was pre-embryonic. It was still a corporate sperm swimming around in the dark, looking for a socially responsible egg emitting a weak beacon of receptivity. But the rules of the game were changing. Big companies were coming under greater scrutiny and could no longer afford to act as if they had undergone an ethical lobotomy.

So too the risk industry. The stage was set for the arrival of a new type of company. A type that operated not beyond the pale but within the law and the boundaries of decent corporate behaviour. It was time to step out of the shadows. In those early days, governments were often suspicious and disapproving of the private sector poking around in the world of security and intelligence. As a fresh-faced newcomer, I once found myself attending a meeting at the British Foreign and Commonwealth Office. We were shown into a splendid wood-panelled room to be met by an up-and-coming diplomatic grandee with an illustrious family lineage. ‘Ah, here come the princes of darkness,’ he announced, with maximum condescension. It seemed a little unkind as we were there– pro bono – to help him resolve an embarrassing and delicate situation involving a British citizen in South America. Years later, the same now fully-fledged grandee welcomed me to his palatial ambassadorial residence with much warmer words and copious quantities of whisky and soda.

After these early teething troubles, it became clear that sustainability meant no longer emulating Tudor adventurers but acting lawfully and in ways that did not draw the ire of governments and regulators around the world. My great friend Simon Adamsdale and the late Arish Turle from Control Risks spent several months in a Colombian jail in 1976 after being arrested while successfully negotiating the release of a kidnapped American business executive in Bogotá. Their incarceration was eventually deemed illegal and they were released and pardoned. But there is nothing like a stint in Bogotá’s notorious La Modelo prison to give you the chance to realise that if this business is going to prosper, it needs some guard rails.

This was the decisive step, even if some of the early pioneers still had a whiff of roguish glamour about them. Many of them continued to carry a little dust on their boots and feel the siren’s lure of exotic exploits in obscure locations. Even now not everybody is on best behaviour all of the time. Every few years, some throwback to an earlier swashbuckling dogs-of-war, guns-for-hire era will emerge to grab the international headlines with some nefarious Boys’ Own tale straight from the pages of a John le Carré novel. There are still plenty of very rich people in the world who feel that the normal rules do not apply to them. When it comes to securing rare-earth minerals in Africa or avoiding judicial process in Japan, they want direct access to the particular sets of skills that the former intelligence and special forces community has to offer and, in some quarters, is still ready to supply – for a price.

There was no need to fly below the radar. There was enough perfectly legitimate business to be had, not least because at the end of the Eighties the world changed dramatically in favour of the risk business. Indeed, the industry has a lot to thank Mikhail Gorbachev and Deng Xiaoping for in triggering the start of a multi-decade boom. The Cold War had just come to an end and history was, according to one over-quoted American political scientist, apparently a thing of the past. The Soviet Union had abruptly dissolved and been replaced by a free-for-all brand of casino capitalism. China meanwhile had made the more orderly decision to switch to its version of market economics after the massed anti-government protests in Tiananmen Square in Beijing had jolted the Chinese authorities onto the path of economic reform.

Suddenly a whole chunk of the world that had previously been off-limits to business was now hungry for investment and expertise. There was lots of work to be had helping new investors understand the changing political dynamics behind these new opportunities, figuring out who they were likely doing business with, what hidden liabilities lurked in the shadows of opaque markets and making sure they stayed safe in unfamiliar territory. All of this gave the risk industry the air in its wings to grow and expand.

Elsewhere in the world, change was afoot with international trade organisations being beefed up. In April 1993, just as I was starting in the industry, NAFTA was ratified by the US Congress and the Maastricht Treaty creating the European Union came into force in November. Five months later the World Trade Organisation was created. We didn’t realise it at the time, but we were entering the era of globalisation, that epoch when barriers to trade started to fall, new rules were written and virtually the whole of the world was open for business. Suddenly it seemed everybody was going everywhere, and global growth exploded. Deep in the thick of it, it was hard to comprehend quite what revolutionary forces were at work reshaping the global economy so radically.

This sense of infinite possibility in a world in which capital flowed freely across borders in search of hitherto unimagined opportunities also led to outbreaks of massive over-exuberance and grandiosity. One of my stranger encounters was with a mergers and acquisitions lawyer who walked into my office in London claiming to represent the interests of a Middle East investment fund with royal connections. He was fluent and self-confident, with an overly firm handshake. He was wearing an almost very well-cut suit – apart from his trousers. They were several inches too short, as if he was expecting the Thames Barrier to give way at any moment. I now know always to be suspicious of men with too-short trousers.

He had a lot to say. Just occasionally he would stop talking long enough to allow me to speak. When he did it was clear, though, that he was not listening. He was just pausing to reload. Soon he was off again on another round of bankers’ bingo. This is a common game in the City of London, Wall Street and wherever else money mingles with privilege and entitlement. He reeled out the names of a dizzying but predictable array of private schools, universities, regiments, banks, brokerage houses, friends and colleagues. It was the usual suspects and you mentally tick them off on an imaginary bingo sheet as he tries to impress you. Before I got to a full house, he realised that he was wasting his time with me and he got to the point.

On behalf of his client, he explained, he would like to buy Zimbabwe. I raised my eyebrows as he outlined some hair-brained agricultural production scheme that would provide food security for the Middle East and economic rejuvenation for Zimbabwe. He hoped that I would help in persuading then-President Mugabe to accept some substantial financial inducement to hand over the reins of power and retire, even richer than he already was, to Malaysia. As I had never met Robert Mugabe, had never been to Zimbabwe and was not in the habit of bribing heads of state, I suspect I was not the first person he had approached with his daft idea. I declined the opportunity, and he was off in search of the next sucker. He was playing the percentages game: ask enough people and someone will agree to help with your nutty plan. Eventually, he went to jail. It took a while, and a manhunt across several continents with the help of Interpol, but he got his just deserts eventually.

All of that was in the future when I started in the industry in 1993. My interview at Control Risks was a strange affair. Three former British army officers asked me a series of near-impossible to answer questions. While I was floundering around trying to craft a response, they set about answering their own questions for me. I was basically a bystander at my own interview. Eventually, I picked up the courage to enquire, somewhat tentatively, what it was exactly that they wanted me to do. It was clear that this was the first time they had given this subject any material consideration and they looked mildly irritated that I had asked such a specific question. They paused, furrowed their brows and then ignored me and continued answering each other’s questions. I left the room bemused but intrigued.

In the coming decades, business would boom. The world would become safer, healthier and more prosperous than at almost any time since we first dragged ourselves from the primordial sludge. From the early 1990s, the global economy would quadruple in size over the next thirty years, a billion people would be lifted out of poverty, access to sanitation and medicine would expand exponentially and child mortality would halve. And it seemed that the threat of nuclear self-destruction had receded. It was, by almost any measure, a period of extraordinary material progress.

But all these grand statistics did not translate into a sense of universal wellbeing. Partly, it was the uneven geographical distribution of the fruits of economic expansion. You were certainly likely to be much better off if you were Chinese rather than Congolese during this period, from Manhattan not Michigan, Belgravia not Bolton. And you were better placed if you were setting off to work each morning clutching your laptop and smartphone rather than as a manual worker clinging to the wreckage of a declining industrial heritage. But it was about more than geographical chance. Aggregated data showing we are safer does not make us feel secure. Impressive progress in economic expansion does not translate into a general sense of prosperity. Feeling insecure and fearful or confident and relaxed is not the consequence of a logical formula. It defies the simple calculus of cause and effect.

II The unholy trinity: war, terror and hubris

In retrospect, the clues were there that this brave new world of globalisation contained the seeds of its own comeuppance. There were certainly early indicators that it was not all going to be a bed of roses. Just as I was starting work at Control Risks in 1993, a young Kuwaiti-born Pakistani national called Ramzi Yousef attempted to blow up the World Trade Centre in New York. His plan was to detonate a massive car bomb in the underground parking bay below the north tower. The intention was to cause this tower to collapse and bring down the south tower as well. The plot failed but it was a terrible harbinger of what would occur eighteen years later on 9/11 when the same target was attacked but this time using hijacked planes as the delivery mechanism. And it seemed to be a family business. Ramzi Yousef’s uncle turned out to be Khalid Sheikh Mohammed, named as the principal architect of the attacks by the 9/11 Commission report.

Like millions of other people, I watched in horror as the 9/11 attacks unfolded on television. I was in London having just returned from many years living in New York. I headed back there on the first flight from London once air travel was deemed safe to resume, a desperately sombre journey, sitting on the airplane among grieving relatives. Arriving in Manhattan, the air was thick with dust from the collapsed towers and the city smelt of what it was, a still-smouldering acrid bonfire. Ahead, were weeks of scrambling to help companies suddenly shocked by their own sense of vulnerability to put in place – post facto – the mechanisms to keep their businesses and people safer in a new, more vulnerable world. This is a business that often echoes to the sound of stable doors being bolted. But in those first few days in New York, I was struck by the extraordinary resilience and defiance of New Yorkers. I realised emphatically that however appalling and shocking terrorism can be, it is an unequal battle when confronted by ordinary people who collectively refuse to be cowed.

9/11 set in chain the wars in Afghanistan and Iraq that would take so many lives, cost trillions and prove more enduring and harder to conclude than even the most stony-faced pessimists felt at the time they kicked off. They also unleashed a virulent destabilising virus in the Middle East. It would lay the foundations for the ill-fated Arab Spring and its terrible backlash in Syria and elsewhere. It would sharpen the wealth and opportunity disparity that fuels so much resentment and upend the power dynamics of an always volatile region. And it would act as an accelerant to the growth and spread of the mutating nightmare of radical Islamic terrorism.